Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down. Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in...

Read More »Oil prices and the global economy

Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down.Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in new orders, industrial...

Read More »Oil prices are reeling

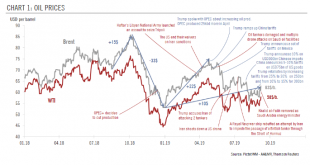

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts. The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession. Business sentiment has been...

Read More »Oil prices are reeling

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession.Business sentiment has been deteriorating for some time. By May, the world Purchasing Manager Index for...

Read More »Oil price forecast revised up

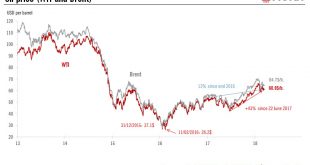

Tensions surrounding oil supplies from Iran and Venezuela are destabilising the supply/demand balance.The decision by Donald Trump to withdraw from the nuclear agreement with Iran in early May constitutes a major geopolitical shift. Iran is the world’s seventh-largest world oil producer, exporting 1.1 million barrels per day (mbd). At this stage, it is unclear how Iranian exports will be affected, but taken together with the crisis in Venezuelan oil production, it could cause significant...

Read More »Limited upside potential for oil

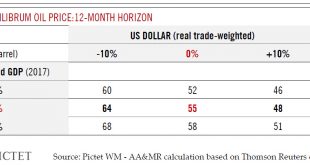

The current spot price is already close to oil’s upwardly revised equilibrium price.Strong global growth, a substantial US fiscal stimulus, signs that reflation is taking hold in the US and a relatively weak US dollar all should represent a favourable environment for commodities, and for oil in particular, for the rest of this year. However, our analysis suggests that oil is now close to its long-term equilibrium price, offering limited upside potential.Now that markets have fully taken on...

Read More »Oil market tilted towards oversupply

The same discipline shown by OPEC and Russia in 2017 will be required to support prices at their current level. After the 30 November agreement between OPEC and Russia to extend oil production cuts until the end of 2018, it is worth looking again at the balance between oil supply and demand. The most recent data indicate that without continued willingness from OPEC to limit supply, the market will be naturally tilted towards oversupply in 2018 and 2019. Non-conventional production, in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org