Swiss Franc The Euro has fallen by 0.21% to 1.0869 CHF. EUR/CHF - Euro Swiss Franc, June 15(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar gains scored yesterday in response to what appeared to be a more hawkish FOMC than expected have been extended today. The euro and the Swiss franc have recorded new lows for the month. In some ways, a do-nothing MPC meeting may be overshadowed by the Mansion House speeches tonight by Hammond and Carney. Recall many expected Hammond to have lost his post in if the Tories would have been able to secure a majority in parliament. He is expected to make a case for a more pro-business Brexit, and while that sounds good, it is not clear what it means.

Topics:

Marc Chandler considers the following as important: Australia Participation Rate, Australia Unemployment Rate, CAD, EUR, EUR/CHF, Eurozone Trade Balance, Featured, FX Daily, FX Trends, GBP, Italy Consumer Price Index, JPY, newslettersent, U.K. Retail Sales, U.S. Capacity Utilization Rate, U.S. Initial Jobless Claims, U.S. NY Empire State Manufacturing Index, U.S. Philadelphia Fed Manufacturing Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.21% to 1.0869 CHF. |

EUR/CHF - Euro Swiss Franc, June 15(see more posts on EUR/CHF, ) |

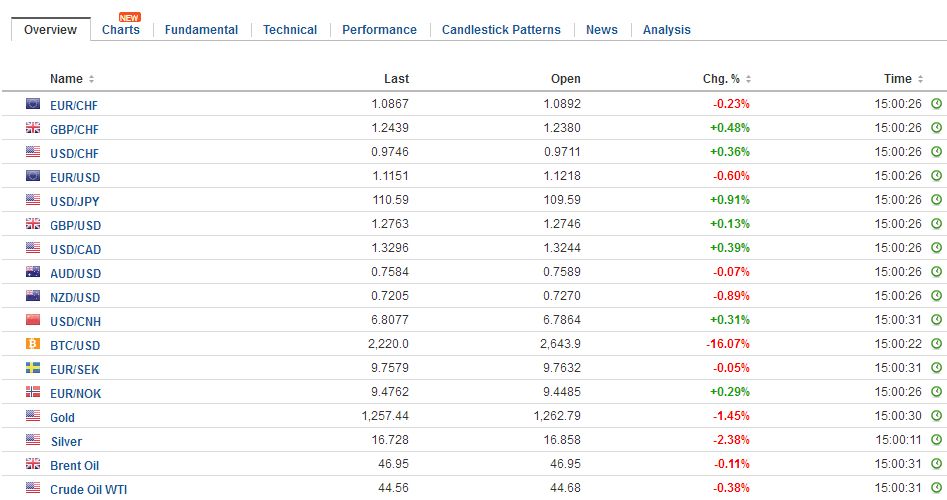

FX RatesThe US dollar gains scored yesterday in response to what appeared to be a more hawkish FOMC than expected have been extended today. The euro and the Swiss franc have recorded new lows for the month. In some ways, a do-nothing MPC meeting may be overshadowed by the Mansion House speeches tonight by Hammond and Carney. Recall many expected Hammond to have lost his post in if the Tories would have been able to secure a majority in parliament. He is expected to make a case for a more pro-business Brexit, and while that sounds good, it is not clear what it means. Of course, the UK wants access to the single market, but the EU does not appear prepared to compromise on the four freedoms. The central trade-off of “control over national borders” and the single market remains as stark today as it was a year ago. The US dollar recovered smartly against the Canadian dollar yesterday after probing the lowest level since February. Some follow through US dollar buying has been a big adjustment to interest rate expectations for Canada. Looking at the derivative markets, it appears that more Bank of Canada rate hikes has been discounted than Fed hikes over the next year. Recall too that in the futures market, speculators had nearly a record short Canadian dollar position. A US dollar move above CAD1.3310 could spark a correcting the move that began at the end of last week’s CAD1.3340 area. |

FX Daily Rates, June 15 |

| The Bank of England meets. Although Forbes is likely to dissent again at this her last meeting, she has failed to persuade her colleagues, and a 7-1 vote is expected. The minutes will likely recognize the recent high frequency data and risks. Focusing on the signal, the strongest case will be made for a steady hand.

The euro’s low from late-May is near $1.1110. A break of this area will likely be seeing the euro longs peel back. Below there is the 50% retracement of the euro rally since mid-May that is found near $1.1070. That said, the kind of topping pattern we are looking suggests potential toward $1.10. The dollar is trading inside yesterday’s broad range against the yen. US yields are slightly firmer. We have found the direction of rates is often more important than level. Resistance is seen in the JPY110.00-JPY110.20 area, even though yesterday the dollar briefly traded a little higher. There is an important caveat against taking the data at face value. It is the sixth month in the past seven that sample for the data was rotated. The data is not clean, and although the Australian dollar rose, Australian bonds rallied, with the 10-year yield easing almost five bp to 2.35%, and the equity market lost 1.2%, among the largest decline in the region. Equity markets are lower. The 0.9% drop in the MSCI Asia Pacific Index is the largest of the month. China and Taiwan were the exceptions. Their equity markets increased, but the Hong Kong market and the HK Enterprise Index fell 1.2% and 1.6% respectively. In Europe, the Dow Jones Stoxx 600 is off 0.6%, for the third losing session this week after four last week. The 0.6% decline is being led by telecoms and materials, but no sector is gaining today. |

FX Performance, June 15 |

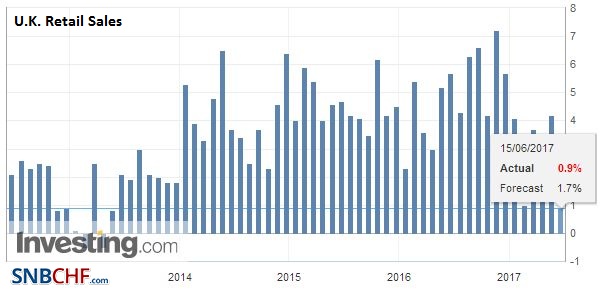

United KingdomSterling’s attempt to recover from the election rout fizzled yesterday above $1.28 after the poor average weekly earnings data. News today that May retail sales were dismal compounds concerns that higher inflation and weaker earnings growth will undermine consumption, and through it, production. Retail sales, excluding auto fuel, fell 1.6%, the most this year. It follows a revised 2.2% rise in April (from 2.0%). The decline was widespread, everything but fuel. Household goods sales fell 5.7%. Department store sales were off 0.8%, and sales at other stores fell 2.9%. The year-over-year pace fell to 0.9%, matching a four-year low. |

U.K. Retail Sales YoY, May 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

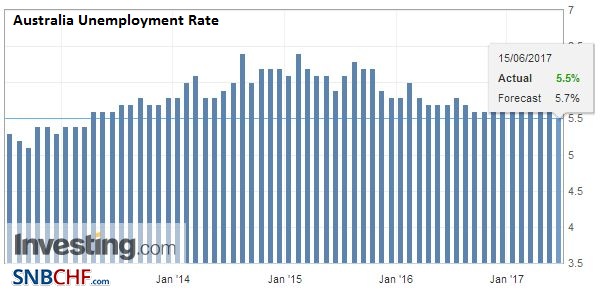

AustraliaThe only major currency that is gaining against the dollar today is the Australian dollar. It is trading at the upper end of yesterday’s range and trying to get a foothold above $0.7600. It began the month below $0.7400. A strong employment report is a key driver. The unemployment rate fell to 5.5% from 5.7%, |

Australia Unemployment Rate, May 2017(see more posts on Australia Unemployment Rate, ) Source: Investing.com - Click to enlarge |

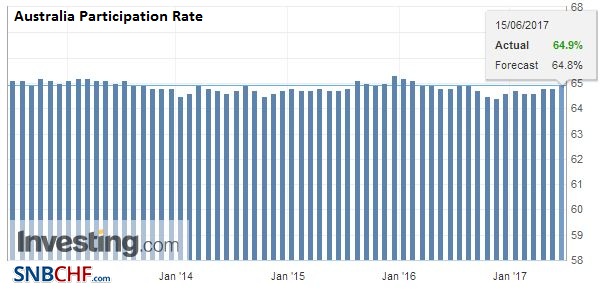

| and the participation rate ticked up to 64.9% from 64.8%. The country grew 42k job, four-times more than expected and the April jobs growth was revised to 46.1k from 37.4k. Those jobs Australia created were all full-time positions (52.1k). |

Australia Participation Rate, May 2017(see more posts on Australia Participation Rate, ) Source: Investing.com - Click to enlarge |

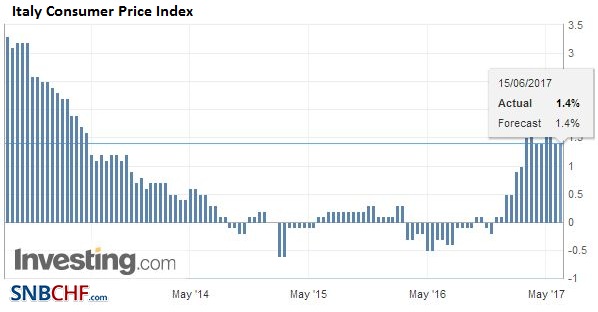

Italy |

Italy Consumer Price Index (CPI) YoY, May 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

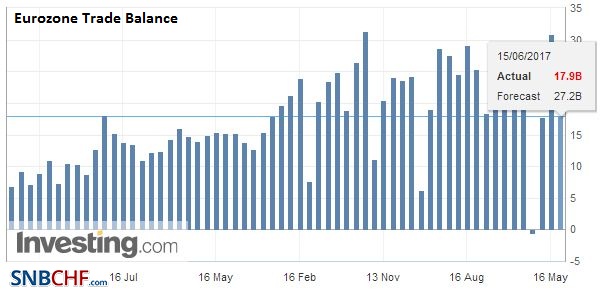

Eurozone |

Eurozone Trade Balance, April 2017(see more posts on Eurozone Trade Balance, ) Source: Investing.com - Click to enlarge |

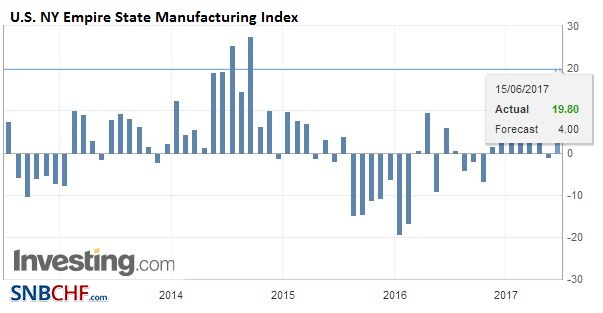

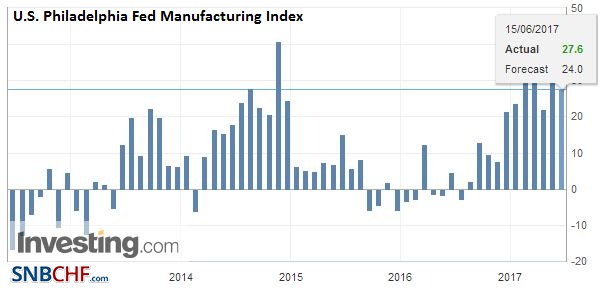

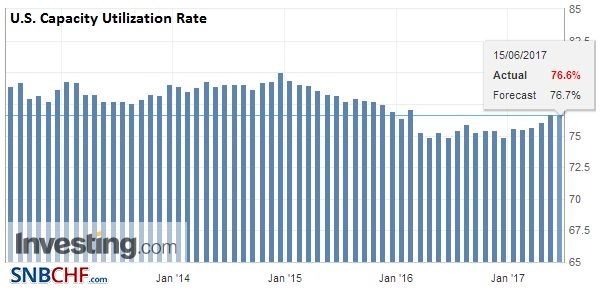

United StatesThe FOMC meeting may make today’s US economic data less potent. The Empire and Philly Fed surveys are for June and represent the new news, but May industrial output and manufacturing will draw attention. After 1.0% gains in both in April, the risk to the median guess (0.2% and 0.1% respectively) is to the downside. Treasury International Capital flows are reported at the close of the equity market. |

U.S. NY Empire State Manufacturing Index, June 2017(see more posts on U.S. NY Empire State Manufacturing Index, ) Source: Investing.com - Click to enlarge |

U.S. Philadelphia Fed Manufacturing Index, June 2017(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) Source: Investing.com - Click to enlarge |

|

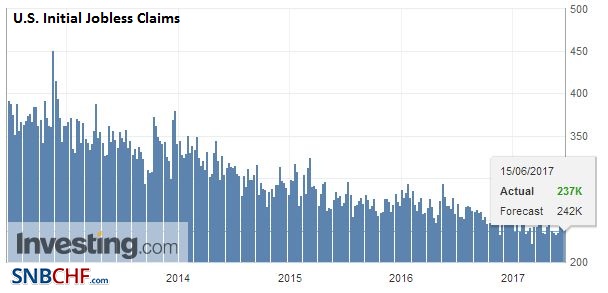

| Import/Export prices and weekly initial jobless claims will draw little attention. |

U.S. Initial Jobless Claims, May 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

U.S. Capacity Utilization Rate, May 2017(see more posts on U.S. Capacity Utilization Rate, ) Source: Investing.com - Click to enlarge |

Reviewing the FOMC statement and Yellen’s comments, we stick with our initial impression that as a while, the Fed was more hawkish than many expected. The willingness of officials to look past the recent economic weakness and softness of prices is important. It also dropped a reference to the global economy and financial developments being monitored. Officials are simply more confident of the broad direction. Indeed, as we have suggested before, the Fed is not longer worried about the recovery and expansion. It is accepted, and moreover, it seems to accept that trend growth has slowed, and the economy is growing near trend. Yellen was willing to dismiss the 3-4 month decline in core inflation to one-off factors.

Late in her press conference, Yellen suggested that the balance sheet adjustment could begin “relatively soon.” This is potentially an important tell. This is a strong hint that it will be initiated after the September FOMC meeting. This means that the third rate cut of the year, which the median dot plot still suggests will be appropriate, may come in December. Here the significant caveat is that the economy must evolve in line with the Fed expectations.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,$JPY,Australia Participation Rate,Australia Unemployment Rate,EUR/CHF,Eurozone Trade Balance,Featured,FX Daily,Italy Consumer Price Index,newslettersent,U.K. Retail Sales,U.S. Capacity Utilization Rate,U.S. Initial Jobless Claims,U.S. NY Empire State Manufacturing Index,U.S. Philadelphia Fed Manufacturing Index