China’s Q1 GDP higher than forecasts, but we maintain our view that growth will start to slip, especially in the second half of 2017.Chinese GDP grew 6.9% year-over-year (y-o-y) in real terms in Q1 2017, up from 6.8% in Q4 2016 and 6.7% for the full year of 2016. The strong growth figure beats both the consensus forecast (6.8%) and our own estimate (6.7%). In nominal terms, the rise in GDP was even more significant, growing 11.8% over the year to March 31, mainly driven by higher prices for industrial goods. This is the highest nominal growth that China has seen since Q1 2012.In light of the strong Q1 growth figure, we have decided to revise up our GDP forecast for China in 2017 to 6.5% from our previous forecast of 6.2%.However, this revision does not materially change our core scenario. We maintain the view that growth in China will likely decline on a quarterly basis going forward, and that the deceleration may become more noticeable in H2 2017. In other words, the strong Q1 numbers likely represent the peak of growth momentum in 2017, both in real and nominal terms.Strong industrial activity, one of the key contributors to the solid growth momentum in Q1, was driven by resilient fixed-asset investment (FAI) growth and improving external demand. FAI has been rebounding on stronger infrastructure investment and a property boom.

Topics:

Dong Chen considers the following as important: China growth forecast, china Q1 GDP, chinese growth acceleration, Macroview, slowing chinese growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

China’s Q1 GDP higher than forecasts, but we maintain our view that growth will start to slip, especially in the second half of 2017.

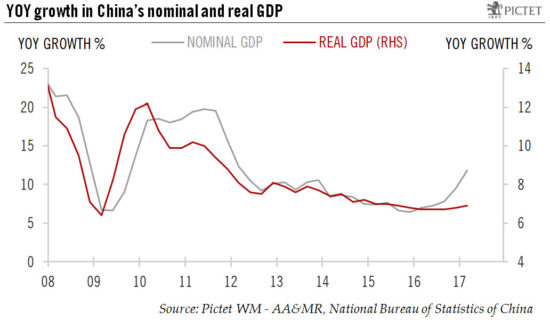

Chinese GDP grew 6.9% year-over-year (y-o-y) in real terms in Q1 2017, up from 6.8% in Q4 2016 and 6.7% for the full year of 2016. The strong growth figure beats both the consensus forecast (6.8%) and our own estimate (6.7%). In nominal terms, the rise in GDP was even more significant, growing 11.8% over the year to March 31, mainly driven by higher prices for industrial goods. This is the highest nominal growth that China has seen since Q1 2012.

In light of the strong Q1 growth figure, we have decided to revise up our GDP forecast for China in 2017 to 6.5% from our previous forecast of 6.2%.

However, this revision does not materially change our core scenario. We maintain the view that growth in China will likely decline on a quarterly basis going forward, and that the deceleration may become more noticeable in H2 2017. In other words, the strong Q1 numbers likely represent the peak of growth momentum in 2017, both in real and nominal terms.

Strong industrial activity, one of the key contributors to the solid growth momentum in Q1, was driven by resilient fixed-asset investment (FAI) growth and improving external demand. FAI has been rebounding on stronger infrastructure investment and a property boom. Meanwhile, the US economy continues to expand steadily, and growth momentum in Europe seems to be picking up faster than expected. The improving global growth picture has led to a rebound in major Asian economies’ exports, including China. The broad-based rise in export demand for Chinese goods has translated into stronger manufacturing activity.

But there are two broad arguments for thinking that Chinese growth will slow. First, growth in property investment will likely moderate as the authorities step up measures to deal with a housing bubble. Already, property sales are slowing. Second, the People’s Bank of China is likely to maintain its tightening bias and its efforts to rein in shadow banking. Interbank rates have risen, with small and medium-size companies are already feeling the effect of tighter liquidity conditions.