Swiss Franc The Euro has risen by 0.43% to 1.1568 CHF. EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge The US dollar is slumping against all the major currencies in the aftermath of the hawkish Federal Reserve. In fact, the inability of the greenback to hold on to the gains scored in the initial reaction to the Fed’s hike, optimism on the economy,...

Read More »Bi-Weekly Economic Review – VIDEO

[embedded content] Interview with Joe Calhoun about BiWeekly Economic Review 15/06/2018. Related posts: Bi-Weekly Economic Review: As Good As It Gets? Bi-Weekly Economic Review – VIDEO Weekly SNB Intervention Update: SNB Resumes Interventions Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth Bi-Weekly Economic Review Bi-Weekly...

Read More »Swiss shooting event draws fewer gun enthusiasts

Shooting in Switzerland is no longer as popular as it once was. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel: http://www.youtube.com/swissinfovideos Subscribe:...

Read More »Swiss National Bank commits to FX Global Code and supports establishment of foreign exchange committee

The Swiss National Bank (SNB) has signed a Statement of Commitment to the FX Global Code (“Code”), thereby demonstrating that its internal processes are consistent with the principles of the Code. It also expects its regular counterparties to adhere to the Code and comply with the agreed rules of conduct. Published on 25 May 2017, the Code outlines principles of good practice developed by central banks and market...

Read More »Swiss Producer and Import Price Index in May 2018: +3.2 percent YoY, +0.2 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

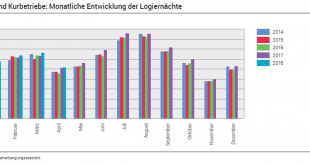

Read More »Tourist Accommodation in the Winter Season 2017/2018: Growth in Overnight stays in Switzerland

Neuchâtel, 7 June 2018 (FSO) – The Swiss hotel industry registered 16.5 million overnight stays during the winter tourist season (November 2017 to April 2018), i.e. an increase of 4.6% (+724 000) compared with the same period of the previous year. With a total 8.7 million overnight stays, foreign demand grew by 5.6% (+460 000). Domestic demand rose by 3.5% (+264 000) reaching 7.8 million units. These are the provisional...

Read More »Vaud Plans Tax Cuts

Last week, Vaud’s government announced a plan for future tax cuts. ©-Erix2005-_-Dreamstime.com_ - Click to enlarge The residents of Vaud are among the highest taxed in Switzerland. In 2016, a single person in Lausanne earning CHF 100,000 paid CHF 16,050 in cantonal and communal tax on top of CHF 1,840 of federal tax. This was the fourth highest across all of Switzerland’s 26 cantonal capitals, and almost triple Zug,...

Read More »FX Daily, June 13: Dollar Edges Higher Ahead of FOMC

The US dollar is trading firmly as the FOMC decision looms. In many ways, the actionable outcome of this meeting has hardly been in doubt this year. By all accounts, the Fed will deliver its second hike of the year today. The question is not so much about the next meeting in August. The Fed has only hiked rates at meetings that a press conference follows. This is the source of one of our persistent criticisms of the...

Read More »A Slight Hint Of A 2011 Feel

Whenever a big bank is rumored to be in unexpected merger talks, that’s always a good sign, right? The name Deutsche Bank keeps popping up as it has for several years now, this is merely representative of what’s wrong inside of a global system that can’t ever get fixed. In this one case, we have a couple of perpetuated conventional myths colliding into what is still potentially grave misfortune. As noted last time, I...

Read More »Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘. The Sovereign Money referendum...

Read More » SNB & CHF

SNB & CHF