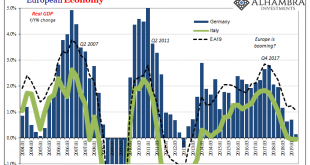

The Economics textbook says that when faced with a downturn, the central bank turns to easing and the central government starts borrowing and spending. This combined “stimulus” approach will fill in the troughs without shaving off the peaks; at least according to neo-Keynesian doctrine. The point is to raise what these Economists call aggregate demand. If everyday folks don’t want to spend – because a lot of them can’t – then the government will spend on their...

Read More »Swiss health insurers to send patients to pharmacy first

© Tero Vesalainen | Dreamstime.com Swiss healthcare is typically ranked the world’s second most expensive, as a percentage of GDP, after the US. In Switzerland, compulsory health insurance premiums cover 37% of healthcare costs. Much of the rest is covered by tax payers and non-reimbursable out-of-pocket payments by individuals. As part of a plan to reduce costs, this week, the health insurer Groupe Mutuel, launched a new lower cost plan which requires its clients to...

Read More »G7 to Deliver a Nothing Burger

A Bloomberg article about the weekend G7 meeting says, “multilateralism is dead.” An op-ed in the Financial Times suggests that the most important political alliance may be “rejuvenated” at the G7 meeting. The truth is likely found somewhere in between. Economic nationalism, personalities of (some) of the leaders are not conducive to deepening or broadening cooperation among the leading market economies. At the same time, the G7 is an expression of...

Read More »FX Daily, August 23: Market has Second Thoughts on Magnitude of Fed Cuts Ahead of Powell

Swiss Franc The Euro has fallen by 0.07% to 1.0887 EUR/CHF and USD/CHF, August 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and...

Read More »Charles Hugh Smith on Advice for Millennials: Low Cost Education and Where the Jobs Are!

Charles Hugh Smith on Advice for Millennials: Low Cost Education, Affordable Housing and Where the Jobs Are! Click here for the full transcript: http://financialrepressionauthority.com/2019/08/22/the-roundtable-insight-charles-hugh-smith-on-advice-for-millennials-low-cost-education-affordable-housing-and-where-the-jobs-are/

Read More »Charles Hugh Smith on Advice for Millennials: Low Cost Education and Where the Jobs Are!

Charles Hugh Smith on Advice for Millennials: Low Cost Education, Affordable Housing and Where the Jobs Are! Click here for the full transcript: http://financialrepressionauthority.com/2019/08/22/the-roundtable-insight-charles-hugh-smith-on-advice-for-millennials-low-cost-education-affordable-housing-and-where-the-jobs-are/

Read More »Swiss food-waste pioneer wins CHF200,000 prize

Some two million tonnes of food is thrown away every year in Switzerland. This year’s CHF200,000 ($204,000) J.E. Brandenberger Foundation prize has been awarded to Yvonne Kurzmeyer, founder of the charity organisation Schweizer Tafel. The organisation redistributes over 4,000 tonnes of food a year to underprivileged groups in Switzerland. Kurzmeyer was awarded the prize for her outstanding achievements in the redistribution of surplus resources to benefit those in...

Read More »Our Wile E. Coyote Federal Reserve

Whatever the Fed chooses to do, it’s already failed.. Wile E. Coyote has gotten a bad rap: in all fairness, his schemes are ingenious, if overly complicated, and it’s not his fault that the Acme detonator misfires or the Road Runner doesn’t respond as predicted. Every set-up to nail the Road Runner should work. That it fails and leaves him suspended over the cliff for a woefully brief second to intuit his impending doom really isn’t his fault. Wile E. Coyote and the...

Read More »Die Nationalbank riskiert Ärger mit Donald Trump

Donald Trump (Picture: Shutterstock) Die Deviseninterventionen der Schweizerischen Nationalbank sorgen für Spannungen. Die Schweiz läuft Gefahr, von den USA als Währungsmanipulatorin gebrandmarkt zu werden. (K)ein Grund zur Sorge? In den vergangenen Wochen hat die Schweizerische Nationalbank (SNB) wiederholt am Devisenmarkt interveniert, um den Franken davor zu bewahren, noch stärker gegen die wichtigsten Handelswährungen wie Euro und Dollar zu steigen. So weit sind...

Read More »Dollar Firm Ahead of Jackson Hole

FOMC minutes were not as dovish as many had hoped; bond and equity markets are set up for a big reset Today sees the start of the annual Fed symposium in Jackson Hole; the US reports a slew of data Markit flash eurozone August PMI readings were reported; ECB publishes the account of its July 25 meeting Japan-Korea relations continue to deteriorate Indonesia delivered a dovish surprise; Mexico and Brazil report mid-August inflation data The dollar is broadly firmer...

Read More » SNB & CHF

SNB & CHF