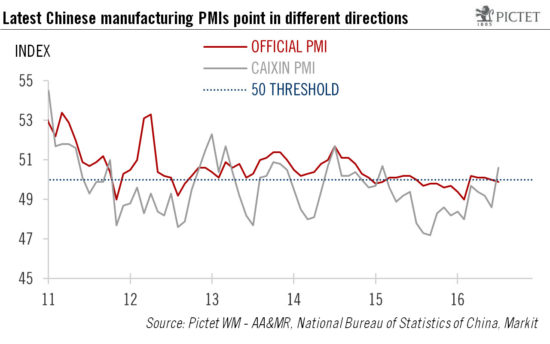

The slight decline in the official manufacturing PMI does not tally with the Caixan equivalent. We believe the official PMI better reflects a Chinese economy heading towards growth of around 6.5% this year. China’s official manufacturing PMI declined slightly to 49.9 in July, while the Caixin (Markit) PMI rose significantly, to 50.6 from 48.6 in June. The official non-manufacturing PMI extended its rise from last month and increased by 0.2 to 53.9, well above the 50 mark that separates expansion in activity from contraction. Combined with the other macro indicators that are available so far, the latest PMI releases confirm our view that China’s growth will likely ease moderately in the second half of 2016 and that full-year growth may settle at around 6.5%.We believe that in the current environment, the official PMI may better reflect momentum in the overall economy than the Caixan equivalent. This is because the domestic investment cycle is playing a much bigger role in determining China’s economic performance today than external demand.

Topics:

Dong Chen considers the following as important: Chinese growth, Chinese manufacturing, Chinese PMI, Chinese services activity, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The slight decline in the official manufacturing PMI does not tally with the Caixan equivalent. We believe the official PMI better reflects a Chinese economy heading towards growth of around 6.5% this year.

China’s official manufacturing PMI declined slightly to 49.9 in July, while the Caixin (Markit) PMI rose significantly, to 50.6 from 48.6 in June. The official non-manufacturing PMI extended its rise from last month and increased by 0.2 to 53.9, well above the 50 mark that separates expansion in activity from contraction. Combined with the other macro indicators that are available so far, the latest PMI releases confirm our view that China’s growth will likely ease moderately in the second half of 2016 and that full-year growth may settle at around 6.5%.

We believe that in the current environment, the official PMI may better reflect momentum in the overall economy than the Caixan equivalent. This is because the domestic investment cycle is playing a much bigger role in determining China’s economic performance today than external demand. The Caixin index is better equipped to capture changes in activity among small and medium-sized enterprises (SMEs) that are more subject to fluctuations in external demand, while the official PMI tends to better represent conditions at the larger state-owned enterprises (SOEs), which are more domestically oriented and whose performance is more influenced by China’s domestic investment cycle.

The official non-manufacturing PMI was a bright spot for China in July. While the construction component eased off a bit, as expected, the reading for the service sectors strengthened. Overall, Chinese non-manufacturing PMI rose to 53.7 in July from 52.7 in June.

The latest PMI releases confirm our view that China’s growth will likely ease moderately in the second half of 2016 as construction activity comes off its peak and that full-year growth may settle at around 6.5%.

The slight slowdown in manufacturing activity in July was not unexpected and we believe the pace of the current economic deceleration is still within the authorities’ range of tolerance. As a result, we do not believe it will trigger any major policy moves to further stimulate the economy.