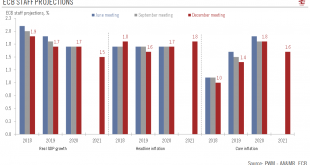

First rate hike still expected in September 2019, although downside risks are growing.The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer of 2019”.Given the tone of today’s meeting, we see no reason to contradict...

Read More »Stagnant US trucker wages raise questions about macro theory

In spite of a thriving economy and driver shortages, wage growth in US haulage have been lagging, leaving economists (and Fed officials) scratching their headsDespite a huge shortage of drivers and soaring transportation costs as a result, wages in the US haulage sector have remained stuck. This illustrates the ongoing chasm between macro theory (which would suggest much stronger wages) and reality (still-tepid wage growth).While microeconomic dynamics specific to the sector might be at play...

Read More »2019 US credit outlook

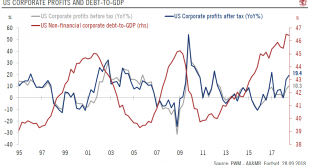

The reversal of accommodative lending conditions and rising volatility mean we will stick to quality.While the US economy continues to grow, knowledge that we are late in the cycle means we are closely watching two developments of significance to credit markets: US corporate leverage and US Federal Reserve (Fed) rate hikes.Many indicators are pointing to rising leverage among US companies, be it the non-financial corporate debt-to-GDP ratio (which reached an all-time high of 46% in 2018), or...

Read More »Large downward revisions to the Swiss National Bank’s inflation forecasts

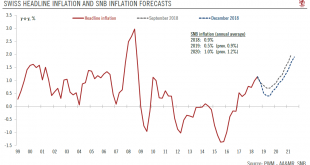

Fresh inflation projections likely to keep the central bank on the path of prudence.The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today.The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge.Importantly, the SNB’s inflation forecasts for 2019 and 2020 were significantly revised down—another argument for the SNB to remain cautious and wait for the European Central Bank to start hiking...

Read More »Emerging market currencies: idiosyncratic risks strike back

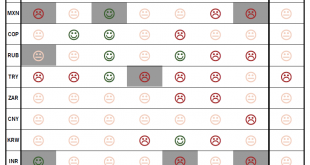

The environment will remain challenging for EM currencies next year.Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latestEM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single attractive EM currency among the 10 it monitors on a 12-month horizon.Being...

Read More »Unlocking cash by sharing possessions

Three British entrepreneurs have created the world’s first insurance-backed peer-to-peer marketplace to rent almost anything, bringing the sharing economy to cameras, projectors, disco equipment, drones, hot tubs, kayaks and a lot more.Mass consumption has become a common complaint in modern life, as consumers increasingly feel that they need to acquire the latest gadgets, update their mobile phones frequently and own cars used on average for only 4 per cent of the day. Throughout our lives,...

Read More »Chinese export growth slumps

Net exports likely to be a drag on GDP growth in 2019.Chinese exports decelerated significantly in November, rising by 5.4% year-over-year (y-o-y), down from 15.5% the previous month. The slowdown in Chinese exports was likely a result of the deceleration in both global growth and the tapering of front-loading of exports to the US.Looking forward, we expect Chinese exports to decelerate further, especially in early 2019, just as China honours its commitment to increase purchases from the US,...

Read More »Exit of central bank head adds to Indian market uncertainties

The surprise resignation of governor of the Reserve Bank of India poses a question mark over its policies and independence ahead of next year’s election.Urjit R. Patel, the governor of the Reserve Bank of India (RBI), unexpectedly resigned on 10 December, just four days before a crucial board meeting on discuss internal governance issues.His resignation came amid a period of acute tension between the RBI and the Indian government over a range of issues, from banking regulations and the use...

Read More »French move to increase spending will raise eyebrows in Italy

New French deficit spending comes amid heated budget discussions between Brussels and Rome.The French President, Emmanuel Macron, has responded to the “yellow vest” protests with a dose of fiscal easing, mainly by bringing forward already planned measures. The spending package has four main building blocks: a tax exemption to incentivise employers for overtime pay; a tax break on overtime pay; a EUR100 increase in the minimum monthly wage; and the cancellation of the 1.7% surcharge on...

Read More »Weekly View – From trade wars to tech wars

The CIO office’s view of the week ahead.The arrest of Huawei CFO Meng Wanzhou by Canadian officials on a US extradition order brings a new layer of complication to the ongoing US-China trade dispute. Chinese telecoms giant Huawei Technologies has ambitions to be a global leader in the next generation of 5G wireless network technology, which has equipment vendors around the world in a race to secure early dominance. Timing was particularly notable as the US and Chinese presidents Donald Trump...

Read More » Perspectives Pictet

Perspectives Pictet