The ECB remains dovish, but a reassessment of its plans for exiting quantitative easing could come later this year and hikes in the deposit rate in 2018 if core inflation data improve.The European Central Bank left policy and forward guidance unchanged at today’s meeting notwithstanding the “increasingly solid” recovery and “diminished” downside risks to the outlook. Our impression is that there is a strong consensus to “finish the job” by keeping the monetary stance very accommodative until the ECB sees signs of life in core consumer prices.Two important features of the ECB’s communication will likely be adjusted in the next few months -the balance of risks to the economic outlook and the sequencing of policy normalisation embedded in the forward guidance. The former should move to neutral in June. The latter could be adjusted step-by-step in June and September. Still, the risk of market overreaction to any exit signal will likely remain elevated.We continue to expect a slow tapering of QE to start in Q1 2018, the deposit rate to be hiked in June 2018, and a proper rate normalisation cycle to start very slowly in H2 2019.

Topics:

Frederik Ducrozet considers the following as important: ECB policy meeting, ecb QE exit, ecb statement changes, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

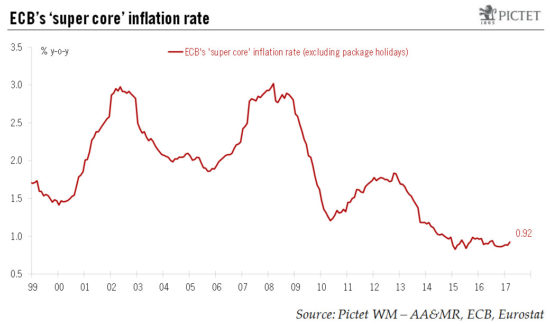

The ECB remains dovish, but a reassessment of its plans for exiting quantitative easing could come later this year and hikes in the deposit rate in 2018 if core inflation data improve.

The European Central Bank left policy and forward guidance unchanged at today’s meeting notwithstanding the “increasingly solid” recovery and “diminished” downside risks to the outlook. Our impression is that there is a strong consensus to “finish the job” by keeping the monetary stance very accommodative until the ECB sees signs of life in core consumer prices.

Two important features of the ECB’s communication will likely be adjusted in the next few months -the balance of risks to the economic outlook and the sequencing of policy normalisation embedded in the forward guidance. The former should move to neutral in June. The latter could be adjusted step-by-step in June and September. Still, the risk of market overreaction to any exit signal will likely remain elevated.

We continue to expect a slow tapering of QE to start in Q1 2018, the deposit rate to be hiked in June 2018, and a proper rate normalisation cycle to start very slowly in H2 2019.