Investec Switzerland. Swiss stocks are set to close higher this week, outperforming global equities on positive earnings releases and brighter inflation signals. Stock markets around experienced a mixed week as investors weighed Federal Reserve rate hike expectations against gloomy economic data out of the US with more positive indicators out of China. © Jakub Krechowicz | Dreamstime.com Last Fridays US employment report showed that firms took on the fewest workers in seven months, supporting a lower probability of higher interest rates in the short-term, giving stocks around the world a boost. Steady inflation numbers out of Beijing also helped quell concerns about the health of China’s economy and drove gains in many global stock markets at the start of the week. Later in the week, oil prices rose to their highest level in six months after the US government reported crude oil inventories unexpectedly fell for the first time since March. While some markets enjoyed gains this week, the Dow Jones Industrial Index posted one of its largest declines in months. The move was driven by a negative news on the health of US retail spending. Some of the country’s largest retailers posted disappointing first quarter results, fueling concerns about the outlook for US consumer spending.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

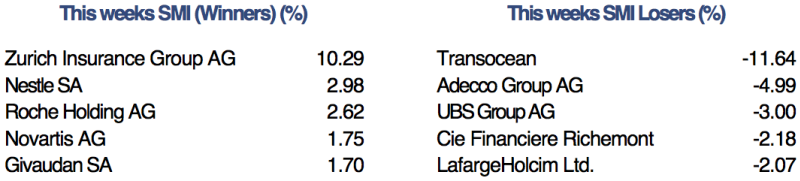

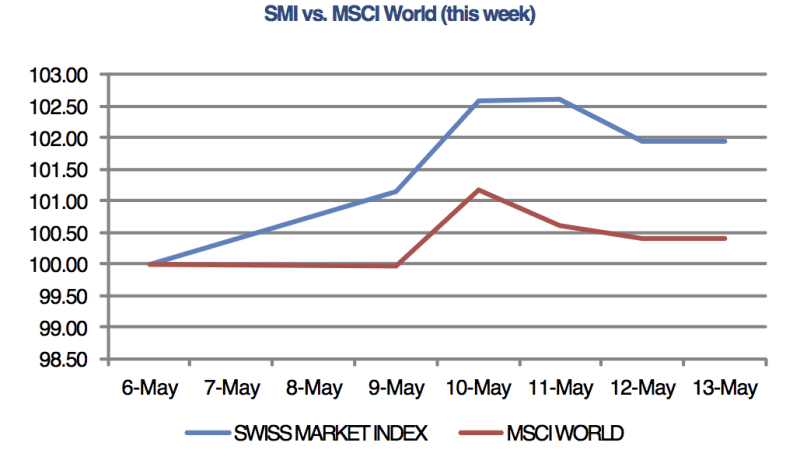

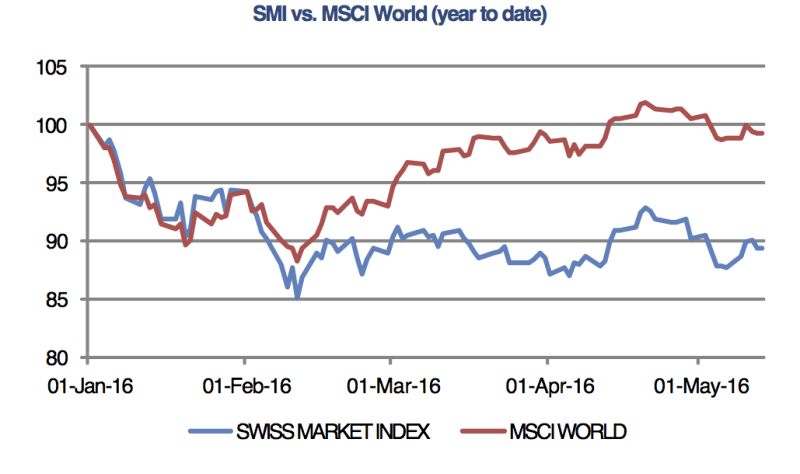

Swiss stocks are set to close higher this week, outperforming global equities on positive earnings releases and brighter inflation signals. Stock markets around experienced a mixed week as investors weighed Federal Reserve rate hike expectations against gloomy economic data out of the US with more positive indicators out of China.

© Jakub Krechowicz | Dreamstime.com

Last Fridays US employment report showed that firms took on the fewest workers in seven months, supporting a lower probability of higher interest rates in the short-term, giving stocks around the world a boost. Steady inflation numbers out of Beijing also helped quell concerns about the health of China’s economy and drove gains in many global stock markets at the start of the week. Later in the week, oil prices rose to their highest level in six months after the US government reported crude oil inventories unexpectedly fell for the first time since March.

While some markets enjoyed gains this week, the Dow Jones Industrial Index posted one of its largest declines in months. The move was driven by a negative news on the health of US retail spending. Some of the country’s largest retailers posted disappointing first quarter results, fueling concerns about the outlook for US consumer spending. In other news, the Bank of England left interest rates unchanged this week and said a vote to leave the European Union in the June 23rd referendum “could materially alter the outlook for output and inflation” in the UK.

In Switzerland, a report showed that the unemployment rate increased to a seasonally adjusted 3.5% in April, up from 3.4% in March. Youth unemployment (15-24 year olds) however decreased to 3.2% from 3.4% in March. Swiss consumer price figures appear to be improving after consumer prices reportedly rose 0.3% in April. That makes three successive monthly advances for the first time in over two years. The Swiss National Bank (SNB) has previously warned of the underlying risks to the economy from a deflationary environment, so the latest data should ease concerns and support expectations that inflation will move into positive territory by 2017.

In company news, shares of Zurich Insurance Group AG headed for their biggest gain in more than four years after Switzerland’s biggest insurer posted a first-quarter profit that beat analyst expectations. Chief Executive Officer Mario Greco took over in March with a mission to restore confidence in the company after it reported operating losses in its general insurance unit in the third and fourth quarters of 2015. Greco, the former CEO of Italian insurer Assicurazioni Generali SpA, is continuing with an overhaul of the insurer’s biggest unit, while preparing a strategy update to be announced in November.