The central bank’s growth and inflation forecasts were left largely unchanged on Sept. 8, but more intervention is in the offing. The ECB kept policy rates and QE unchanged at its 8 September meeting, in line with our expectations. ECB staff forecasts were broadly stable: the 2018 HICP projection, which was left at 1.6%, while the GDP growth was revised down slightly, from 1.7% to 1.6% in 2017 and 2018.The relative stability in the macroeconomic projections reflects, according to the ECB, the “resilience of the euro area economy to the continuing global economic and political uncertainty”, including the Brexit vote. The ECB remains optimistic about the transmission of its various policy measures to the real economy, although its baseline scenario “remains subject to downside risks”.Importantly, the ECB acknowledged for the first time the need to adjust the modalities of its asset purchase programme in order to address scarcity issues. This paves the way for QE extension in December along with some technical changes. The ECB is likely to view an increase in issue and issuer share limits as the easiest choice but other options are possible, including the removal of the yield floor or limited deviations from capital keys (our preferred choice).The ECB remains deeply concerned over the low level of core inflation and wage growth.

Topics:

Frederik Ducrozet considers the following as important: ECB growth forecast, ECB quantitative easing, ECB staff forecasts, European core inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The central bank’s growth and inflation forecasts were left largely unchanged on Sept. 8, but more intervention is in the offing.

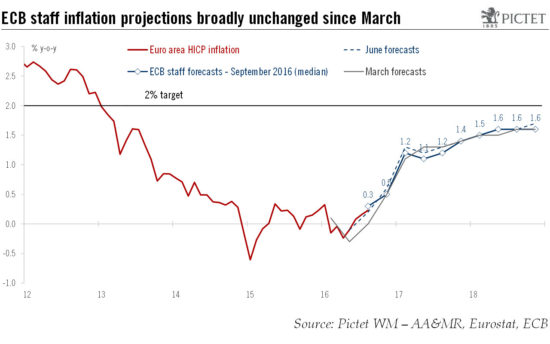

The ECB kept policy rates and QE unchanged at its 8 September meeting, in line with our expectations. ECB staff forecasts were broadly stable: the 2018 HICP projection, which was left at 1.6%, while the GDP growth was revised down slightly, from 1.7% to 1.6% in 2017 and 2018.

The relative stability in the macroeconomic projections reflects, according to the ECB, the “resilience of the euro area economy to the continuing global economic and political uncertainty”, including the Brexit vote. The ECB remains optimistic about the transmission of its various policy measures to the real economy, although its baseline scenario “remains subject to downside risks”.

Importantly, the ECB acknowledged for the first time the need to adjust the modalities of its asset purchase programme in order to address scarcity issues. This paves the way for QE extension in December along with some technical changes. The ECB is likely to view an increase in issue and issuer share limits as the easiest choice but other options are possible, including the removal of the yield floor or limited deviations from capital keys (our preferred choice).

The ECB remains deeply concerned over the low level of core inflation and wage growth. Indeed, ECB staff projections for core inflation still look high (at 1.3% on average in 2017 and 1.5% in 2018). Once QE is extended, the Governing Council is likely to have to weigh the case for further action by March 2017 when the staff will extend its GDP and inflation forecasts to 2019 for the first time. Unless we see unexpectedly large rebound in core inflation in coming months, it is difficult under current circumstances to imagine how price stability can be achieved by 2019.

ECB president Mario Draghi reiterated his call for more action from national governments, including targeted fiscal support. But barring a quantum leap in government action, which looks unlikely, the risk is that the ECB will need to do more beyond 2017.