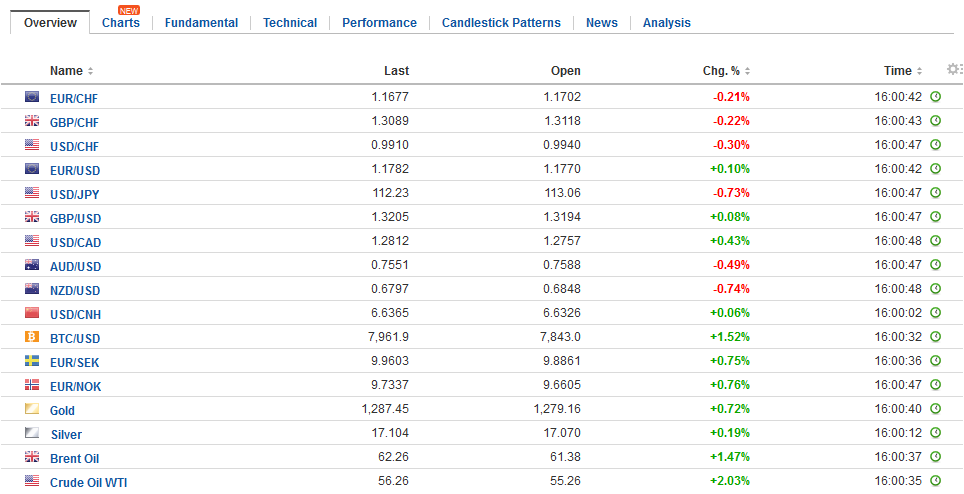

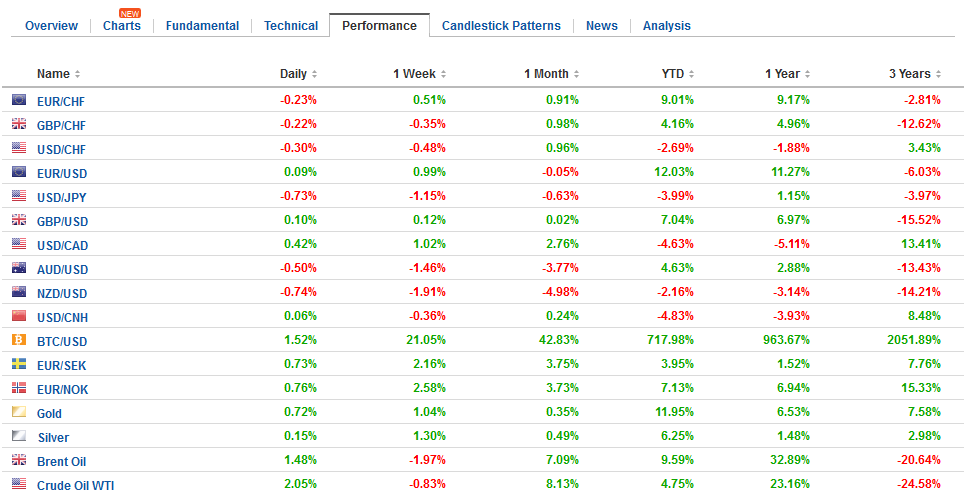

Swiss Franc The Euro has fallen by 0.09% to 1.1686 CHF. EUR/CHF and USD/CHF, November 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading with a heavier bias against the euro, sterling, and yen, but is firmer against the Antipodean currencies and many of the actively traded emerging market currencies. This mixed performance is the story of the week. The US 2-10 yr yield curve is flattening further today with the two-year pushing above 1.70% for the first time since the financial crisis. The 10-year yield is slipping toward the middle of this week’s 2.32%-2.41% trading range. FX Daily Rates, November 17 - Click to enlarge There are two big US

Topics:

Marc Chandler considers the following as important: $INR, EUR, EUR/CHF, Eurozone Current Account, Featured, FX Trends, GBP, JPY, newslettersent, U.S. Housing Starts, USD, USD/CHF

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has fallen by 0.09% to 1.1686 CHF. |

EUR/CHF and USD/CHF, November 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is trading with a heavier bias against the euro, sterling, and yen, but is firmer against the Antipodean currencies and many of the actively traded emerging market currencies. This mixed performance is the story of the week. The US 2-10 yr yield curve is flattening further today with the two-year pushing above 1.70% for the first time since the financial crisis. The 10-year yield is slipping toward the middle of this week’s 2.32%-2.41% trading range. |

FX Daily Rates, November 17 |

| There are two big US stories being discussed today. The progress on US tax reform and news that the special prosecutor had subpoenaed documents from more than a dozen Trump campaign officials several weeks ago.

The House of Representatives passed its version of tax reform yesterday. The Republican majority in the Senate is narrower, and only a third face voters next year compared with the entire House. In its current form, it is difficult to see the current bill pass. It did pass the Senate Finance Committee late yesterday. The bill will be debated by the entire Senate after the Thanksgiving break. There will be a dozen legislative sessions between Thanksgiving and the holiday break in December. |

FX Performance, November 17 |

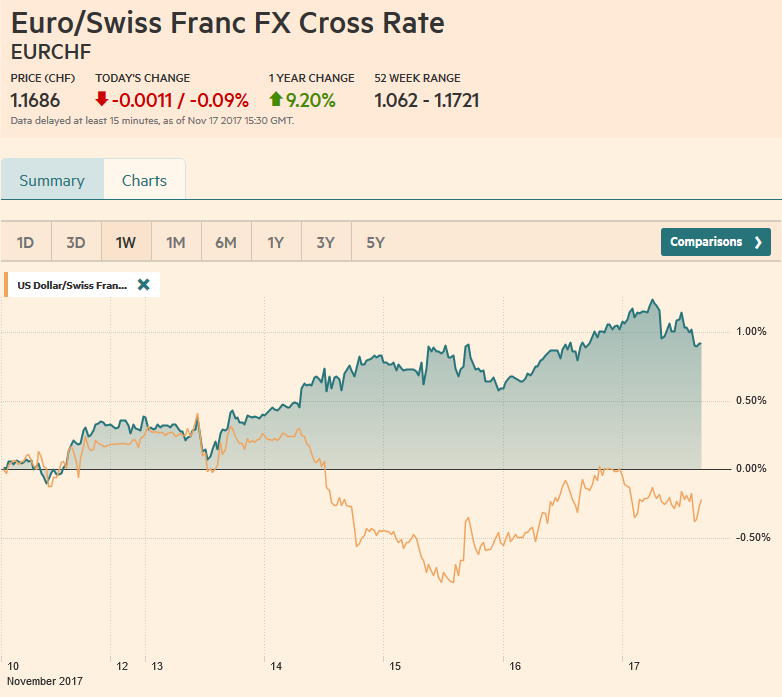

United StatesThe US reports October housing starts and permits. A strong rebound is expected after a weak September report saw a 4.7% decline in starts and a 4.5% fall in permits. The New York and Atlanta Fed will update their GDP trackers. Coming into today, the latest estimate of both is 3.2% for Q4. There may be scope for slightly higher figures as the recent data is incorporated. Canada reports October CPI figures. The headline pace is expected to slow to 1.4% from 1.6%. The Canadian dollar has been sensitive to economic data, but the central bank is seen on hold well into next year. |

U.S. Housing Starts, Oct 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

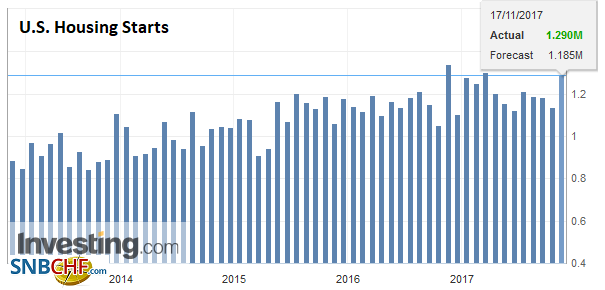

Eurozone |

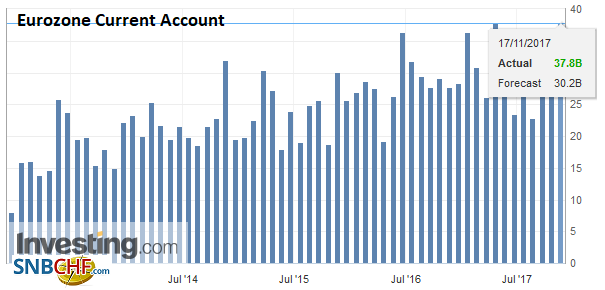

Eurozone Current Account, Sep 2017(see more posts on Eurozone Current Account, ) Source: Investing.com - Click to enlarge |

The Joint Committee on Taxation, which does for taxes what the CBO does for budgets: official arbiter looked at the Senate plan. It found that the Senate’s plan, without including the repeal of the estate tax, leads to higher taxes for those households earning less than $75k a year. Note that the median household income in the US is around $55k. The JCT estimates that 65% of households will experience higher taxes, while 24% will get a cut. Oscar Wilde once quipped that there are only two tragedies in life. One is not getting what one wants, and the other is getting it. The Senate does not seem to know which tragedy it is writing.

There are seven Republican Senators that have expressed some misgivings, sometimes in contradictory ways. For example, Senator Paul wants broad tax cuts, while Senators Corker, Flake, and Lankford are concerned about adding to US indebtedness. A couple of other Senators are concerned about adding the repeal of the individual health care mandate.

There are several other developments to note today, including Moody’s decision to raise India’s sovereign debt rating (first time since 2004) to Baa2 from Baa3, with a stable outlook (from positive). This puts it one notch above the other two major rating agencies, Fitch and S&P. Moody’s cited progress on institutional and economic reforms. Investors responded favorably, as one would expect. The current 10-year benchmark yield slipped nine bp. The rupee gained 0.25% against the US dollar, and Indian equities rose a little more than 0.5%. The other rating agencies did not comment, but they are likely to wait until after next year’s budget is passed. There is some speculation that the upgrade will encourage the central bank to cut rates at its next meeting on December 6.

Meanwhile, German efforts to forge a four-party coalition government continued to be bogged down, as the self-imposed deadline passed. These are still so-called exploratory talks; the concrete coalition negotiations have not begun. There are some genuine policy disagreements on immigration, climate change, fiscal policy, internal security, and Europe. The negotiations are further troubled by the reported leadership challenge within the CSU, the Bavarian sister party to Merkel’s CDU. The talks are set to continue. The underlying threat is that if the talks fail, new elections would be necessary, and many fear that the AfD would gain more support.

There was an informal EU head of state meeting, and leaders indicated they are waiting for additional concessions by the UK before proceeding. UK Prime Minister May met with Swedish and Polish prime ministers last night. These prime ministers are thought to be more sympathetic to the UK’s cause than others. Today she meets with Ireland’s Prime Minister Varadkar and EU President Tusk. In recent days, some officials, including in Germany, seemed to indicate concern that if May is pushed too hard, her position would be untenable and her replacement would likely come from the harder Brexit camp. That said there are reports suggesting May is prepared to double her initial GBP18 bln financial commitment, though other reports deny it.

News that Saudi Arabia is backing an extension of output cuts ahead of the meeting in Vienna at the end of the month is helping lift crude oil prices today. Crude prices fell earlier this week on the IEA’s upgrade of supply and paring demand forecast and an increase in US inventories. Brent is snapping a five-day skid, gaining 0.7%, but is still nearly 2.7% lower on the week, and will post its first losing week since the first week of October. Light sweet crude for December delivery is up 1.4%, which nearly halves this week’s decline, the first in six weeks.

Equity markets are mixed. Asia-Pacific rose while Europe is struggling. The MSCI Asia Pacific Index rose 0.4% to build on yesterday’s nearly 1% gain. However, it was not enough to sustain the six-week advancing streak. European shares are lower. Yesterday’s almost 0.8% gain broke a seven-session swoon, but selling pressure reemerged today. The Dow Jones Stoxx 600 is off 0.33%. The loss is broad-based, with all sectors but energy under water. Near midday in London, it is nursing a 1.25% loss on the week. MSCI Emerging Markets Index is building on yesterday’s gains and is up 2% between the two sessions. It is about 0.4% better on the week, the third consecutive weekly advance.

There is a 694 mln euro option struck at $1.1825, which expires today that could be in play. Although yen option expires today do not seem particularly relevant, we note that Monday there is a large $2.1 bln option stuck at JPY112.30 that could be relevant.

For today’ sterling appears to be near a peak against the dollar, having tested the $1.3260 area in early European turnover. The euro also found support near GBP0.8900 and appears poised to recover. The euro is firm against the dollar and found support near $1.1760-$1.1780. Initial resistance is seen near $1.1820 now and the week’s high was set near $1.1860. The dollar fell to three-week lows against the yen (~JPY112.40 ) in Asia but was confined to about a 25-pip range in Europe.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$INR,$JPY,EUR/CHF,Eurozone Current Account,Featured,newslettersent,U.S. Housing Starts,USD/CHF