Extreme negative sentiment on the greenback and improving US data should pave the way for a significant US dollar rebound.Following disappointing US economic data and another failure to form a Republican majority on key legislation, the US dollar has slipped to a 10-month low, at 94.68 on 18 July.This extreme USD weakness has led to strong negative market sentiment, as highlighted by speculative positions on the futures market.Although we acknowledge that the foundations (rising inflation and fiscal stimulus) of our strong US dollar view have weakened, we think that the combination of high USD pessimism and improving US data should pave the way for a significant USD rebound.Consequently, we do not think the time is right to be overly negative on the US dollar, especially as the EUR/USD

Topics:

Luc Luyet considers the following as important: Currency outlook, Dollar strength, Macroview, USD currency forecast, USD/EUR rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Extreme negative sentiment on the greenback and improving US data should pave the way for a significant US dollar rebound.

Following disappointing US economic data and another failure to form a Republican majority on key legislation, the US dollar has slipped to a 10-month low, at 94.68 on 18 July.

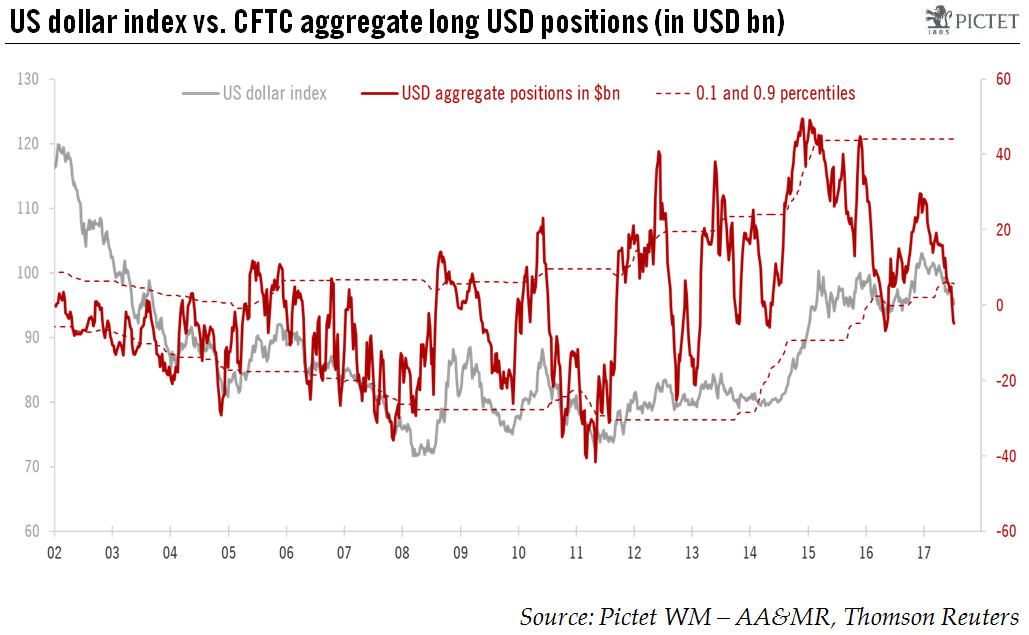

This extreme USD weakness has led to strong negative market sentiment, as highlighted by speculative positions on the futures market.

Although we acknowledge that the foundations (rising inflation and fiscal stimulus) of our strong US dollar view have weakened, we think that the combination of high USD pessimism and improving US data should pave the way for a significant USD rebound.

Consequently, we do not think the time is right to be overly negative on the US dollar, especially as the EUR/USD rate is close to major resistance levels and optimism in other non-USD currencies is very elevated.