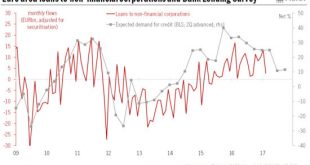

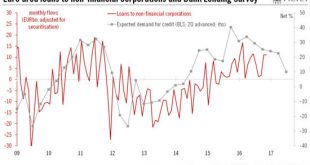

The April Bank Lending Survey remains consistent with the ECB leaving its stance unchanged on credit conditions, negative rates and QE.Credit standards on loans to euro area enterprises eased in Q1, according to the ECB’s Bank Lending Survey (BLS), released today. Although banks expect a small net tightening of credit standards across all loan categories in Q2, credit conditions remain broadly favourable in the euro area.Demand for credit continued to rise in Q1, albeit at a slower pace than...

Read More »Euro area: strong rebound in bank lending

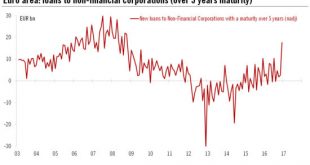

The euro area M3 and credit report strengthened in December after a few months of weakness. However, the latest Bank Lending Survey signalled more modest gains in credit flows in the months ahead.Euro area credit flows to non-financial corporations increased again in December, by EUR13 bn in adjusted terms. The large rebound in long-terms loans, in particular, bodes well for business investment spending.With loans to households still expanding at a healthy pace (+EUR9 bn in December), the...

Read More »First tightening of euro area credit standards in three years

The latest Bank Lending Survey (BLS) from the ECB, showed that credit standards tightened somewhat in Q4 2016. But the details were much more upbeat than the headline reading.Credit standards on loans to euro area enterprises tightened in Q4 2016 for the first time in three years. The move was essentially driven by developments in the Netherlands. Demand for credit continued to rise across all categories of loans, once again driven by generally low interest rates and M&A activity.Looking...

Read More »Credit conditions improve in the euro area

Banks see QE and negative deposit rates as contributing to lending volumes—but also hurting their net interest income. Released on 18 October, the ECB’s third-quarter Bank Lending Survey– the first one to fully capture the effects of the 23 June Brexit referendum – remained broadly consistent with improving credit conditions. The BLS is of special significance in the current environment where commercial banks remain under a lot of pressure from all sides, whether from regulation,...

Read More »Banking crisis? What banking crisis?

In spite of the various pressures facing banks, the ECB's latest Bank Lending Survey points to continued improvement in loan conditions. The hope must be that ECB policies will continue to facilitate bank lending in the months ahead Read the full report here The ECB’s April Bank Lending Survey (BLS), conducted among 141 banks between 11 and 30 March 2016 and released today, revealed a net easing of credit conditions for companies for the eighth consecutive quarter. The demand for loans...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org