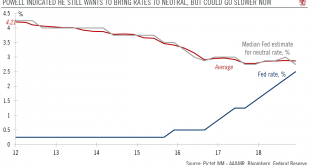

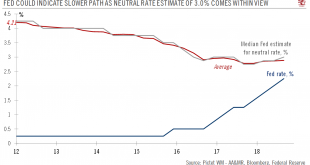

Fed chair Jerome Powell still wants to “normalize” monetary policy in 2019.The Federal Reserve (Fed) raised the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, as widely anticipated. The new FFTR range is 2.25-2.50%. This marked the fourth rate increase of 2018.There was no formal guidance about the next hike and clues were rather hazy. It seems like the Fed still wants to bring rates towards ‘neutral’ in 2019 (currently 2.75% based on the median Fed dot –...

Read More »Federal Reserve December meeting preview

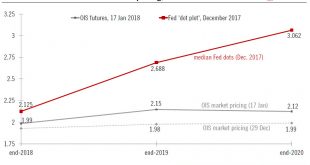

Fed shows shows signs of adopting a more flexible approach to future rate hikes.The Federal Reserve (Fed) is widely expected to increase the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, marking the fourth rate increase of 2018. This increase would push up the new FFTR range to 2.25%-2.50%.The focus will be on the rate guidance for 2019, including the one given by the ‘dot plot’ (summary of Fed policymakers’ interest rate forecasts). We think the 2019 median...

Read More »Gradual, moderate rise in the 10-year US Treasury yield next year

Modest inversion in yield curve, with recession more of an issue for 2020.After an impressive rise in US Treasury yields in 2018, we expect the upward movement in 2019 to be gradual, moderate and driven mainly by further rate hikes by the US Federal Reserve (Fed). We have a year-end target of 3.4% for the 10-year Treasury yield.In light of the limited risk of a sharp rise in the 10-year yield, the relatively high coupon they now pay and the approaching end of the economic cycle, Pictet...

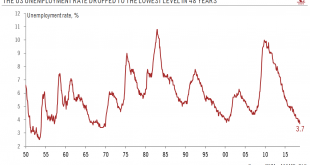

Read More »Hurricane aside, US job market is still very solid

US unemployment rate drops to lowest level in 48 years.Setting aside the impact of the hurricane that hit the Carolinas (and also the headline payroll reading as a result), the US jobs market remains in very good shape. Today’s data showed the unemployment rate dropped to its lowest level in 48 years in September (3.7%).Importantly, the nonfarm payrolls reportshowed strong employment gains in September, consistent with the view that GDP growth is remaining firm in the second half of the...

Read More »Academic debates aside, Fed officials’ optimism is rising

With Fed officials becoming more optimistic about the US outlook, there is a risk of additional rate hikes this year. Meanwhile, strategy brainstorming about tweaking inflation targeting continues.A number of Fed officials have given speeches since the beginning of the year, sending mixed messages to markets in the process. Complicating matters, the discussion about the short-term cyclical outlook has become mixed up with an open debate about whether the Fed’s current flexible inflation...

Read More »QE put to bed, the focus shifts to rate hikes

In line with our expectations, the Fed announced 'normalisation' of its balance sheet at its September meeting. Our scenario for a December Fed rate hike remains unchanged.As widely expected, the Federal Reserve announced at its 20 September meeting the start of the ‘normalisation’ of its balance sheet; some of its bond holdings will not be reinvested from October on. The Fed’s balance sheet should therefore start to shrink gradually. Fed chair Janet Yellen justified this decision by saying...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org