On June 1, Angela Merkel and Francois Hollande will take a break from their respective domestic crises and attend a ceremony to inaugurate the Gotthard Base Tunnel (GBT) in Switzerland. While the US has been focused on resolving LGBT rights issues and deciding whether or not the Confederate flag can fly in cemeteries, Switzerland has focused on something that's actually productive. After 17 years of work, and at a cost of $12 billion, Switzerland has engineered and constructed the...

Read More »Stock markets under pressure on US interest rate hike speculation

Investec Switzerland. Swiss stocks are set for a modestly positive end to the week despite stock markets coming under pressure on growing speculation that the US Federal Reserve could raise rates as early as next month. © Kenneth Graff | Dreamstime.com Stocks markets were volatile this week after the latest meeting minutes from the US Federal Reserve showed that most policymakers thought a June interest rate hike was appropriate given the continued improvement of the US...

Read More »Swiss customs sees a huge rise in meat smuggling

Le Matin. Swiss customs couldn’t believe their eyes when they visited the garages of a Vaud resident who they had questioned at a border stop in Geneva. The two garages contained a total of 5,000 kgs of food. Among the stash they found 520 litres of spirits, 1,400 litres of wine, 2,800 kgs of meat and large quantities of oil, port and cheese. © Ferenc Ungor | Dreamstime.com The smuggler had created a network allowing the resale of the goods to regular clients including restaurants,...

Read More »Glencore’s best start to year eases blow from post-IPO slump

Investec Switzerland. Glencore Plc shareholders showing up for the miner’s annual meeting on Thursday can take comfort in the stock’s best ever start to a year. Less so the loss of about half the company’s value since they met 12 months ago and more than 70 percent since a $10 billion initial public offering in 2011. Such wild share swings highlight both the opportunities from billionaire Chief Executive Officer Ivan Glasenberg’s plans to cut net debt by as much as $9...

Read More »Julius Baer says new money short of target in first four months

Investec Switzerland. Julius Baer Group Ltd. said net new money from clients amounted to less than 3 percent of managed assets in the first four months of the year, missing its target. Source: Julius Baer Clients in eastern Europe and Latin American showed “slow momentum,” while customers in Asia reduced borrowings and wealthy French and Italians repatriated money for tax declarations, the Zurich-based company said in a statement on Thursday. Julius Baer said it can still...

Read More »Global Stocks Slide, S&P Set To Open Red For The Year As Hawkish Fed Ignites “Risk Off”

After yesterday's algo-driven mad dash to close the S&P green both for the day and for the year following Fed minutes that came in shocking hawkish, the selling has continued overnight, led by the commodity complex as rate hike fears have pushed oil back down some 2% from yesterday's 7 month highs, which in turn has dragged global stocks lower to a six-week low, while pushing bond yields higher across developed nations as the market suddenly reprices the probability of a June/July rate...

Read More »Swiss stocks higher on positive earnings releases and brighter inflation signals

Investec Switzerland. Swiss stocks are set to close higher this week, outperforming global equities on positive earnings releases and brighter inflation signals. Stock markets around experienced a mixed week as investors weighed Federal Reserve rate hike expectations against gloomy economic data out of the US with more positive indicators out of China. © Jakub Krechowicz | Dreamstime.com Last Fridays US employment report showed that firms took on the fewest workers in...

Read More »Zurich Insurance shares up sharply after beating estimates

Investec Switzerland. Shares of Zurich Insurance Group AG headed for the biggest gain in more than four years after Switzerland’s biggest insurer posted a first-quarter profit that beat analyst expectations. Source: Facebook – Zurich Switzerland The stock rose as much as 5.6 percent, and was trading 5.4 percent higher at 228 francs as of 11:24 a.m. in Zurich, paring losses this year to 12 percent. A close at this level would mark the biggest one-day gain since September...

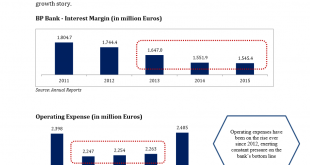

Read More »Veritaseum Blockchain-based Bank Research Hits Another Home Run – Banco Popular Shown to be Bear Stearns Redux!

During the months of March and April of 2016 we released a series of proprietary research reports indicating signficant weakneses that we found in the European banking system and released it for sale through the blockchain (reference The First Bank Likely to Fall in the Great European Banking Crisis). This was performed by the same macro forensic and fundamental analysis team that first warned about the pan-European sovereign debt crisis in 2009 and 2010 (reference Pan-European...

Read More »Japan Banks May Soon Pay Borrowers To Take Out Loans

Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one's means. Curiously, it was just a month ago when an offer was spotted in Germany offering a negative -1% rate on small consumer loans issued by Santander Bank. ...

Read More » le News

le News