Solid manufacturing and non-manufacturing numbers plus strong consumer spending mean we expect 2.5% GDP growth in the US in Q3 Although the ISM Manufacturing index in the US dropped back a little to 52.6 in July, it remained well above the low levels recorded at the turn of the year. The Non-manufacturing index moved back down as well but remained at relatively healthy levels.The rebound in the ISM Manufacturing index over the past few months is both encouraging and a bit surprising. The marked decline in the dollar’s trade-weighted value and the rebound in oil prices in H1 may well have given some support to manufacturing activity. However, we have some doubts that this revival will prove really powerful. In any case, the manufacturing sector accounts for only about 12% of the US economy.Following its sharp monthly rebound in June to 56.5, the headline ISM Non-manufacturing figure fell back to 55.5 in July. In spite of the one-month decline this yardstick is also off its lows of earlier this year (see chart).Taken together, the two indices point to US GDP growth picking up from 2.5% on average in Q2 to 2.7% in July. But although ISM surveys are timely and useful indicators of the strength of an economy, they are not very reliable at forecasting growth in the short run. Indeed, ISM indices had been pointing to 2.

Topics:

Bernard Lambert considers the following as important: Macroview, US auto sales, US manufacturing, US non-manufacturing, USM index

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Solid manufacturing and non-manufacturing numbers plus strong consumer spending mean we expect 2.5% GDP growth in the US in Q3

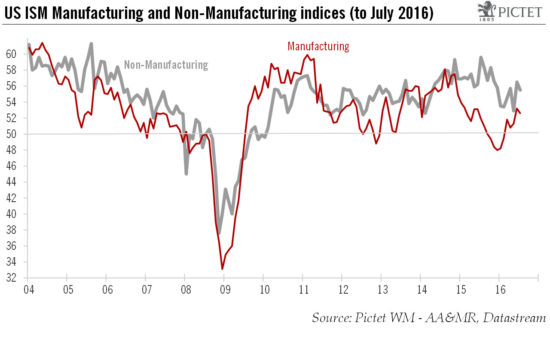

Although the ISM Manufacturing index in the US dropped back a little to 52.6 in July, it remained well above the low levels recorded at the turn of the year. The Non-manufacturing index moved back down as well but remained at relatively healthy levels.

The rebound in the ISM Manufacturing index over the past few months is both encouraging and a bit surprising. The marked decline in the dollar’s trade-weighted value and the rebound in oil prices in H1 may well have given some support to manufacturing activity. However, we have some doubts that this revival will prove really powerful. In any case, the manufacturing sector accounts for only about 12% of the US economy.

Following its sharp monthly rebound in June to 56.5, the headline ISM Non-manufacturing figure fell back to 55.5 in July. In spite of the one-month decline this yardstick is also off its lows of earlier this year (see chart).

Taken together, the two indices point to US GDP growth picking up from 2.5% on average in Q2 to 2.7% in July. But although ISM surveys are timely and useful indicators of the strength of an economy, they are not very reliable at forecasting growth in the short run. Indeed, ISM indices had been pointing to 2.5% GDP growth in the US in Q2, whereas the first estimate published on 29 July showed it was 1.2%.

Other economic releases in the past few days have been mixed overall. Construction spending in June was quite disappointing and the Fed’s Senior Loan Officer Survey for Q3 showed further tightening of credit standards for commercial & industrial loans, as well as for commercial real estate loans.

Importantly, however, month-on-month auto sales bounced back sharply in July, following a marked contraction in monthly sales growth in the first six months of 2016. The encouraging auto data support our view that consumer spending growth should remain solid in Q3. Our scenario – revised last week – that US GDP growth will recover to a quarter-over-quarter rate of 2.5% annualised in Q3 remains unchanged.