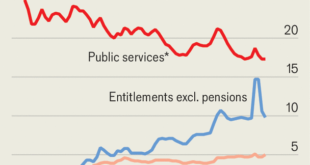

Says The Economist. The authors argue that falling state capacity, incompetence, corruption, and transfer/entitlement spending, which crowds out public investment and services, are to blame. Update: Related, in VoxEU, Martin Larch and Wouter van der Wielen argue that [g]overnments lamenting a stifling effect of fiscal rules on public investment are often those that have a poor compliance record and, as a result, high debt. They tend to deviate from rules not to increase public investment...

Read More »Urban Roadway in America: Land Value

In a CEPR discussion paper, Erick Guerra, Gilles Duranton, and Xinyu Ma estimate the cost of land use for roads in the U.S.

Read More »Banks and Privacy, U.S. vs Canada

JP Koning writes: An interesting side point here is that Canadians don’t forfeit their privacy rights by giving up their personal information to third-parties, like banks. We have a reasonable expectation of privacy with respect to the information we give to our bank, and thus our bank account information is afforded a degree of protection under Section 8 of the Charter. My American readers may find this latter feature odd, given that U.S. law stipulates the opposite, that Americans...

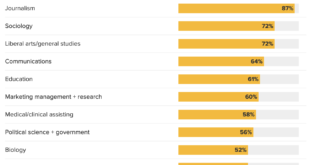

Read More »Most-Regretted College Majors

Source: CNBC.

Read More »No CBDC Act

Source IN THE SENATE OF THE UNITED STATES September 13, 2022 Mr. Lee (for himself and Mr. Braun) introduced the following bill; which was read twice and referred to the Committee on Banking, Housing, and Urban Affairs A BILL To amend the Federal Reserve Act to limit the ability of Federal Reserve banks to issue central bank digital currency. Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, SECTION 1. SHORT TITLE. This Act...

Read More »Week Ahead: More Evidence US Consumption and Output are Expanding, and RBNZ and Norges Bank to Hike

After two-quarters of contraction, many still do not accept that the US economy is in a recession. Federal Reserve officials have pushed against it, as has Treasury Secretary Yellen. The nearly 530k rise in July nonfarm rolls, more than twice the median forecast in Bloomberg's survey, and a new cyclical low in unemployment (3.5%) lent credibility to their arguments. If Q3 data point to a growing economy, additional support will likely be found. While the interest...

Read More »The Dollar Remains Bid, while Sterling Shrugs Off Johnson’s Political Woes

Overview: The dollar jumped yesterday making new highs against most of the major currencies, including the euro, sterling, the dollar-bloc and the Scandis. The yen and Swiss franc held in better, but the greenback still closed firmly against the yen despite a six-basis point decline in the 10-year yield. The Swiss franc rose to its highest level against the euro since the lifting of the cap in early 2015. After opening sharply lower, the S&P 500 and NASDAQ...

Read More »White House on Digital Assets

An executive order dated March 9, 2022 outlines what is on the White House’s mind: The United States has an interest in responsible financial innovation, expanding access to safe and affordable financial services, and reducing the cost of domestic and cross-border funds transfers and payments, including through the continued modernization of public payment systems. We must take strong steps to reduce the risks that digital assets could pose to consumers, investors, and business...

Read More »“Dynamic Tax Externalities and the U.S. Fiscal Transformation,” JME, 2020

Journal of Monetary Economics, with Martin Gonzalez-Eiras. PDF. (Appendix: PDF.) We propose a theory of tax centralization in politico-economic equilibrium. Taxation has dynamic general equilibrium implications which are internalized at the federal, but not at the regional level. The political support for taxation therefore differs across levels of government. Complementarities on the spending side decouple the equilibrium composition of spending and taxation and create a role for...

Read More »“Tractable Epidemiological Models for Economic Analysis,” VoxEU, 2020

VoxEU, June 5, 2020, with Martin Gonzalez-Eiras. HTML. A comparison of epidemiological models for use in economic analyses, based on the CEPR discussion paper.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org