The SNB is unlikely to pre-empt the ECB in normalising monetary policy. We are keeping our baseline scenario unchanged and expect the interest on sight deposit to stay at -0.75%.The SNB’s 14 September meeting could be one of the most interesting in a while, as it comes just after a period when the Swiss franc has witnessed significant depreciation, mainly against the euro.The key focus of the SNB’s September 14 meeting will be its assessment of exchange rate moves. We do not expect the SNB to remove previous references to the “overvalued” currency or to its commitment to intervene in the foreign exchange market if needed. However, the SNB could also note its satisfaction with the direction the exchange rate has taken of late. We expect the SNB to keep the interest rate on sight deposits

Topics:

Nadia Gharbi considers the following as important: Macroview, SNB currency intervention, SNB September meeting, Swiss economy, Swiss monetary policy

This could be interesting, too:

Investec writes Swiss economy stalls in second quarter of 2023

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

The SNB is unlikely to pre-empt the ECB in normalising monetary policy. We are keeping our baseline scenario unchanged and expect the interest on sight deposit to stay at -0.75%.

The SNB’s 14 September meeting could be one of the most interesting in a while, as it comes just after a period when the Swiss franc has witnessed significant depreciation, mainly against the euro.

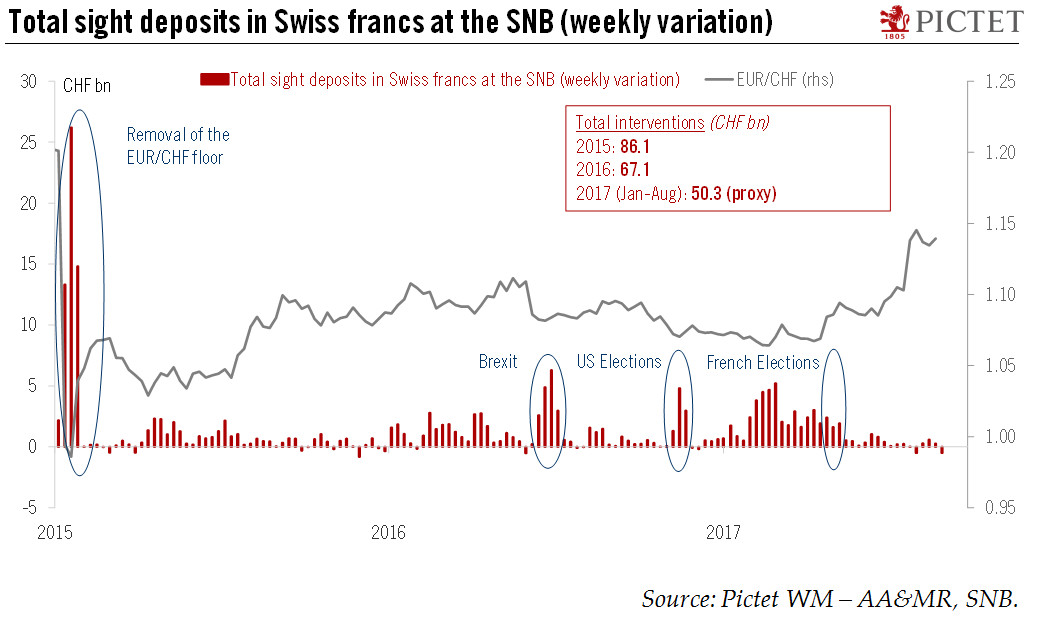

The key focus of the SNB’s September 14 meeting will be its assessment of exchange rate moves. We do not expect the SNB to remove previous references to the “overvalued” currency or to its commitment to intervene in the foreign exchange market if needed. However, the SNB could also note its satisfaction with the direction the exchange rate has taken of late. We expect the SNB to keep the interest rate on sight deposits at a record low of -0.75%.

As regards the economic outlook, the SNB will probably increase marginally its inflation forecasts (currently at 0.3% in 2017, 0.3% in 2018 and 1.0% in 2019), while maintaining its assessment of Swiss GDP growth unchanged at roughly 1.5% in 2017.

Looking ahead, our baseline scenario remains unchanged. We expect the interest on sight deposits at the SNB to stay at its current level (-0.75%) for the remainder of 2017. We also continue to believe that the SNB is unlikely to pre-empt the ECB in normalising monetary policy.