Net exports likely to be a drag on GDP growth in 2019.Chinese exports decelerated significantly in November, rising by 5.4% year-over-year (y-o-y), down from 15.5% the previous month. The slowdown in Chinese exports was likely a result of the deceleration in both global growth and the tapering of front-loading of exports to the US.Looking forward, we expect Chinese exports to decelerate further, especially in early 2019, just as China honours its commitment to increase purchases from the US, leading to a rebound in US imports. All in all, net exports will likely be a drag on Chinese growth in 2018 and 2019.In the first 10 months of 2018, Chinese held up remarkably well in the light of elevated trade tensions with the US, growing at an average rate of 12.6% y-o-y, compared to 7.9% in

Topics:

Dong Chen considers the following as important: Chinese exports, Chinese growth, Chinese imports, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Net exports likely to be a drag on GDP growth in 2019.

Chinese exports decelerated significantly in November, rising by 5.4% year-over-year (y-o-y), down from 15.5% the previous month. The slowdown in Chinese exports was likely a result of the deceleration in both global growth and the tapering of front-loading of exports to the US.

Looking forward, we expect Chinese exports to decelerate further, especially in early 2019, just as China honours its commitment to increase purchases from the US, leading to a rebound in US imports. All in all, net exports will likely be a drag on Chinese growth in 2018 and 2019.

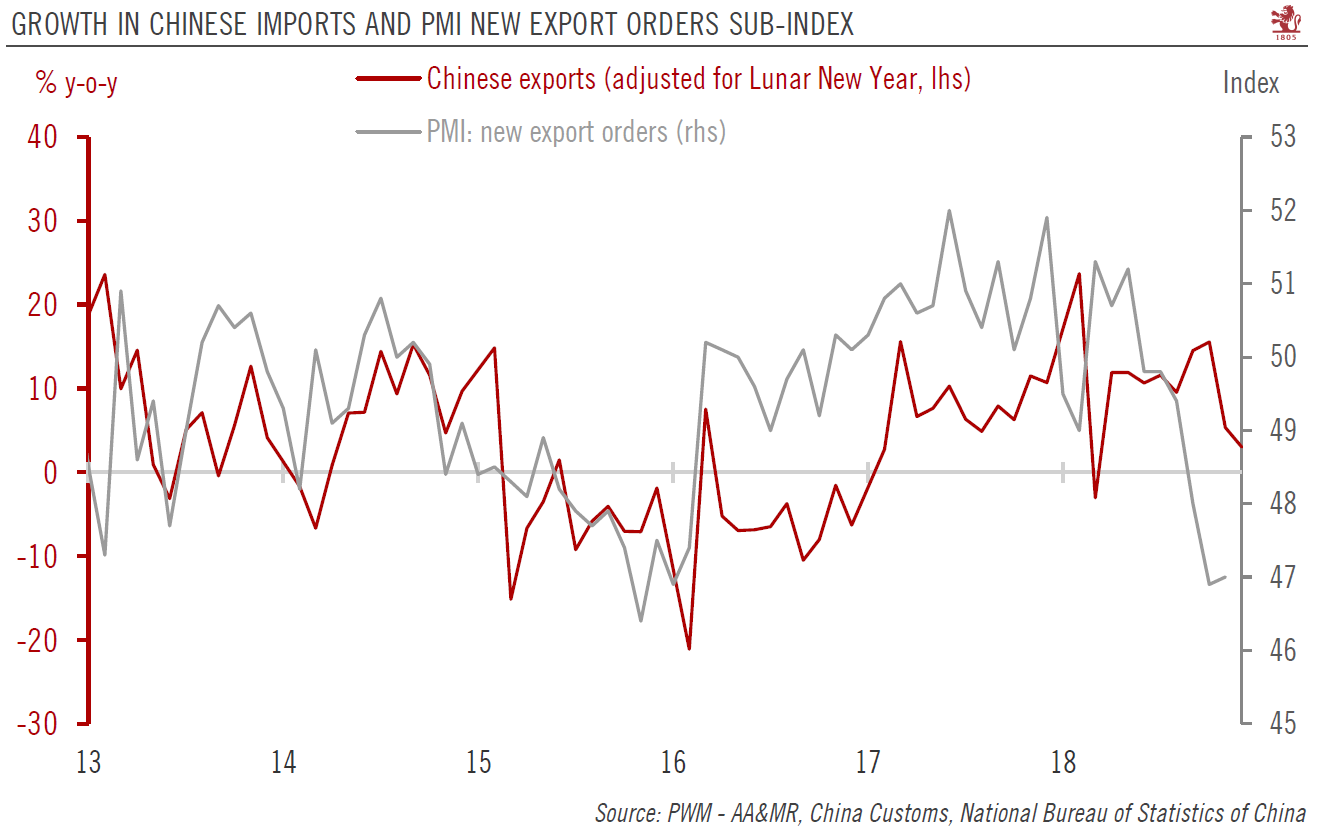

In the first 10 months of 2018, Chinese held up remarkably well in the light of elevated trade tensions with the US, growing at an average rate of 12.6% y-o-y, compared to 7.9% in full-year 2017. The strength in Chinese exports stood in contrast to purchasing managers’ index (PMI), whose new orders sub-index collapsed much earlier. However, November export figures draw the hard export data closer to the survey results.

China’s imports slowed down even more, growing by only 3.0% y-o-y in November, down from 20.8% in October. As a result, the Chinese trade surplus increased to USD44.8 billion in November, compared to USD34.8 billion in October and an average of USD30.7 billion in the previous six months. Chinese imports and exports tend to be highly correlated, as a big part of the imports are raw materials or components in products that end up being exported The decline in imports is therefore in line with the sharp decline in export growth, soft domestic demand in November and retaliatory tariffs imposed by the Chinese government on select US goods.

In our view, the recent meeting between Donald Trump and Xi Jinping make raises the likelihood of a trade deal being reached, but a lot of uncertainties still remain. Even if a deal is reached and there is no further increase in tariffs, the payback effect after the large-scale stockpiling for the holiday season could still result in a big drop in Chinese export growth next year.For full-year 2018, we expect China’s merchandise trade surplus to be around USD357 billion, roughly 15% less than last year, and likely the lowest since 2013. We expect China to increase agricultural exports from the US, especially soyabeans and pork. The Chinese government has also confirmed it will lower tariffs on US automobiles from the current 40% to 15%. Net exports very will therefore likely be a drag on Chinese growth in 2018 and remain so in 2019.