October non-farm payrolls provided another sign of the US economy’s strength. But tepid wage growth means the Fed will likely remain cautious.October payrolls showed the US economy remains in fine fettle, as underlying payroll growth remained firm. Robust labour-market signals echo recent solid business surveys, strong job opening data, and very low levels of initial jobless claims.Payrolls rose 261,000, reversing some hurricane-related weakness (payroll growth was only 18,000 in September). The unemployment rate dropped to 4.1%, the lowest level since December 2000. Average hourly earnings moderated to 2.4% y-o-y.The employment report provided strong hints that underlying economic activity remains firm, with some exceptions. The retail sector’s woes, for instance, are deepening.This

Topics:

Thomas Costerg considers the following as important: Macroview, US forward indicators, US nonfarm payrolls, US unemployment, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

October non-farm payrolls provided another sign of the US economy’s strength. But tepid wage growth means the Fed will likely remain cautious.

October payrolls showed the US economy remains in fine fettle, as underlying payroll growth remained firm. Robust labour-market signals echo recent solid business surveys, strong job opening data, and very low levels of initial jobless claims.

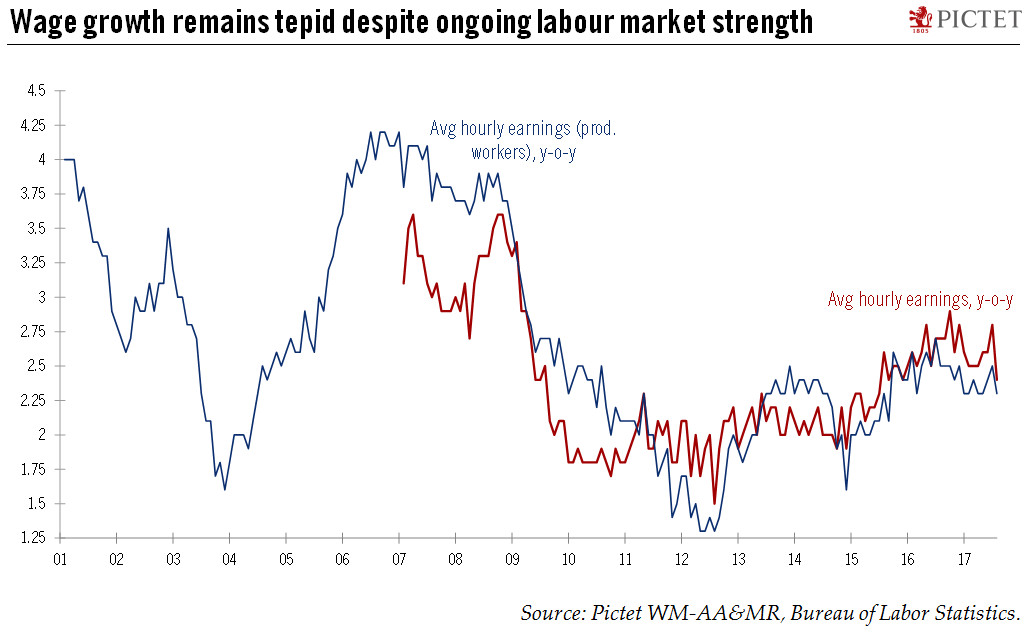

Payrolls rose 261,000, reversing some hurricane-related weakness (payroll growth was only 18,000 in September). The unemployment rate dropped to 4.1%, the lowest level since December 2000. Average hourly earnings moderated to 2.4% y-o-y.

The employment report provided strong hints that underlying economic activity remains firm, with some exceptions. The retail sector’s woes, for instance, are deepening.

This employment report keeps the Fed on track to raise rates again at its December meeting, in line with our long-held scenario. However, tepid wage growth should mean the Federal Reserve is unlikely to accelerate monetary tightening, and is more likely to keep its expected terminal rate low. This scenario would change if wage growth went above 3-3.5% (compared with y-o-y growth in average hourly earnings of 2.4% in October), but this seems unlikely.