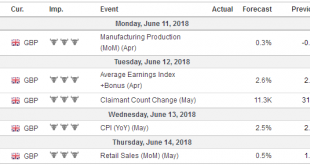

The week ahead is eventful. The Federal Reserve, the European Central Bank, and the Bank of Japan hold policy meetings. This would make for a busy week by themselves, but there is more. Trade tensions are likely to escalate further, if the US, as scheduled provides a list of $50 bln of Chinese goods that will face another 25% tariff for intellectual property violations. If the US does so, China has threatened to retract...

Read More »Emerging Markets: What Changed

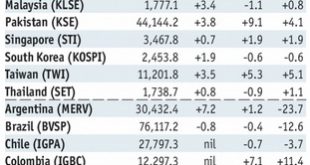

Summary The Reserve Bank of India hiked rates for the first time since 2014. Malaysia’s central bank governor resigned. Czech central bank tilted more hawkish. Russia central bank tilted more dovish. Argentina got a $50 bln standby program from the IMF. Brazil central bank signaled more aggressive FX intervention ahead. Mexico trade tensions with US are rising. Peru has a new Finance Minister. Stock Markets In the EM...

Read More »“Without Gold I Would Have Starved To Death” – ECB Governor

– “Without gold I would have starved to death” – Ewald Nowotny, governor of Austrian central bank and member of ECB’s governing council – “I was born in 1944. When I was a baby, my mother could only buy food because she still had some gold coins…” – “When the going gets tough, gold becomes the ultimate money” reports Die Presse Under central bank governor Ewald Nowotny, Austria has brought back half of its gold reserves...

Read More »The Nestlé story

Nestlé has a long history in Switzerland, but how Swiss is it nowadays? Nouvo brings you short videos about Switzerland, Swiss current affairs and the wider world. Keep up to date and watch the videos wherever you are, whenever you like. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or...

Read More »Nestlé plans to move 580 jobs out of Switzerland

Last week, Nestlé announced plans to cut its Swiss workforce by 580. The plans involve restructuring its IT department, with a focus on extending its technology hub in Spain. Over the next 18 months, this re-organization could lead to a reduction of up to 500 IT positions in Switzerland, said the company. A source close to Nestlé told Le News that around two thirds of the cuts will occur in Vevey and the remaining...

Read More »Dollar and Yen Rise Amid Heightened Anxiety

With what promises to be an acrimonious G7 meeting, from which the isolated US President will depart early, and a broadening pressure in emerging markets, the US dollar turned better bid late yesterday and is recovering further today. Disappointing April industrial production figures in Germany and France did not do the euro any favors. Sterling is faring better than the euro after Prime Minister May survived yet...

Read More »Swiss Government Pension Fund To Buy Gold Bars Worth Some $700 Million

Swiss Government Pension Fund Allocating 2% Of Pension Fund To Gold Bars via IPE Quest The Swiss government pension fund, Switzerland’s AHV/AVS fund, has decided to diversify into physical gold bars in their substantial CHF35.2bn (€30.5bn) pension portfolio. At the end of last week the first pillar buffer fund tendered a custodianship and storage for CHF 700m (EUR 600m / USD 700m / GBP 525m) in gold bars via IPE Quest....

Read More »‘Much too early’ to lift interest rates, says SNB chairman

The strong franc is hurting Swiss exporters and the domestic tourism industry The continued volatility surrounding the Italian elections and the threat of global trade wars make it far too early for the Swiss National Bank (SNB) to consider raising rock bottom interest rates, says chairman Thomas Jordan. “It’s much too early at this moment,” Jordan told CNNMoney Switzerland. “The situation is still quite fragile...

Read More »Swiss Prosecutors will not Pursue Novartis over Trump Lawyer Payments

Novartis admitted that it had signed a one-year contract with the company of Trump’s private lawyer, Michael Cohen. (Keystone) The Office of the Attorney General of Switzerland (OAG) announced on Wednesday that it will not bring proceedings against Novartis in connection with the payments the Swiss pharmaceutical company made to Donald Trump’s personal lawyer. The OAGexternal link had received a criminal complaint...

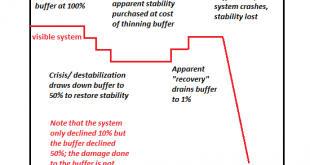

Read More »The Three Crises That Will Synchronize a Global Meltdown by 2025

We’re going to get a synchronized global dynamic, but it won’t be “growth” and stability, it will be DeGrowth and instability. To understand the synchronized global meltdown that is on tap for the 2021-2025 period, we must first stipulate the relationship of “money” to energy:“money” is nothing more than a claim on future energy. If there’s no energy available to fuel the global economy, “money” will have little value....

Read More » SNB & CHF

SNB & CHF