Swiss consumer price inflation remain lowest compared to Eurozone and U.S. Swiss consumer price inflation remain the lowest in comparison with different countries in the euro zone and the United States. Consumer prices in the U.S. are driven by rising health care costs and asset price inflation in shelter. In Europe, we see the opposite phenomenon: Rents in Italy or Spain are steady or falling. In Germany and Switzerland rent control prevents that asset price inflation moves into consumer prices. In Switzerland, more and more supply is helping to contain housing costs. Inflation Rate YoY and Main Drivers Switzerland Germany Euro Area Spain Italy United States Weight (Switzerland) Weight (US) Total -0.3% +0.8% +0.6% +0.5% 0.0% +1.6% 100% 100% Food +0.8% +1.2% +0.7% -0.1% +0.5% -0.2% 10.2% 13.7% Shelter/Rents +1.2% +1.4% +1.2% +0.3% -1.9% +3.5% 24.7% 33.4% Health Care -0.6% +1.6% Not published 0% +0.3% +4.6% 15.6% 8.6% Energy & Fuels -2.4% -2.7% -1.1% +0.3% +0.3% +0.1% 5.5% 7.1% Source Swiss Statistics Destatis EuroStat INE Istat BLS From the official press release by Swiss Statistics: Swiss Consumer Price Index in November 2016: Consumer prices fall by 0.2% Neuchâtel, 06.12.2016 (FSO) – The Swiss Consumer Price Index (CPI) fell by 0.

Topics:

George Dorgan considers the following as important: Featured, newslettersent, Swiss consumer prices, Swiss Macro, Switzerland Consumer Price Index, Switzerland inflation

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss consumer price inflation remain lowest compared to Eurozone and U.S.

Swiss consumer price inflation remain the lowest in comparison with different countries in the euro zone and the United States. Consumer prices in the U.S. are driven by rising health care costs and asset price inflation in shelter.

In Europe, we see the opposite phenomenon: Rents in Italy or Spain are steady or falling. In Germany and Switzerland rent control prevents that asset price inflation moves into consumer prices.

In Switzerland, more and more supply is helping to contain housing costs.

| Inflation Rate YoY and Main Drivers |

Switzerland | Germany | Euro Area | Spain | Italy | United States | Weight (Switzerland) | Weight (US) |

| Total | -0.3% | +0.8% | +0.6% | +0.5% | 0.0% | +1.6% | 100% | 100% |

| Food | +0.8% | +1.2% | +0.7% | -0.1% | +0.5% | -0.2% | 10.2% | 13.7% |

| Shelter/Rents | +1.2% | +1.4% | +1.2% | +0.3% | -1.9% | +3.5% | 24.7% | 33.4% |

| Health Care | -0.6% | +1.6% | Not published | 0% | +0.3% | +4.6% | 15.6% | 8.6% |

| Energy & Fuels | -2.4% | -2.7% | -1.1% | +0.3% | +0.3% | +0.1% | 5.5% | 7.1% |

| Source | Swiss Statistics | Destatis | EuroStat | INE | Istat | BLS |

From the official press release by Swiss Statistics:

Swiss Consumer Price Index in November 2016:

Consumer prices fall by 0.2%

| Neuchâtel, 06.12.2016 (FSO) – The Swiss Consumer Price Index (CPI) fell by 0.2% in November 2016 compared with the previous month, reaching 100.1 points (December 2015=100). Inflation was -0.3% in comparison with the same month in the previous year. These are the findings from the Federal Statistical Office (FSO). |

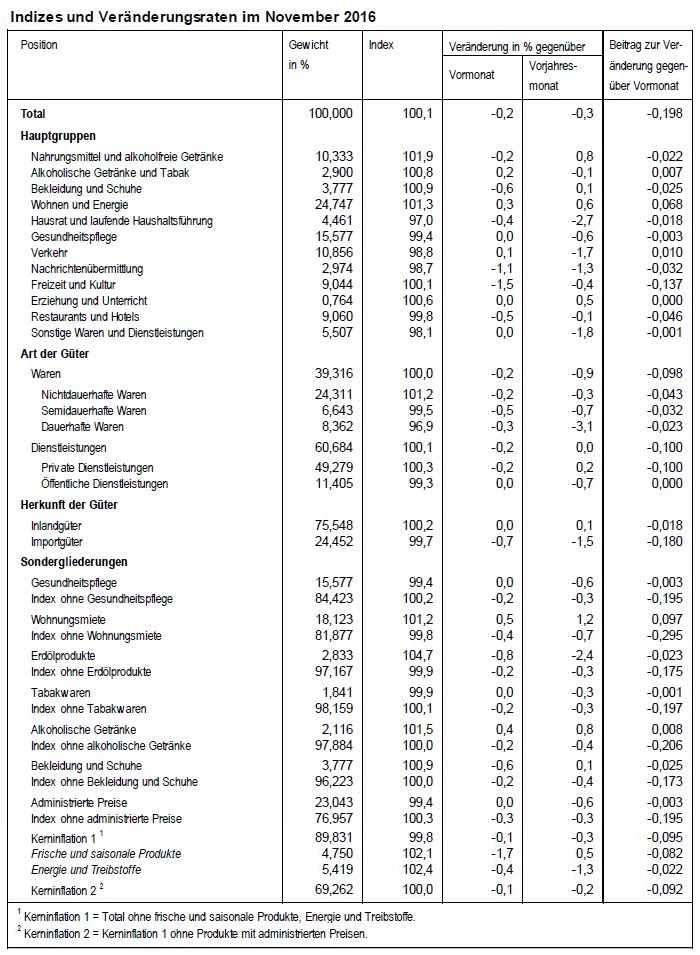

Switzerland Consumer Price Index, November 2016(see more posts on Switzerland Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Download press release: Swiss Consumer Price Index in November 2016

German text:

Landesindex der Konsumentenpreise im November 2016

Konsumentenpreise fallen um 0,2 Prozent

Neuchâtel, 06.12.2016 (BFS) – Der Landesindex der Konsumentenpreise (LIK) sank im November 2016 gegenüber dem Vormonat um 0,2 Prozent und erreichte den Stand von 100,1 Punkten (Dezember 2015=100 Punkte). Im Vergleich zum Vorjahresmonat betrug die Teuerung -0,3 Prozent. Dies geht aus den Zahlen des Bundesamts für Statistik (BFS) hervor.Der Rückgang des LIK um 0,2 Prozent gegenüber dem Vormonat ist hauptsächlich auf tiefere Preise für Pauschalreisen und Hotelübernachtungen zurückzuführen. Weniger bezahlt wurde auch für Heizöl und Mobilnetz-Kommunikation, während die Wohnungsmieten stiegen.