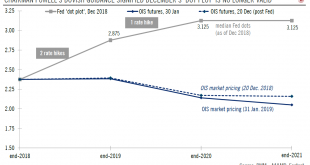

Fed signals end of rate hikes and that bank reserve liquidity tightening is near.Dovishness was on full display at the Fed meeting on 30 January. The Fed removed its rate tightening bias, and emphasised its “patience” until the next rate move.Chairman Powell seemed particularly anxious about the global growth backdrop and explained the more dovish stance is just “common sense risk management”.Another key focus was the balance sheet reduction as Powell hinted that a decision about ceasing the...

Read More »Outsized rise in rates charged on US credit cards

The increase in interest rates paid for credit card debt far exceeds the rise in the Fed funds rate, pointing to sizeable divergence in the impact Fed tightening is having on the US economy.The Fed’s interest-rate tightening since Q4 2015 has had divergent repercussions on interest rates paid by ‘end users’ across the US economy.Interest rates on credit card debt have risen particularly sharply since the start of Fed tightening.How monetary policy is transmitted to the ‘real economy’,...

Read More »US Federal Reserve hints it might turn off the auto pilot

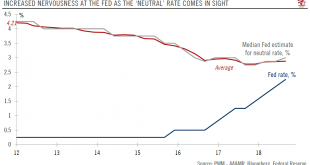

While a December rate hike is on the cards, comments from the central bank are raising questions about when the Fed will pause its rate-hiking cycle.The Federal Reserve (Fed) has been sending dovish signals in recent days: The previous exuberantly optimistic tone about the US growth has been pared down, as some pockets of data have softened, notably housing.Meanwhile, there is renewed debate about the landing zone of the current monetary tightening. Some Fed members want to change the...

Read More »Markets react well to Fed hike

Financial conditions remain accommodative, perhaps setting the stage for next hike in June.In line with what almost every forecaster was expecting, the Federal Open Market Committee (FOMC) decided at its latest policy meeting to raise the Fed funds rate target range by 25bp to 0.75%-1.0%. Fed Chair Janet Yellen explained that the decision to raise rates was appropriate “in light of the economy’s solid progress toward our goals of maximum employment and price stability“. Financial markets...

Read More »Fed revises rate projections higher: ours remain unchanged

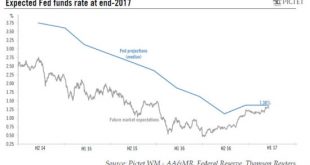

Given the ongoing tightening in monetary conditions, we are leaving our forecasts for two Fed rate hikes next year unchanged for the time being.The decision by the Fed this week to raise the Fed funds rate target range by 25bp to 0.5%-0.75% was widely expected. More surprisingly for the market was certainly the upward revisions in the (in)famous ‘dot plot’. The Federal Open Market Committee’s (FOMC) median forecast for Fed funds rates at the end of 2017 was shifted up by 25bp, to 1.375%,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org