Investec Switzerland. Swiss stocks fell significantly this week, underperforming global equities, amid renewed global growth worries and a poor performance from financial heavyweights. Stock markets across the world tumbled after weaker-than-expected manufacturing data out of China revived fears around global growth prospects. © Huating | Dreamstime.com In the US, the future path of interest rate hikes remained in focus. Two regional Federal Reserve presidents said earlier this week that an interest-rate increase should be considered at next month’s meeting. Employment numbers on Wednesday however showed that private payroll gains slowed markedly in April, supporting a less optimistic view for higher rates in the short term. Employment figures due for release in the US Non-farm payrolls report on Friday will be watched closely for clues to any potential June policy changes. The key driver of the negative market sentiment this week came out of China. Activity in the country’s manufacturing sector unexpectedly declined again in April, stoking fears about the health of the world’s second largest economy. In addition, the International Monetary Fund said rising debt levels in major Asian economies have become a significant risk, compounding doubts about the outlook for the wider regional economy.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Swiss markets 6 May 2016

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

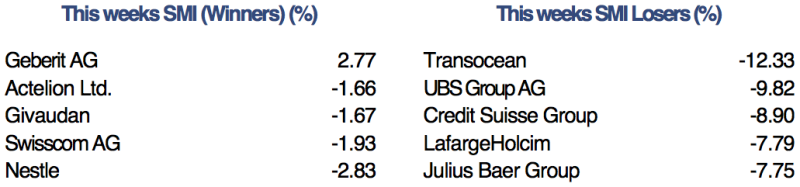

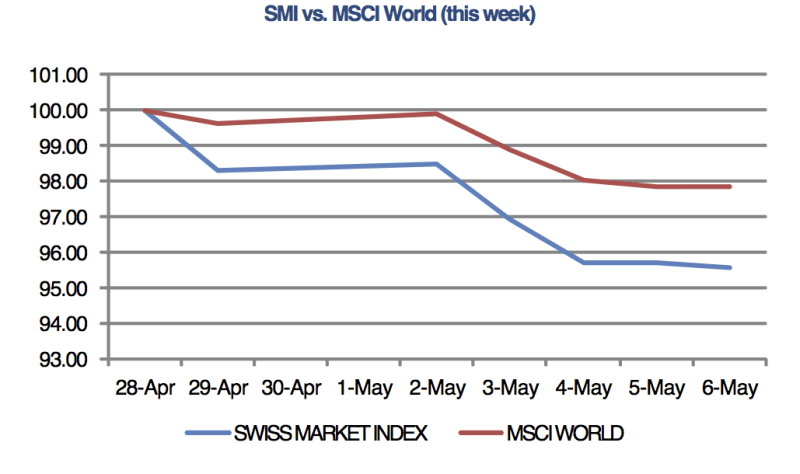

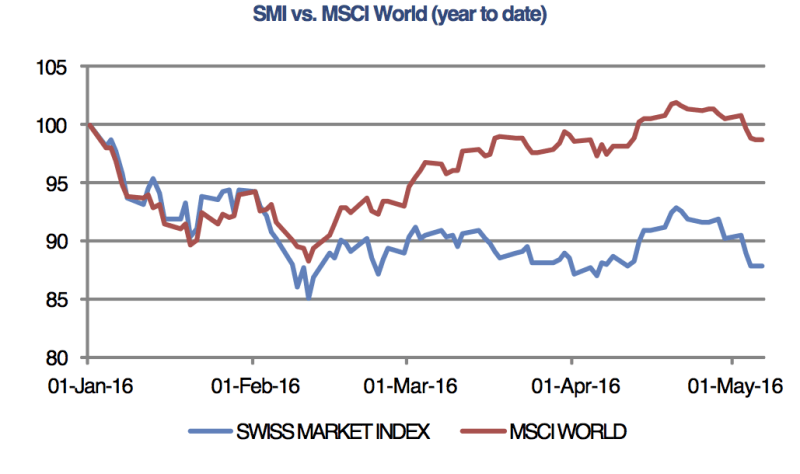

Swiss stocks fell significantly this week, underperforming global equities, amid renewed global growth worries and a poor performance from financial heavyweights. Stock markets across the world tumbled after weaker-than-expected manufacturing data out of China revived fears around global growth prospects.

© Huating | Dreamstime.com

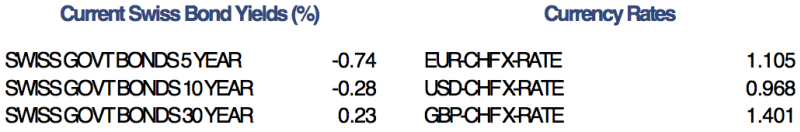

In the US, the future path of interest rate hikes remained in focus. Two regional Federal Reserve presidents said earlier this week that an interest-rate increase should be considered at next month’s meeting. Employment numbers on Wednesday however showed that private payroll gains slowed markedly in April, supporting a less optimistic view for higher rates in the short term. Employment figures due for release in the US Non-farm payrolls report on Friday will be watched closely for clues to any potential June policy changes.

The key driver of the negative market sentiment this week came out of China. Activity in the country’s manufacturing sector unexpectedly declined again in April, stoking fears about the health of the world’s second largest economy. In addition, the International Monetary Fund said rising debt levels in major Asian economies have become a significant risk, compounding doubts about the outlook for the wider regional economy.

In Switzerland, a report showed that business sentiment rose for the third consecutive time in April with companies gradually recovering from their poor start to the year. However, according to the report, the situation still remains less favourable compared to before the suspension of the Swiss franc’s minimum exchange rate with the euro at the beginning of 2015. Furthermore, employment data released this week suggests that the recovery of the Swiss labour market continues to stall. The KOF Employment Indicator hardly moved in April as a gloomy employment outlook across manufacturing, retail and service sectors drags on labour market growth.

In company news, Syngenta AG said this week that former DuPont Co. director Erik Fyrwald will take over as chief executive officer to steer the Swiss agrochemical maker through the final stages of its $43 billion takeover by state-owned China National Chemical Corp. UBS shares plunged after the group first-quarter profit missed analysts’ estimates. The result was hurt by the weakest start to the year in investment banking since Chief Executive Officer Sergio Ermotti began to reshape the business four years ago. Net income fell 64 percent to 707 million Swiss francs.