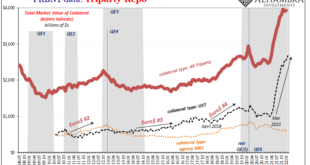

Securities lending as standard practice is incredibly complicated, and for many the process can be counterintuitive. With numerous different players contributing various pieces across a wide array of financial possibilities, not to mention the whole expanse of global geography, collateral for collateral swaps have gone largely unnoticed by even mainstream Economics and central banking. This despite the fact, yes, fact, securities lending was the epicenter of the 2008...

Read More »The Great Eurodollar Famine: The Pendulum of Money Creation Combined With Intermediation

It was one of those signals which mattered more than the seemingly trivial details surrounding the affair. The name MF Global doesn’t mean very much these days, but for a time in late 2011 it came to represent outright fear. Some were even declaring it the next “Lehman.” While the “bank” did eventually fail, and the implications of it came to be systemic, those overly melodramatic descriptions actually served to downplay the event in public imagination. The world...

Read More »Banks Or (euro)Dollars? That Is The (only) Question

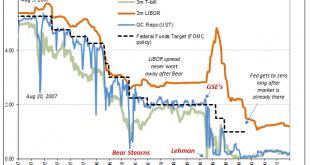

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes. Total financial resilience otherwise. Yesterday was,...

Read More »Taleb Explains How He Made Millions On Black Monday As Others Crashed

Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday. Taleb famously supercharged his career – and earned a considerable sum of money (though turns out it was less than Taleb felt he deserved) – thanks to his trading profits from...

Read More »Talking Global Macro Investing With A 25-Year Market Veteran

- Click to enlarge By Chris at www.CapitalistExploits.at If you were rich, successful, and intelligent – which often, not always, go hand in hand together – where would you live? The last time I was in the Rockies, I remember thinking to myself. You know what, if it weren’t for the fact it’s so damn far from the beach I could actually live here. It’s really quite lovely....

Read More »Talking Global Macro Investing With A 25-Year Market Veteran

By Chris at www.CapitalistExploits.at If you were rich, successful, and intelligent - which often, not always, go hand in hand together - where would you live? The last time I was in the Rockies, I remember thinking to myself. You know what, if it weren't for the fact it's so damn far from the beach I could actually live here. It's really quite lovely. Bite-your-hand-to-stop-you-from-crying-out-loud-lovely and if, like me, you're a sucker for snowboarding, then it's pretty hard to be...

Read More »Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

Submitted by Koos Jansen from BullionStar.com After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes? After the Germans had activated a program to...

Read More »Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach ‘Deal’ With DOJ: Bild

Following the seemingly endless procession of short-squeeze-fueling trial balloons last week – from settlement rumors to German blue-chip bailouts to Qatari investors – Germany’s Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department. John Cryan - Click to enlarge Having soared over 25% off the briefly...

Read More »Could the Fed have Rescued Lehman Brothers?

In a paper, Larry Ball argues that inadequate collateral and lack of legal authority were not the reasons that the Fed let Lehman fail. … … the primary decision maker was Treasury Secretary Henry Paulson–even though he had no legal authority over the Fed’s lending decisions. … evidence supports the common theory that Paulson was influenced by the strong political opposition to financial rescues. … Another factor is that both Paulson and Fed officials, although worried about the effects of...

Read More »End of an Era: The Rise and Fall of the Petrodollar System

The Transition “The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better.” Ron Paul The intricate relationship between energy markets and our global financial system, can be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org