In spite of dilemma, we still think the Fed will announce plans to shrink balance sheet in September and will hike rates again in December.Several Federal Reserve (Fed) officials, and a few foreign central bankers, will meet for their traditional August gathering in Jackson Hole, Wyoming, on 24–26 August. Fed Chair Janet Yellen will give the opening speech on Friday (08:00 local time, 16:00 Geneva), but with neither a Q&A session, nor a scheduled media briefing. Unlike her predecessor, Ben Bernanke, Yellen has put less emphasis on Jackson Hole as a back-from-summer communication method, preferring instead to go there for what it has been since Paul Volcker’s era at the Fed – merely a research seminar for central bankers. Wall Street economists are no longer invited, for instance.The

Topics:

Thomas Costerg considers the following as important: Central bankers meeting, Fed rate policy, Jackson Hole meeting, Macroview, US economic projections, us financial conditions, US inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In spite of dilemma, we still think the Fed will announce plans to shrink balance sheet in September and will hike rates again in December.

Several Federal Reserve (Fed) officials, and a few foreign central bankers, will meet for their traditional August gathering in Jackson Hole, Wyoming, on 24–26 August. Fed Chair Janet Yellen will give the opening speech on Friday (08:00 local time, 16:00 Geneva), but with neither a Q&A session, nor a scheduled media briefing. Unlike her predecessor, Ben Bernanke, Yellen has put less emphasis on Jackson Hole as a back-from-summer communication method, preferring instead to go there for what it has been since Paul Volcker’s era at the Fed – merely a research seminar for central bankers. Wall Street economists are no longer invited, for instance.

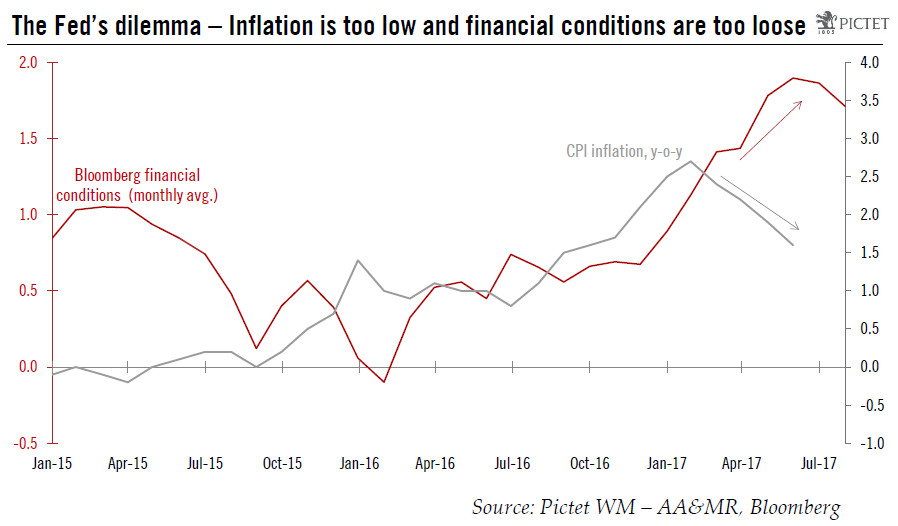

The meeting takes place amid an acute dilemma for the Fed. Despite a few Fed rate hikes since end-2015, financial conditions have remained very loose. High asset prices are worrying Fed officials, and also the influential Fed staff. However, inflation remains stubbornly low, which significantly constrains the Fed’s freedom of action. In recent years, Yellen would argue that financial regulation must be kept tight to avoid asset-price bubbles, while monetary policy should stay loose to help kick-start the economy. But now, with an unemployment rate below the Fed’s “longer-run” rate of 4.6%, she is more open to the idea of continuing the gradual normalisation in rates. Influential New York Fed president Bill Dudley spoke in a similar vein lately, ignoring recent low inflation prints while hinting at a hike in December.

With loose financial conditions front-and-centre right now at the Fed, we think it will go ahead with announcing plans to shrink the balance sheet at the September meeting, and hike rates at the December meeting.