See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Shill Alarm One well-known commentator this week opined about the US health care industry: “…the system is designed the churn and burn… to push people through the clinics as quickly as possible. The standard of care now is to prescribe some medication (usually antibiotics) and send people on their way without taking the time to conduct a comprehensive examination.” Nope. That is not the standard of care. And anyone who works in health care knows that the above is BS. This same guy has touted the conspiracy theory which claims the gold price would be thousands of dollars higher, but for a long-term gold

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6b) Austrian Economics, 7) Markets, Chart Update, dollar price, Featured, Gold, gold basis, Gold co-basis, gold price, gold silver ratio, newslettersent, Precious Metals, silver, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Shill AlarmOne well-known commentator this week opined about the US health care industry:

Nope. That is not the standard of care. And anyone who works in health care knows that the above is BS. This same guy has touted the conspiracy theory which claims the gold price would be thousands of dollars higher, but for a long-term gold price-suppression racket. And anyone who works in banking knows that is BS. And anyone who doesn’t work in banking, but who works in health care, would suspect it. Be careful who you buy your gold from. Also be careful who you buy your macroeconomic analysis from. Not everyone uses the same standard of care with the facts. This segues into a pet peeve of ours. Who puts more tarnish on gold? The central bankers and the apologists for fiat currencies? Or the people who care little for truth, touting whatever speculation they hope to sell or get paid to pump? They treat gold as if it is nothing more than a speculation. And when the price doesn’t go up it is blamed on “manipulation”. Folks, look all around you at regular people. If they have a distaste for gold, a vague dislike that they can’t quite articulate, then perhaps this sort of behavior is part of the reason why. Civilization cannot exist without money. Gold is money. This is serious stuff. Money should be treated with respect, if not reverence. It is not some get-rich-quick scheme, and a conspiracy is not the only conceivable reason not to be rich already. The price of gold rose four bucks, to $1,318.85. Actually, that is not quite precise. $1,318.85 is the last cleared price for spot gold at the end of the day on Friday. While the market is open, there are two prices. There is the bid and the offer (also called the ask). Late on Friday, gold was bid $1,318.85 and offered $1,319.75. If you own gold, then $1,318.85 was the price (in dollars) you were paid, to permanently get rid of it. Interest, on the other hand, is the price (in gold) you are paid to part with it for a year, and then get it back again. Which is more important? And which is more popular? We hope this makes it clearer why we scorn the conspiracy theory. |

|

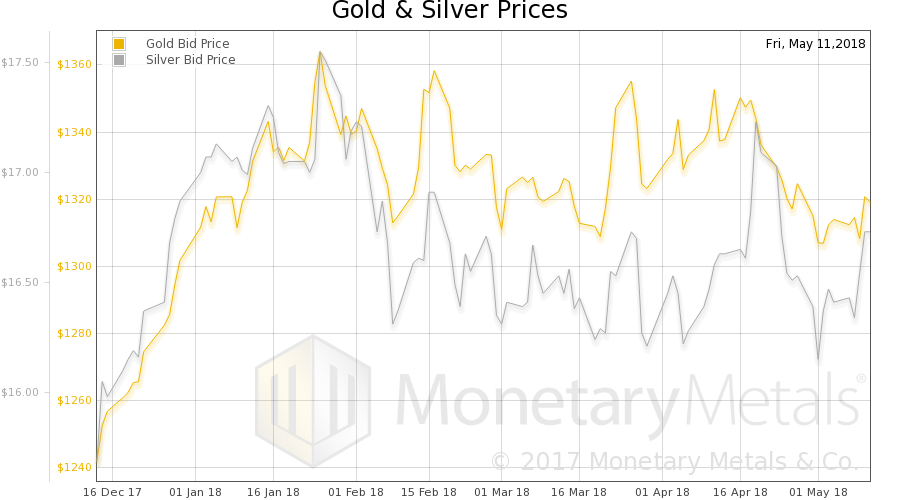

Fundamental DevelopmentsHere is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

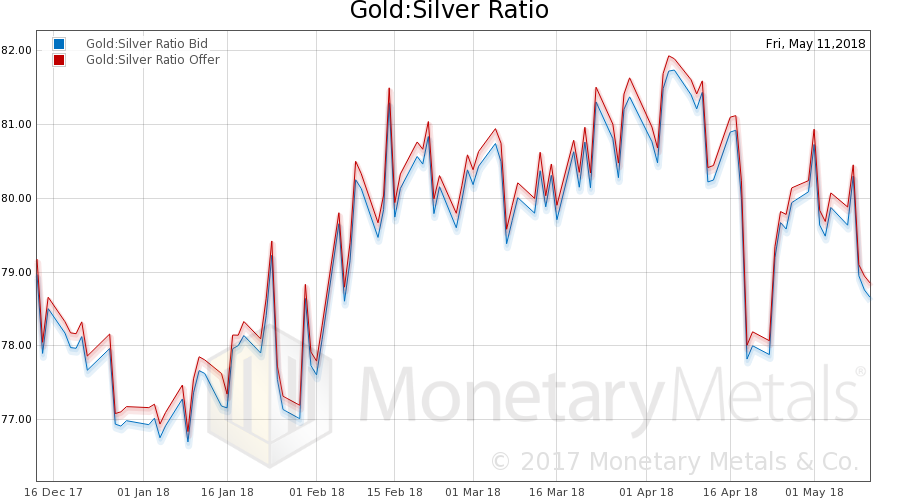

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell slightly this week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

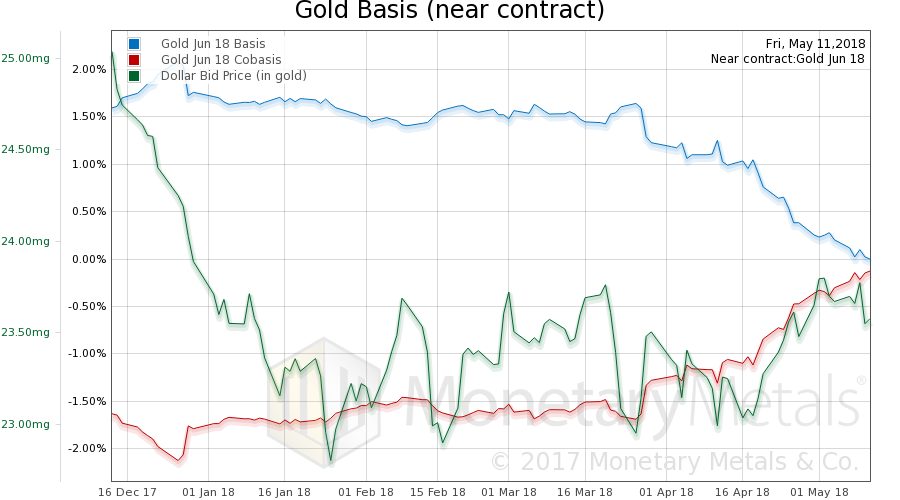

Gold Basis and Co-basis and Dollar PriceHere is the gold graph showing gold basis, co-basis and the price of the dollar in terms of gold price. The June gold contract is approaching backwardation, with a co-basis of -0.1%, though farther-out contracts subsided slightly. This is selling pressure on the near contract, which goes First Notice Day in a few weeks. |

Gold Basis and Co-basis and the Dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

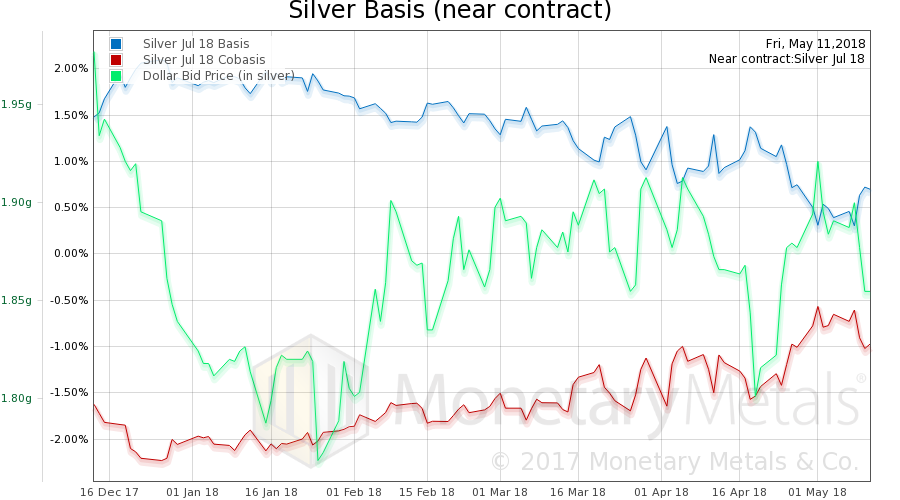

Silver Basis and Co-basis and the Dollar PriceThe Monetary Metals Gold Fundamental Price fell $4 this week to $1,493. Now let’s look at silver. The July silver co-basis fell a bit, as did farther-out contracts. This corresponds to the fall in the price of the dollar, measured in gold (the inverse of the price of silver, conventionally viewed in dollar terms). In other words, speculators bid up silver futures… so what’s new? The Monetary Metals Silver Fundamental Price fell 9 cents to $17.60. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Tags: Chart Update,dollar price,Featured,Gold,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver,silver basis,Silver co-basis,silver price