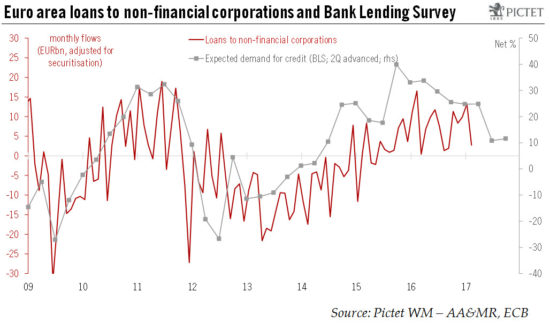

The April Bank Lending Survey remains consistent with the ECB leaving its stance unchanged on credit conditions, negative rates and QE.Credit standards on loans to euro area enterprises eased in Q1, according to the ECB’s Bank Lending Survey (BLS), released today. Although banks expect a small net tightening of credit standards across all loan categories in Q2, credit conditions remain broadly favourable in the euro area.Demand for credit continued to rise in Q1, albeit at a slower pace than in the previous quarter, indicating there has been no material rebound in credit growth. Increased use of alternative sources of finance by corporates as well as elevated cash balances likely go a long way to explaining subdued demand for bank loans.The BLS looks consistent with an unchanged ECB stance on credit conditions, negative rates and quantitative easing. An eventual decision to hike the deposit rate will likely be based on the ECB’s fundamental assessment of economic conditions rather than motivated by growing side effects of such policy on the banking sector.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Bank Lending Survey, ECB stance, euro lending conditions, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The April Bank Lending Survey remains consistent with the ECB leaving its stance unchanged on credit conditions, negative rates and QE.

Credit standards on loans to euro area enterprises eased in Q1, according to the ECB’s Bank Lending Survey (BLS), released today. Although banks expect a small net tightening of credit standards across all loan categories in Q2, credit conditions remain broadly favourable in the euro area.

Demand for credit continued to rise in Q1, albeit at a slower pace than in the previous quarter, indicating there has been no material rebound in credit growth. Increased use of alternative sources of finance by corporates as well as elevated cash balances likely go a long way to explaining subdued demand for bank loans.

The BLS looks consistent with an unchanged ECB stance on credit conditions, negative rates and quantitative easing. An eventual decision to hike the deposit rate will likely be based on the ECB’s fundamental assessment of economic conditions rather than motivated by growing side effects of such policy on the banking sector.