The latest ECB credit report confirmed that credit flows in the euro area remains strong. But reliance on bank credit is falling in Europe.The ECB’s M3 and credit report for August published this week was pretty strong overall and confirmed the ongoing improvement in lending dynamics in the euro area. Bank credit flows to the private sector (adjusted for seasonal effects and sales and securitisations) amounted to €17bn in August, lower than the July figure of €39bn. In y-o-y terms,...

Read More »Euro area: strong rebound in bank lending

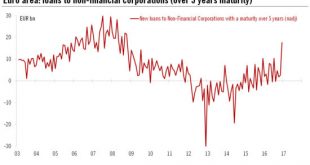

The euro area M3 and credit report strengthened in December after a few months of weakness. However, the latest Bank Lending Survey signalled more modest gains in credit flows in the months ahead.Euro area credit flows to non-financial corporations increased again in December, by EUR13 bn in adjusted terms. The large rebound in long-terms loans, in particular, bodes well for business investment spending.With loans to households still expanding at a healthy pace (+EUR9 bn in December), the...

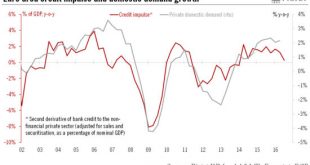

Read More »Credit impulse remains weak in euro area

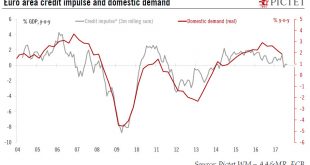

Relatively strong credit data for October were not enough to prevent the credit impulse from continuing to soften.Euro area bank credit flows to non-financial corporations rebounded strongly in October, by EUR11 bn in adjusted terms. Bank loans to households continued to expand at a healthy pace (+EUR10 bn). The slowdown in annual growth of the broad monetary aggregate M3, from 5.1% to 4.4% year on year in October, was largely due to base effects.The rebound in credit flows to the private...

Read More »Disappointing credit flow figures in the eurozone

Data pose a downside risk for GDP forecast and strengthens case for additional ECB intervention.Euro area bank credit flows to non-financial corporations (NFC) were pretty disappointing in September (coming in flat after a decline of EUR 1bn in August). On a country by country basis, NFC flows were positive for the four biggest economies, but not enough to bring the 3-month average back into positive territory in Italy and Spain. On a brighter note, credit flows to euro area households rose...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org