The upcycle in the US dollar that began in 2011 has faded, but further depreciation of the greenback may be limited and there is a good chance of a near-term recovery against the euro.The US dollar index has declined significantly this year, challenging our constructive view on the US dollar. Disappointment regarding potential US tax reform, the decline in US inflation, the significant overvaluation of the greenback and strong economic recovery in the rest of the world all help explain a large part of the US dollar’s decline.Our new scenario for US growth and the path of Fed tightening suggests that the two main drivers behind the USD upcycle that started in 2011 (economic growth and monetary policy divergence) have disappeared and that the peak in the long-term US dollar cycle is now

Topics:

Luc Luyet considers the following as important: Currency cycles, currency trends, dollar depreciation, Dollar euro rate, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The upcycle in the US dollar that began in 2011 has faded, but further depreciation of the greenback may be limited and there is a good chance of a near-term recovery against the euro.

The US dollar index has declined significantly this year, challenging our constructive view on the US dollar. Disappointment regarding potential US tax reform, the decline in US inflation, the significant overvaluation of the greenback and strong economic recovery in the rest of the world all help explain a large part of the US dollar’s decline.

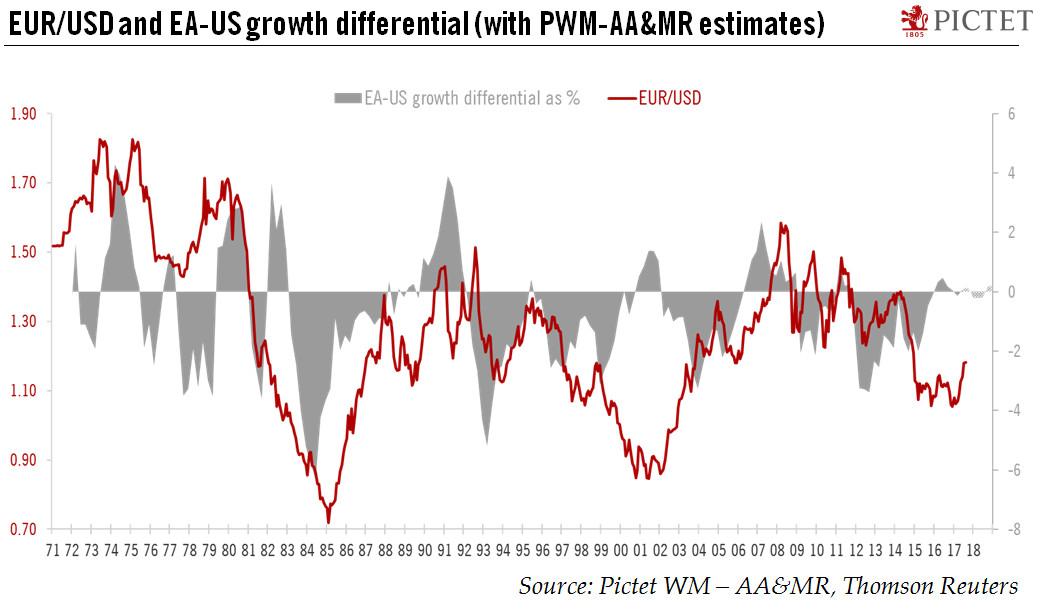

Our new scenario for US growth and the path of Fed tightening suggests that the two main drivers behind the USD upcycle that started in 2011 (economic growth and monetary policy divergence) have disappeared and that the peak in the long-term US dollar cycle is now behind us. However, the magnitude of the dollar’s decline should be lower than this year given mitigating risk factors such as interest rate differentials and relative valuation.

The fact that the dollar’s latest up-cycle lasted only five and half years (a year less than the previous two upcycles) and without any extremes in USD overvaluation of any length makes this upcycle quite different from the others. Consequently, the current USD down cycle could also be different from the past, without a sharp, multi-year USD decline as in 1985 or 2002.

In the event, our central scenario is that the euro is likely to rise further against the US dollar and should reach USD1.24 per EUR by end-2018 (compared with USD1.19 at end-August 2017).

In the shorter term, we expect a rebound in the US dollar during the remainder of 2017, pushing the EUR/USD rate down to around USD1.15. US activity is expected to remain firm for the remainder of 2017, whereas a modest slowdown is likely in the euro area. The Fed will remain active (balance sheet reduction in October and a quarter-point rate hike in December), while the ECB may be somewhat constrained in its plans for policy normalisation by euro strength. Finally, market sentiment is significantly negative towards the USD, as derived from speculators’ positioning in the futures market, while the greenback is severely undervalued based on short-term technical indicators. Such a backdrop favours a short-term rebound in the USD.