A rate cut is on the cards, but communication will be more difficultThe Federal Reserve (Fed) is very likely to cut rates again on 18 September, a follow-up to its 25-basis point (bp) rate cut at its last meeting in July. The explanation is likely to again be the need to take “insurance” against growing downside risks to the outlook, including from President Trump’s erratic trade policy as well as weaker foreign growth.Fed Chairman Powell is unlikely to pre-commit to a third rate cut at this...

Read More »March Fed review – Mr. Middle Ground

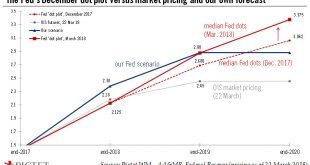

In line with expectations, the Fed raised rates at its last meeting. Chair Powell was keen to underline his “middle ground” approach to normalising monetary policy. We still expect 3 additional rate hikes in 2018.On 21 March, the Federal Reserve hiked rates by one quarter point, as widely expected, nudging the interest rate on excess reserves (IOER) to 1.75%.Chair Jerome Powell’s press conference and the accompanying material – in particular the forecasts for future rate hikes (the ‘dots’) –...

Read More »QE put to bed, the focus shifts to rate hikes

In line with our expectations, the Fed announced 'normalisation' of its balance sheet at its September meeting. Our scenario for a December Fed rate hike remains unchanged.As widely expected, the Federal Reserve announced at its 20 September meeting the start of the ‘normalisation’ of its balance sheet; some of its bond holdings will not be reinvested from October on. The Fed’s balance sheet should therefore start to shrink gradually. Fed chair Janet Yellen justified this decision by saying...

Read More »Fed revises rate projections higher: ours remain unchanged

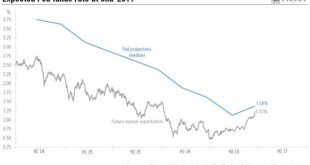

Given the ongoing tightening in monetary conditions, we are leaving our forecasts for two Fed rate hikes next year unchanged for the time being.The decision by the Fed this week to raise the Fed funds rate target range by 25bp to 0.5%-0.75% was widely expected. More surprisingly for the market was certainly the upward revisions in the (in)famous ‘dot plot’. The Federal Open Market Committee’s (FOMC) median forecast for Fed funds rates at the end of 2017 was shifted up by 25bp, to 1.375%,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org