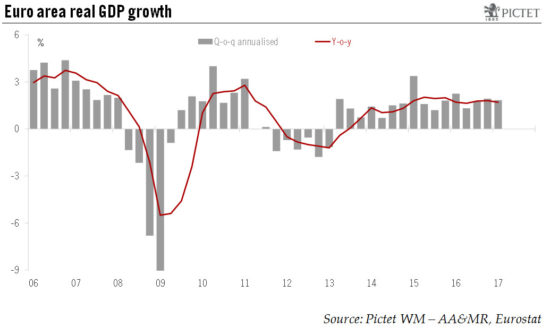

GDP shows economic performance is somewhere between what hard and soft data are suggesting.According to Eurostat’s preliminary flash estimate released today, euro area real GDP expanded by 0.5% q-o-q in Q1 2017 (+0.455% q-o-q; 1.8% q-o-q annualised; 1.7% y-o-y), slightly above consensus expectations (0.4%). This flash estimate confirms that most business confidence surveys overestimated growth at the beginning of the year, with the ‘true pace’ of economic expansion lying somewhere in between estimates based on available soft and hard data.As a result, we have maintained our GDP forecast for 2017 at 1.5%, with risks modestly tilted to the upside. Once detailed estimates are published, assuming no revision to past GDP figures, we might indeed revise our 2017 annual growth forecast to 1.6-1.7%. Speaking of revisions, Q4 GDP growth was revised up from 0.40% to 0.48% q-o-q in the final estimate. It is worth mentioning that the Q4 flash estimate, published on 31 January, was 0.5%.Euro area real GDP now stands 3% above its pre-crisis level. The carryover effect for 2017 reached 1.1%, meaning that even with zero growth in the remaining three quarters of 2017, euro area GDP would grow by 1.1% on average this year. Today’s Q1 estimate is based on published figures from six countries (including for Spain and France) as well as some confidential inputs from five other countries.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Euro area GDP growth, euro area growth prospects, euro area Q1 GDP, euro area soft hard data, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

GDP shows economic performance is somewhere between what hard and soft data are suggesting.

According to Eurostat’s preliminary flash estimate released today, euro area real GDP expanded by 0.5% q-o-q in Q1 2017 (+0.455% q-o-q; 1.8% q-o-q annualised; 1.7% y-o-y), slightly above consensus expectations (0.4%). This flash estimate confirms that most business confidence surveys overestimated growth at the beginning of the year, with the ‘true pace’ of economic expansion lying somewhere in between estimates based on available soft and hard data.

As a result, we have maintained our GDP forecast for 2017 at 1.5%, with risks modestly tilted to the upside. Once detailed estimates are published, assuming no revision to past GDP figures, we might indeed revise our 2017 annual growth forecast to 1.6-1.7%. Speaking of revisions, Q4 GDP growth was revised up from 0.40% to 0.48% q-o-q in the final estimate. It is worth mentioning that the Q4 flash estimate, published on 31 January, was 0.5%.

Euro area real GDP now stands 3% above its pre-crisis level. The carryover effect for 2017 reached 1.1%, meaning that even with zero growth in the remaining three quarters of 2017, euro area GDP would grow by 1.1% on average this year. Today’s Q1 estimate is based on published figures from six countries (including for Spain and France) as well as some confidential inputs from five other countries. The breakdown by expenditure components will be published on 7 June. Based on high-frequency data and some country-specific releases, we think that domestic demand was the main driver of growth in Q1, boosted by buoyant investment and private consumption.