The Swiss economy relies very much (and probably too much) on exports. More than half of GDP growth in 2014 was driven by the trade balance, while consumption lagged. Many consider this dependency on exports insane. In Q4/2016, export of goods fell by 3.8%, while imports remained the same; this implies a fall in GDP for the export/import component. Investment in equipment dipped, after some positive quarters. Construction investments, however, may have peaked after years of strong growth and potential over-investment. In total, the economy grew by only 0.1% QoQ (+0.6% YoY). Consumption On the other side, consumption rose by a strong 0.9%. Based on the recent improvements in consumer confidence, we see continued strength of private consumption. Finally the insane reliance on exports, seems to stop. 2017 shows growth in both consumption and in exports But January exports data shows the old pattern. The trade surplus touched a new record high. At the same time, consumption appears to be strong, too. Investments in equipment should follow the tendencies in consumption and trade. In summary, we are pretty optimistic for the upcoming months for Swiss GDP. But the dependency on exports is still strong.

Topics:

George Dorgan considers the following as important: Featured, newslettersent, Swiss Macro, Switzerland Gross Domestic Product

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The Swiss economy relies very much (and probably too much) on exports. More than half of GDP growth in 2014 was driven by the trade balance, while consumption lagged. Many consider this dependency on exports insane. In Q4/2016, export of goods fell by 3.8%, while imports remained the same; this implies a fall in GDP for the export/import component. Investment in equipment dipped, after some positive quarters. Construction investments, however, may have peaked after years of strong growth and potential over-investment.

In total, the economy grew by only 0.1% QoQ (+0.6% YoY).

Consumption

On the other side, consumption rose by a strong 0.9%. Based on the recent improvements in consumer confidence, we see continued strength of private consumption. Finally the insane reliance on exports, seems to stop.

2017 shows growth in both consumption and in exports

But January exports data shows the old pattern. The trade surplus touched a new record high. At the same time, consumption appears to be strong, too. Investments in equipment should follow the tendencies in consumption and trade.

In summary, we are pretty optimistic for the upcoming months for Swiss GDP. But the dependency on exports is still strong. We see a continued weakening of EUR/CHF towards parity, because the Swiss National Bank will reduce her FX interventions, when she realizes that growth is finally driven by consumption.

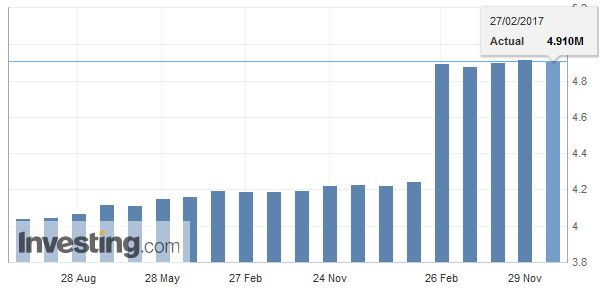

The most import Swiss GDP driver: Immigration and EmploymentSwitzerland is a job creation machine, as visible in the graph. |

Switzerland Employment Level Q4 2016(see more posts on Switzerland KOF Economic Barometer, ) Source: Investing.com - Click to enlarge |

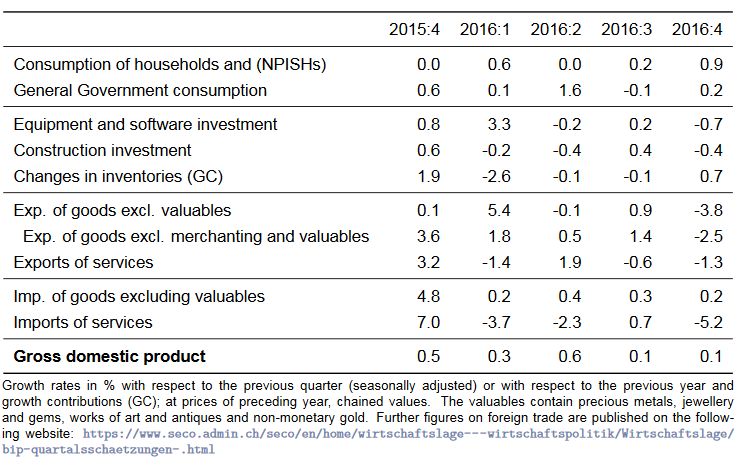

Details from the press release with additional graphsSwitzerland’s real gross domestic product (GDP) has grown by 0.1% in the 4th quarter of 2016*. Private and government consumption has had a positive impact, while investment in construction and equipment has fallen slightly. The trade balance has also curbed GDP growth. On the production side, healthcare and social work as well as financial services have boosted growth, while value added in manufacturing and energy production has declined. For 2016 as a whole, real GDP grew by 1.3% (+0.8% in 2015). |

Switzerland Gross Domestic Product (GDP) YoY, Q4 2016 Source: Investing.com - Click to enlarge |

GDP GrowthFollowing two weak quarters, consumption expenditure of private households has grown by a significant 0.9% in the 4th quarter of 2016. Growth in consumption has been broad-based. Spending on healthcare as well as housing and energy have been the key drivers of growth. General government consumption has risen moderately (+0.2%). Investment in equipment has fallen by 0.7% and thus has not managed to build on the positive results of the previous quarter. Although the machinery and automobile segments have made gains, these have been more than offset by the slowdown in others including research and development and other vehicles. Investment in construction has also dropped (-0.4%). Overall, domestic final demand has boosted GDP growth in the 4th quarter of 2016. |

Quarter on Quarter Growth Rates ESVG, Q4 2016(see more posts on Switzerland Gross Domestic Product, ) Quarter on Quarter Growth Rates ESVG Source: GDP-QNA - Click to enlarge |

ExportsExports of goods** have declined by 3.8% in the 4th quarter of 2016, the weakest quarterly result in three years. Exports of precision tools, watches and jewellery in particular have continued their negative trend of the previous quarters, while those of chemical and pharmaceutical products have decreased for the first time after several positive quarters. Exports of services have also experienced a downturn in the 4th quarter (-1.3%), while imports of goods have grown slightly (+0.2%), mainly underpinned by imports of chemical and pharmaceutical products. Imports of services2 have declined (-5.2%) due to the research and development sector, among other things. Overall, the trade balance in goods and services has slowed GDP growth in the 4th quarter of 2016. |

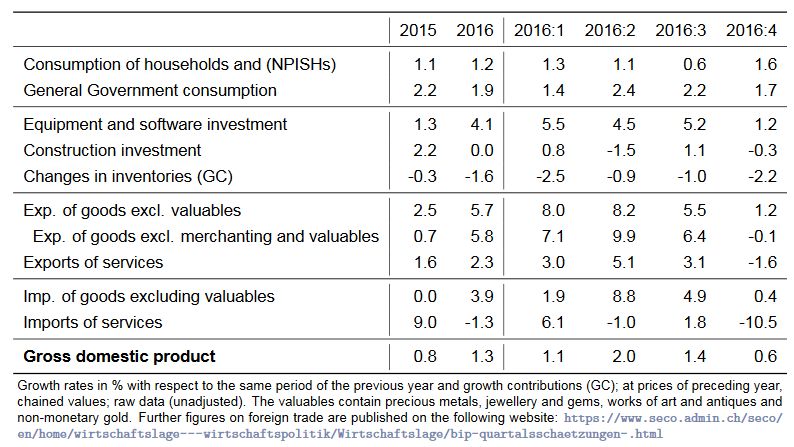

Year on Year Growth Rates ESVG Source: GDP-QNA - Click to enlarge |

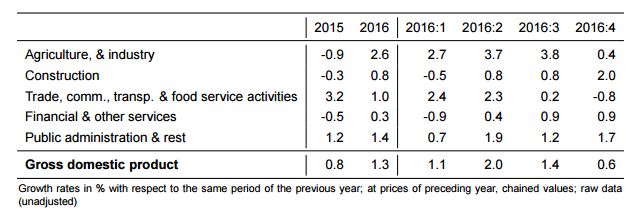

Production SideOn the production side of GDP, the economic sectors have seen uneven development this quarter. Some service sectors have achieved marked increases in value added, including healthcare and social work (+2.7%), financial services (+1.7%) and public administration (+0.3%). In the industry sector, although construction has grown (+1.3%), manufacturing and energy production have dropped (-1.2% and -3.8% respectively). This has resulted in overall GDP growth of 0.1% in the 4th quarter of 2016, meaning the subdued growth of the previous quarter is continuing after a stronger first half of 2016. Compared to the 4th quarter 2015, the GDP deflator*** has fallen by 0.2% in the 4th quarter of 2016. In previous quarters, prices have fallen more sharply. The deflators for private consumption (-0.4%), investment in construction (-0.9%) and exports (-0.7%) have also declined in the 4th quarter of 2016. Import prices**** have risen once again (+1.7). |

Production Side YoY Growth Rates Source: GDP-QNA - Click to enlarge |

Initial provisional results for 2016

The results reveal a provisional real GDP growth rate of 1.3% for 2016. At +0.8%, GDP growth was far weaker in 2015. The figures for 2016 thus reflect the economy’s modest recovery from the economic slump after the sharp appreciation of the Swiss franc in early 2015. This recovery is mainly due to the strong first half of the year 2016 however.

On the expenditure side, both domestic demand components and foreign trade have helped to bolster growth in 2016. Consumption expenditure of private households (+1.2%) and general government consumption (+1.9%) have developed at a similar rate as in the previous two years, while investment in equipment (+4.1%) has accelerated. The trade balance has also stimulated growth thanks to increased exports of goods in particular. The negative growth contribution of changes in stocks (including statistical variations) has offset this development.

On the production side, manufacturing (+2.4%) has proved the most substantial boost to growth in 2016. Having been hit especially hard by the strength of the Swiss franc in 2015, the sector seems to be mounting a gradual recovery overall. The hotel and catering industry – another sector that is seen as being sensitive to exchange rates – has also performed significantly better in 2016 than in 2015, with only a slight decline in added value (-0.3%). As in 2015, positive growth has also come from the key sectors of healthcare and social work (+4.8%) and trade (1.1%).

*Unless stated otherwise, the percentage changes of the previous quarter listed here (not annualised) are calculated on the basis of chained series, price, seasonal and calendar adjusted values.

**Total of exports/imports in goods and services excluding non-monetary gold and valuables.

***The comparisons with the previous year which are used in particular for the comments on the development of the price indices are based on the changes in the original figures over the previous year (before seasonal and calendar adjustments).

****Total exported/imported goods and services excluding non-monetary gold and valuables.

Tags: Featured,newslettersent,Switzerland Gross Domestic Product