The Italian government’s budget plans set it on a collision course with the European Commission. The road to some kind of agreement is likely to be long and bumpy. The Italian government has confirmed its deficit target at 2.4% of GDP for 2019. This represents significant slippage from a previous budget deficit target of 0.8% in 2019. The deficit target has been set at 2.1% for 2020 and 1.8% for 202. But it is not the headline deficit numbers that are a problem, but rather the details behind them and the path the current coalition government is taking. As things stand currently, the European Commission is likely to ask Italy to send a revised draft budget. If Italy’s government does not comply with a revised budget,

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, Euroscepticism, Featured, Italian budget, Italian debt, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Italian government’s budget plans set it on a collision course with the European Commission. The road to some kind of agreement is likely to be long and bumpy.

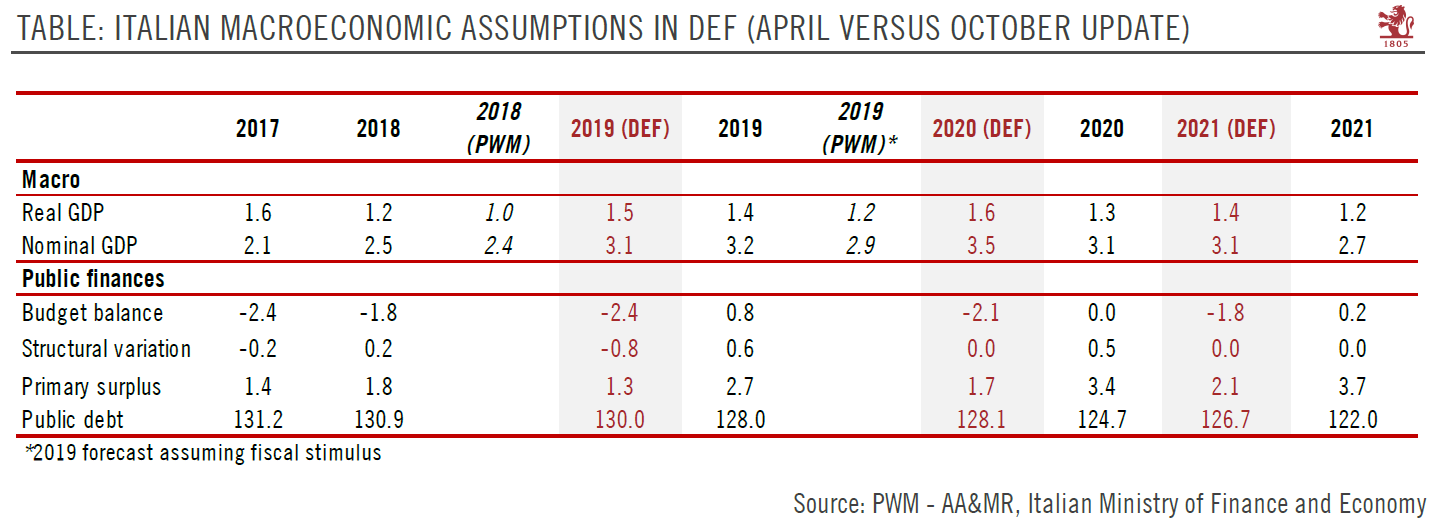

The Italian government has confirmed its deficit target at 2.4% of GDP for 2019. This represents significant slippage from a previous budget deficit target of 0.8% in 2019. The deficit target has been set at 2.1% for 2020 and 1.8% for 202. But it is not the headline deficit numbers that are a problem, but rather the details behind them and the path the current coalition government is taking.

As things stand currently, the European Commission is likely to ask Italy to send a revised draft budget. If Italy’s government does not comply with a revised budget, the European Commission could sanction Italy or could decide to open an Excessive Deficit Procedure.

| However, the Commission’s reaction to Italy’s deficit plans could be tempered by the risk of fueling eurosceptic sentiments before the European Parliament elections next May. For its part, the Italian government will know that if recent bond market volatility persists and Italy’s credit rating is cut, the (potentially) positive impact of its proposed fiscal stimulus could be jeopardised. Therefore, a combination of elements leads us to think that there is room for Europe and Italy to find common ground involcing concessions from both the Commission and the government in Rome— but the road is likely to be long and bumpy, leading to continued market volatility in the coming months.

This is our central scenario. A worst-case scenario sees a crisis in the Italian bond market, with contagion to other euro periphery countries as the Italian government continues to face down the European authorities. In a best-case scenario, the Italian government backs down on its deficit plans (although domestic political imperatives makes it unlikely that it will make concessions to Brussels without a fight). |

Italy Macro Assumptions |

Tags: Euroscepticism,Featured,Italian budget,Italian debt,Macroview,newsletter