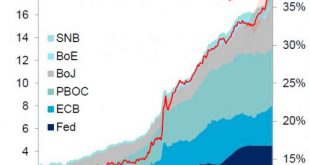

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »Gold Bullion Coin Worth $4 Million, Stolen in Berlin Museum Heist

Gold Bullion Coin Worth $4 Million, Stolen in Berlin Museum Heist - Gold coin called ‘Million Dollar Gold Coin’ or ‘Big Maple Leaf’ stolen from Berlin museum early on Monday- World's purest gold coin and in the Guinness Book of Records for its purity of 99999 fine gold- Gold coin was legal tender, investment grade, bullion coin and only 5 other coins were minted- The other 'Million Dollar Gold Coin' is still available for sale by GoldCore safely stored in vaults in...

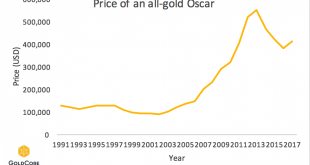

Read More »The Oscars – Gold Plated And Debased Like The Dollar

Submitted by Jan Skoyles via GoldCore.com, The Oscars – Worth Their Weight in Gold? 89th Oscars to air this weekend Oscars have been dipped in 24 karat gold since 1929 If the Oscars were made of solid gold they would weigh 330 ounces 330 ounces of gold is worth $408,210 at today’s prices (nearly €400k & £330k) Only some $630 worth of gold in Oscar statue Oscars cannot be sold due to regulations Steven Spielberg keeps his gold Oscar with the Academy for...

Read More »The Oscars – Gold Plated and Debased Like Dollar

The Oscars - Worth Their Weight in Gold? 89th Oscars to air this weekend Oscars have been dipped in 24 karat gold since 1929 If the Oscars were made of solid gold they would weigh 330 ounces 330 ounces of gold is worth $408,210 at today's prices (nearly €400k & £330k) Oscars cannot be sold, making them a tricky investment piece Steven Spielberg keeps his gold Oscar with the Academy for ‘safe-keeping’ Shows importance of owning gold in safest ways Price of gold has climbed from $20.67...

Read More »Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland’s Gold Exports To China Surge To 158 Tonnes In December Switzerland’s gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November – a jump of 416%. According to Eddie van der Walt as reported on the Bloomberg terminal this morning, total Swiss gold exports surged to 287.6 tons in December (valued at CHF 10.8b) according to data on the website of...

Read More »Will The ECB Buy Stocks?

Authored by Nick Kounis and Kim Liu via ABN AMRO, Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility We think the ECB could legally buy ETFs that fit its requirements… … but it would be controversial and we question the benefits An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme …and assuming a...

Read More »The World’s Dominant Gold Refineries

There are many precious metals refineries throughout the world, some local to their domestic markets, and some international, even global in scale. Many but by no means all of these refineries are on the Good Delivery Lists of gold and/or silver. These lists are maintained by the London Bullion Market Association (LBMA) and they identify accredited refineries of large (wholesale) gold and silver bars that continue to...

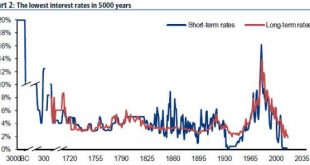

Read More »Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

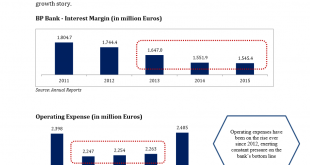

Read More »Veritaseum Blockchain-based Bank Research Hits Another Home Run – Banco Popular Shown to be Bear Stearns Redux!

During the months of March and April of 2016 we released a series of proprietary research reports indicating signficant weakneses that we found in the European banking system and released it for sale through the blockchain (reference The First Bank Likely to Fall in the Great European Banking Crisis). This was performed by the same macro forensic and fundamental analysis team that first warned about the pan-European sovereign debt crisis in 2009 and 2010 (reference Pan-European...

Read More »How Can Brazil Regain Its Investment-Grade Status?

Rising public debt and a large deficit prompted S&P and Fitch to downgrade Brazilian sovereign debt below investment grade in 2015, and Moody’s is expected to follow suit in the coming months. How much will losing its investment-grade rating really affect the economy? What will it take for Brazil to regain investment-grade status, and how long might that take? Hear economist Norbert Gaillard discuss the ramifications of Brazil’s credit rating at the 2016 Latin America Investment...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org