The BOJ confounded market expectations by just tinkering with policy on the margins in July. As a result, the yen should hold on to its recent gains. The Bank of Japan (BoJ) did not significantly change monetary policy at its Monetary Policy Meeting held on 28-29 July, contrary to market expectations. While the BOJ did announce an increase in its annual purchases of ETFs (from ¥3.3 trn to ¥6 trn), it kept the annual increase of the monetary base at ¥80 trn and did not cut interest rates further.In our view the BoJ is reaching the limit of what it can do to meet its inflation target of 2% and to keep the yen significantly undervalued, unless it embarks on extreme measures such as ‘helicopter money’, which would signal a willingness to permanently increase the monetary base. As highlighted by its decision at the end of July, the BoJ is not ready (yet) to take such a bold step.We therefore believe the persistent upward pressures on the Japanese yen are unlikely to abate following the BoJ’s decision. In our view, the continued undervaluation of the yen from a fundamental point of view, the diminishing impact of BOJ policies and the weakening impact of portfolio rebalancing, together with lingering global uncertainties should continue to support the yen in the coming months.

Topics:

Luc Luyet considers the following as important: Bank of Japan monetary policy, Helicopter Money, Japan fiscal stimulus, Macroview, yen exchange rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The BOJ confounded market expectations by just tinkering with policy on the margins in July. As a result, the yen should hold on to its recent gains.

The Bank of Japan (BoJ) did not significantly change monetary policy at its Monetary Policy Meeting held on 28-29 July, contrary to market expectations. While the BOJ did announce an increase in its annual purchases of ETFs (from ¥3.3 trn to ¥6 trn), it kept the annual increase of the monetary base at ¥80 trn and did not cut interest rates further.

In our view the BoJ is reaching the limit of what it can do to meet its inflation target of 2% and to keep the yen significantly undervalued, unless it embarks on extreme measures such as ‘helicopter money’, which would signal a willingness to permanently increase the monetary base. As highlighted by its decision at the end of July, the BoJ is not ready (yet) to take such a bold step.

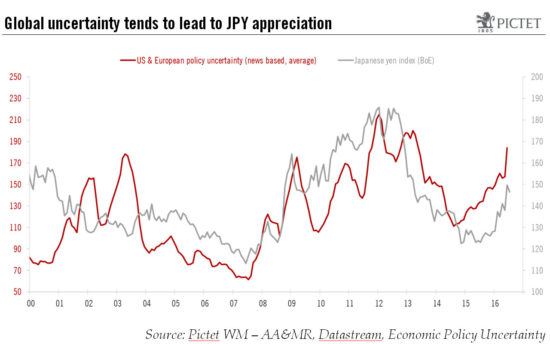

We therefore believe the persistent upward pressures on the Japanese yen are unlikely to abate following the BoJ’s decision. In our view, the continued undervaluation of the yen from a fundamental point of view, the diminishing impact of BOJ policies and the weakening impact of portfolio rebalancing, together with lingering global uncertainties should continue to support the yen in the coming months.

This could change were the BoJ to change its tactics to boost inflation by moving towards ‘helicopter money’ measures. In that case, the weakening of fiscal discipline and the surge in inflation expectations would call for significant JPY depreciation. Still, the sizable fiscal package announced by the government of Shinzo Abe on 27 July may be spread over several years, with the extra spending earmarked for the current fiscal year (to end March 2017) relatively slight. Furthermore, Japanese policy makers will likely remain reluctant to experiment with monetary policy unless the economic situation worsens significantly. Therefore, sustained JPY weakness seems unlikely in the near term.

All in all, we are of the view that the USD/JPY rate is likely to trade below JPY105 per USD in the next few months and that a more hawkish Fed will likely be needed to keep the rate above JPY100 per USD.