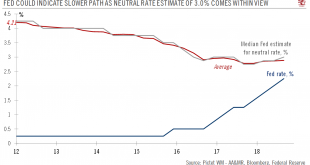

Fed shows shows signs of adopting a more flexible approach to future rate hikes.The Federal Reserve (Fed) is widely expected to increase the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, marking the fourth rate increase of 2018. This increase would push up the new FFTR range to 2.25%-2.50%.The focus will be on the rate guidance for 2019, including the one given by the ‘dot plot’ (summary of Fed policymakers’ interest rate forecasts). We think the 2019 median...

Read More »US CPI update: Costlier T-shirts

But the underlying pick-up in inflation in January was not as severe as it seems.January core CPI inflation was firm, as the index rose 0.35% month-on-month (m-o-m). The year-on-year print was unchanged at 1.8%.Was inflation that bad? Probably not. The sharp increase in apparel prices (1.7% m-o-m, the biggest monthly increase since February 1990) appears particularly suspicious and may fall back again next month. Some notoriously volatile sub-indices, such as leased cars, provided a further...

Read More »Academic debates aside, Fed officials’ optimism is rising

With Fed officials becoming more optimistic about the US outlook, there is a risk of additional rate hikes this year. Meanwhile, strategy brainstorming about tweaking inflation targeting continues.A number of Fed officials have given speeches since the beginning of the year, sending mixed messages to markets in the process. Complicating matters, the discussion about the short-term cyclical outlook has become mixed up with an open debate about whether the Fed’s current flexible inflation...

Read More »Fed’s enthusiasm on tax cut plans remains limited

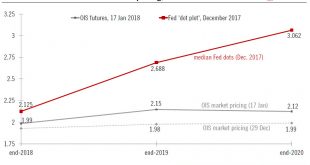

The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’. A salient take -away from the meeting was the Fed’s relative caution about Congress’s tax-cutting plan. Even...

Read More »Fed rate unlikely to move much above 2% next year

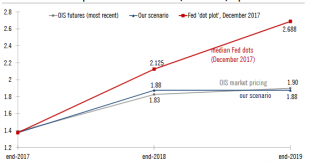

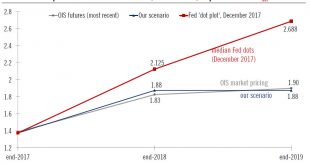

The Federal Reserve is probably looking back at 2017 with satisfaction. After on the rate rise expected on 13 December, it will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by markets. In fact, broader financial conditions have eased this year despite the...

Read More »Fed’s enthusiasm on tax cut plans remains limited

The Fed hiked rates 25bps at its 13 December meeting, as widely expected. We are keeping our scenario unchanged and we expect two rate hikes next year.The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.Chair Janet Yellen was cautious about...

Read More »Fed rate unlikely to move much above 2% next year

The Fed is expected to raise rates again this week. But it continues to wrestle with low core inflation, while the impact of tax cuts will need to be monitored. After the quarter-point rate rise expected on 13 December, the Federal Reserve will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org