Swiss Franc The Euro has risen by 0.17% to 1.0905 EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday’s 1.2% advance despite an unexpected gain in the EMU flash PMI....

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the...

Read More »Big firms required to publish gender pay gap in 2021

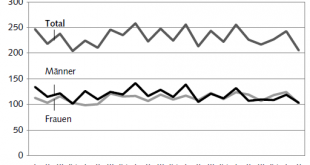

Women in Switzerland earn about a fifth less than men, according to the Federal Equality Office. Large companies in Switzerland will have to analyse wages of men and women starting in 2020 and make the audited results available to staff in 2021. The Federal Council agreed on Wednesday that the equal pay revision to the Gender Equality Act, passed by parliament in December 2018, will come into force on July 1, 2020. Companies will have one year to publish a gender pay...

Read More »FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

Swiss Franc The Euro has risen by 0.27% to 1.0882 FX Rates The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday’s losses and more. It was led higher by consumer discretionary, energy, and industrials. US shares are also trading firmer today,...

Read More »Swiss Labour Force Survey in 2nd quarter 2019: number of persons in employment rises by 1.1 percent, unemployment rate based on the ILO definition falls to 4.2 percent

20.08.2019 – The number of employed persons in Switzerland rose by 1.1% between the 2nd quarter 2018 and the 2nd quarter 2019. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) fell from 4.6% to 4.2%. The EU unemployment rate based on the ILO definition decreased from 6.8% to 6.3%. These are some of the results from the Swiss Labour Force Survey (SLFS). Download press release: 2nd quarter 2019: number of persons...

Read More »USD/CHF technical analysis: 21-DMA exerts downside pressure

USD/CHF pulls back to 23.6% Fibonacci retracement. 21-DMA limits near-term upside. Following its U-turn from the 21-day simple moving average (DMA), USD/CHF confronts 23.6% Fibonacci retracement of April-August declines as it takes the bids to 0.9793 ahead of the European session on Wednesday. While 14-bar relative strength index (RSI) shows normal condition, pair’s sustained run-up beyond 0.9800 enables it to challenge the short-term key DMA level of 0.9811. It...

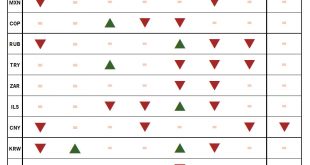

Read More »Brazilian real stands out in EM currency scorecard

Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others. In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More...

Read More »Nine out of ten Swiss are satisfied with their job

Satisfied men at work The vast majority of Swiss people enjoy going to work. In a survey by consultants EY, 87% said they were satisfied or very satisfied with their job. Although the figure has barely changed since last year, differences between sectors persist. In the construction industry and in mechanical and systems engineering, for example, satisfaction has increased significantly. In the banking and insurance sectors, on the other hand, it has declined,...

Read More »FX Daily, August 20: Marking Time Ahead of PMI and Powell

Swiss Franc The Euro has risen by 0.13% to 1.0856 EUR/CHF and USD/CHF, August 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities and bonds are firmer in quiet turnover, and the dollar is narrowing mixed in narrow ranges. The big events of the week, the eurozone flash PMI and Powell’s speech at Jackson Hole still lie ahead. The MSCI Asia Pacific Index rose for the third consecutive session, led by...

Read More »Philipp Hildebrands Coup: Gratisgeld für EU-Bürger

Vergangene Woche stellte Philipp Hildebrand, der frühere Präsident des Direktoriums der Schweizerischen Nationalbank (SNB), nun Vize-Präsident von Blackrock, auf Bloomberg ein Positionspapier vor. Verfasst hat er dieses zusammen mit anderen Autoren wie Stanley Fischer, ehemaliger stellvertretender Vorsitzender der US Federal Reserve (FED). Hildebrands Vorschlag: Geld- und Fiskalpolitik sollen miteinander verschmelzen. Den Bürgerinnen und Bürgern soll Geld direkt...

Read More » SNB & CHF

SNB & CHF