US companies are showing little propensity to use healthy profits to increase their investments. We remain prudent about the outlook for US capex in the coming months.A major feature of the US growth recovery since mid-2009 has been the significant improvement in corporate profits. But improvement has been mostly achieved at the expense of investment (capex) and wage growth, which have been kept on a tight leash. This has puzzled policymakers, including the Federal Reserve, which has been...

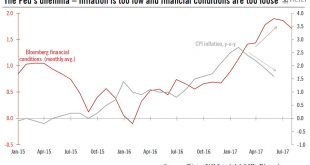

Read More »US economy: Too-loose financial conditions versus too-low inflation

In spite of dilemma, we still think the Fed will announce plans to shrink balance sheet in September and will hike rates again in December.Several Federal Reserve (Fed) officials, and a few foreign central bankers, will meet for their traditional August gathering in Jackson Hole, Wyoming, on 24–26 August. Fed Chair Janet Yellen will give the opening speech on Friday (08:00 local time, 16:00 Geneva), but with neither a Q&A session, nor a scheduled media briefing. Unlike her predecessor,...

Read More »Markets react well to Fed hike

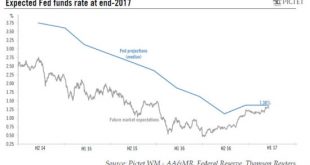

Financial conditions remain accommodative, perhaps setting the stage for next hike in June.In line with what almost every forecaster was expecting, the Federal Open Market Committee (FOMC) decided at its latest policy meeting to raise the Fed funds rate target range by 25bp to 0.75%-1.0%. Fed Chair Janet Yellen explained that the decision to raise rates was appropriate “in light of the economy’s solid progress toward our goals of maximum employment and price stability“. Financial markets...

Read More »When in doubt….The Fed rethinks pace of rate rises

A generally more cautious Fed emerged from its 14-15 June meeting. We continue to expect just one Fed rate hike in 2016, probably in September Read full report hereFollowing a very weak job report for May, and just one week before the EU referendum in the UK, it should be no surprise that the Fed is in no rush to tighten monetary policy, or to send a strong signal about the timing of the next rate hike. Indeed the Federal Open Market Committee (FOMC) statement struck a more cautious tone,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org