Ahead of the mid-term elections, politicians in Washington are trashing out proposals that aim to make permanent the tax cuts voted last December.The House Republicans have launched a new plan to cut taxes, mostly revolving around the idea of making recent cuts for households permanent (they are currently scheduled to lapse in 2025).This willingness by Congress to continue the tax-cutting effort, even if uncertain, could reassure a US business community that has been receiving mixed signals...

Read More »Tax cuts and ‘animal spirits’ mean higher US growth in 2018

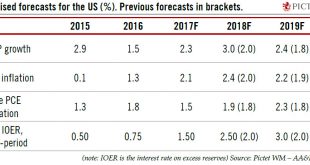

December’s US tax cuts – which saw corporate taxation reduced particularly sharply – are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We therefore upgrade our 2018 US growth forecast from 2.0% to 3.0%. We forecast that real non-residential investment growth will accelerate to 7.0% in 2018, up from an...

Read More »Tax cuts and ‘animal spirits’ mean higher US growth in 2018

The recent US tax cuts and abundant signs of increased corporate investment have led us to raise our forecast for growth and inflation in the US this year and next.December’s US tax cuts – which saw corporate taxation sharply reduced– are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We have raised our 2018 US growth forecast to 3.0% (from a previous forecast of 2.0%), as...

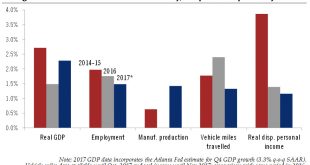

Read More »The US economy was not firing on all cylinders in 2017

The US economy was not firing on all cylinders in 2017, but this could change with the tax cuts.This is a good time to take stock of how well the US economy did in 2017. Assuming Q4 GDP is in line with the current estimate from the Atlanta Fed (which is close to our own), 2017 growth will be 2.3%. This would mark a step-up from annual growth of 1.5% in 2016 – when the sharp drop in oil prices hit investment and the wider economy hard – but would be close to the growth trajectory seen since...

Read More »US tax bill looks set to pass

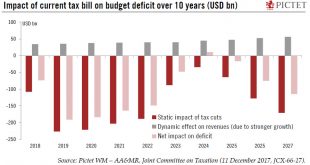

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week, after clearing the conference committee hurdle (a compromise between the House and Senate versions). A few hesitating Republican Senators have eventually said they will vote in favour of the bill, which is key as the Republican majority in the Senate is slim at 52-48. It will...

Read More »US tax bill looks set to pass

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week.The Republican leadership seems to have corralled enough support to pass the tax bill approved in conference committee. The bill could be signed into law as soon as this week.The tax bill cuts the corporate tax rate to 21% from 35%, from January 2018. Global corporate taxation will move to a territorial regime, with a one-off tax on foreign investments...

Read More »A crucial step towards US tax cuts

With the approval of the Senate tax bill in the early hours of Saturday 2 December, a key step has been taken toward tax cuts. The next chapter in the process is to reconcile this version with the House of Representatives’ tax bill, most likely in a ‘conference committee ’ from which a final version will emerge. Various lobbies have been taken by surprise by the speed with which tax legislation has moved forward in...

Read More »A crucial step towards US tax cuts

Approval of the Senate tax bill paves the way for a final congressional bill that leads to tax cuts. Although unchanged, we now see some upside risks to our 2018-19 scenario for US growth and inflation. With the approval of the Senate tax bill in the early hours of Saturday 2 December, a key step has been taken toward tax cuts. The next chapter in the process is to reconcile this tax bill with the House of Representatives’ version, most likely in a...

Read More »US growth forecast raised

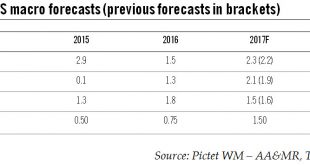

Global growth, post-hurricane reconstruction and higher oil prices are all provided a boost to the US growth outlook. But uncertainty still hangs over tax cuts and the Fed.We are raising our US GDP forecast for 2017 (+0.1 percentage point to 2.3%) and 2018 (+0.3 point to 2.0%) on the back of stronger momentum in Q4 2017. Accelerating global growth is a tailwind for the US economy – as seen in the recent sharp pick up in exports, particularly to emerging markets. Reconstruction efforts in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org