Leaving aside energy prices, there was only modest upward pressure on inflation in May.Rising energy prices continued to push up US inflation in May, but excluding this volatile category, underlying inflationary pressures remained tame, in contrast with the very solid labour market and above-potential GDP growth. This modest inflation picture is echoed by still-soft wage growth (below 3% y-o-y) and well-anchored consumer inflation expectations. In other words, there are still no signs that US inflation is about to spiral out of control. That said, the cyclical impact of GDP growth on inflation, while less evident than before the financial crisis, still exists, so that core CPI is likely to hover slightly above 2% and core PCE is likely to be around 2% in the coming months. An upside risk

Topics:

Thomas Costerg considers the following as important: Macroview, US consumer inflation, US inflation forecast, US PCE inflation, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Leaving aside energy prices, there was only modest upward pressure on inflation in May.

Rising energy prices continued to push up US inflation in May, but excluding this volatile category, underlying inflationary pressures remained tame, in contrast with the very solid labour market and above-potential GDP growth.

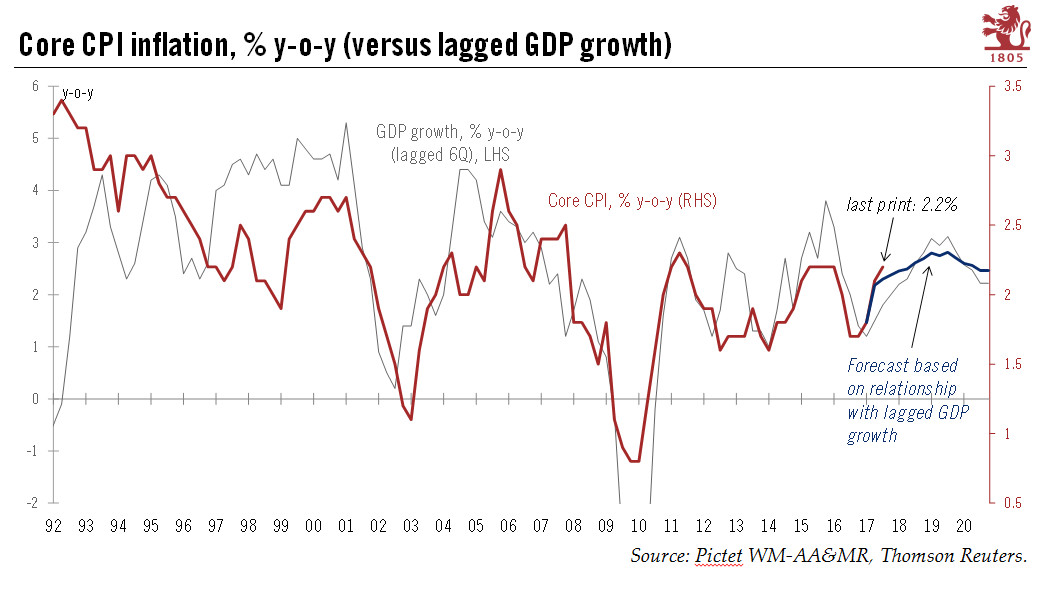

This modest inflation picture is echoed by still-soft wage growth (below 3% y-o-y) and well-anchored consumer inflation expectations. In other words, there are still no signs that US inflation is about to spiral out of control. That said, the cyclical impact of GDP growth on inflation, while less evident than before the financial crisis, still exists, so that core CPI is likely to hover slightly above 2% and core PCE is likely to be around 2% in the coming months. An upside risk to inflation (and downside risk to GDP growth) is further escalation of tariff disputes that lead to higher imported prices—but this is not our central scenario.

In detail, core CPI inflation was up 0.17% m-o-m in May (compared with 0.10% in April and 0.18% in March). That pushed the y-o-y print up to 2.2%. Headline inflation was up 0.21% m-o-m, raising the y-o-y reading to 2.8%. This is mostly explained by energy prices, up 0.9% m-o-m and 11.7% y-o-y.

From a Federal Reserve perspective, the 0.17% core CPI reading (and 1.8% 3-month annualised print) is likely to be viewed as “business as usual” and should not alter the Fed’s routine of one quarter-point rate hike per quarter; a rate hike remains highly likely on 13 June (see our Fed meeting preview in a separate Flash Note). Our US inflation forecasts are unchanged. We continue to expect annual core PCE inflation to average 1.9% in 2018.