Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAfter a bruising 2018, we expect further volatility ahead. But the recent sell-off in equities, particularly in the US, may have been excessive with regard to still-decent fundamentals. We will continue to use spikes in volatility for tactical advantage, believing they offer opportunities.We are cautious on corporate credit overall as leverage, increasing rates and slowing growth make the...

Read More »People’s Bank cuts banks’ reserve requirements, more policy easing ahead

While the latest move will inject liquidity into the Chinese banking system, more direct stimulus can be expected in a bid to lift China’s slowing economy.The People’s Bank of China (PBoC) announced a further reduction in banks’ required reserve ratios (RRR) on Friday by 1 percentage point. According to the central bank, this round of RRR cuts will inject roughly Rmb800 billion of net liquidity into the banking sector.In our view, this move was partly motivated by the economy’s seasonal...

Read More »Fed’s New Year Resolution: Listen to markets

Hints that Fed balance-sheet reduction could in question.Fed Chairman Jerome Powell made dovish remarks at a conference on Friday to the effect that the Fed would be ‘patient’ about further rate increases after having delivered four rate hikes in 2018.Crucially, Powell mentioned possible tweaks to the Fed’s preset plans for balance sheet shrinkage to calm financial markets concerns, after downplaying the balance sheet aspects at the December post-policy meeting press conference.This...

Read More »Weekly View – A kangaroo market week

The CIO office’s view of the week ahead.The first week of the year delivered a series of conflicting signals and a complementary dose of volatility in markets. After 20 days of daily moves of over +/-2% in the S&P 500 in 2018, out of last week’s three trading days of 2019 alone, two were marked by daily moves of over +/-2%. In data, the December US ISM manufacturing index showed its weakest reading in two years, as businesses continue to worry about trade tensions. However, this was...

Read More »China manufacturing PMIs enter contraction territory

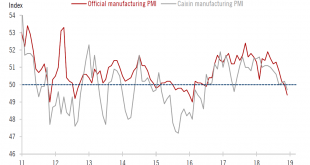

Further economic deceleration is expected ahead.The official Chinese manufacturing purchasing manager indices (PMIs) came in at 49.4 in December, down from 50 in November and below the recent trough in early 2016. This brings PMI survey results below the crucial level of 50, entering contraction territory.The sharp deceleration was evident for both large enterprises and small- and medium-sized enterprises (SMEs), with the latter showing more weakness. The official PMI figure for large...

Read More »December’s Federal Reserve meeting review

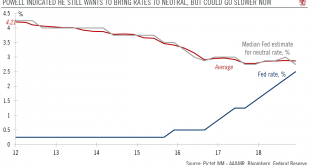

Fed chair Jerome Powell still wants to “normalize” monetary policy in 2019.The Federal Reserve (Fed) raised the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, as widely anticipated. The new FFTR range is 2.25-2.50%. This marked the fourth rate increase of 2018.There was no formal guidance about the next hike and clues were rather hazy. It seems like the Fed still wants to bring rates towards ‘neutral’ in 2019 (currently 2.75% based on the median Fed dot –...

Read More »The dynamic growth of collaborative workplaces

The sharing economy is disrupting many consumer industries such as hotels (Airbnb) and taxis (Uber). One traditional industry that is increasingly facing disruption is office accommodation, where co-working is growing fast around the world. As with traditional offices, there are desks, meeting rooms and other working facilities, but they are usually shared by people not employed by a single organisation who enjoy working together as a community with online services providing benefits.One of...

Read More »2019 US-China trade outlook: major challenges remain

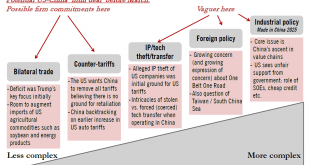

A tentative deal is possible by March, but tensions will likely flare up again.Following the Trump-Xi dinner on 1 December, there are signs of goodwill on both sides, leaving the impression that a ‘mini deal’ is possible before the 1 March 2019 deadline set by the US. This could push back the threat of additional tariffs in the very near term.But we think the devil will be in the details, and particularly in the implementation details. Some sort of hiccup is likely to take place once we...

Read More »Core euro sovereign bonds 2019 outlook

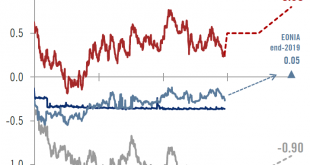

It’s all about the European Central Bank’s hiking cycle.In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.The euro area economic activity has been decelerating this year and the latest prints are not showing encouraging signs going into...

Read More »Fashion window-shopping on the internet

A fast-growing German business which has become the country’s second-largest online clothing retailer and one of the fastest growing e-commerce companies in Europe, has designed its online shop like a fashion magazine to inspire customers seeking new ideas.Most online clothing retailers have a simple model: consumers look at their websites to search for clothing they want and purchase it. ABOUT YOU sees itself as a fashion discovery website which uses personalised data to offer suggestions...

Read More » Perspectives Pictet

Perspectives Pictet