Investec Switzerland. Swiss equities are expected to finish lower this week, underperforming global stocks after the Federal Reserve and the bank of Japan held off on policy changes, mirroring last weeks “wait and see” stance of the European Central Bank. © G0d4ather | Dreamstime.com U.S. central bankers skipped an interest-rate hike on Wednesday for the third straight meeting since kicking off its tightening cycle last year. According to the Banks statement, the Fed remains positive about U.S. growth prospects and a little less worried about global economic weakness but is still in no rush to up rates for a second time. Economic data released on Thursday failed however to support the Fed’s optimistic view. US Gross Domestic Product (GDP) rose just 0.5% in the first quarter of 2016, reflecting a continued deceleration in the pace of economic growth according to analysts. Following the Fed’s inaction, the Bank of Japan disappointed investors on Thursday by dashing hopes for more monetary easing to revive the flagging economy. Governor Haruhiko Kuroda and his colleagues opted to take more time to assess the impact of negative interest rates before taking any further measures to boost growth and inflation. Focus now turns to Prime Minister Shinzo Abe’s administration’s plans for potential fiscal stimulus.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland, SMI, Swiss Shares

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

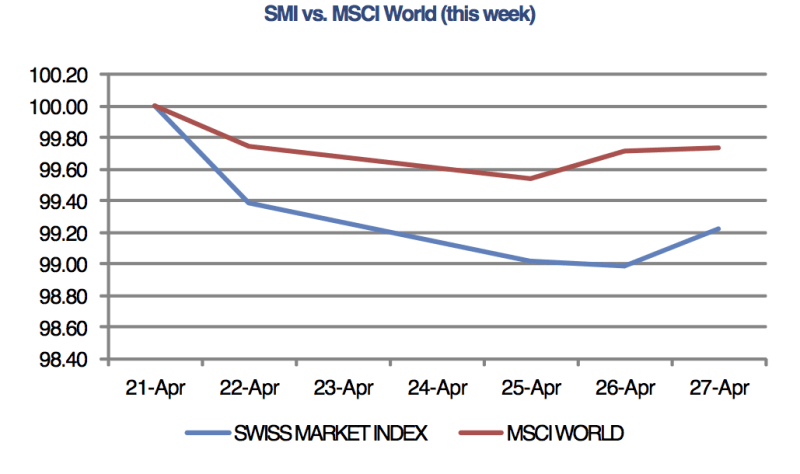

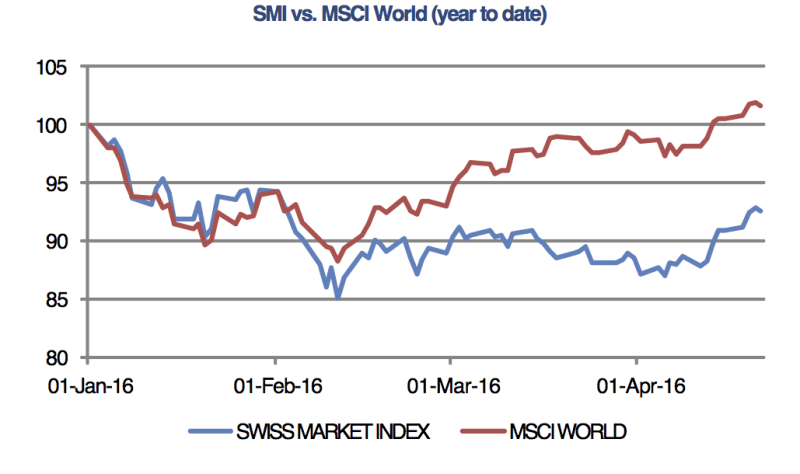

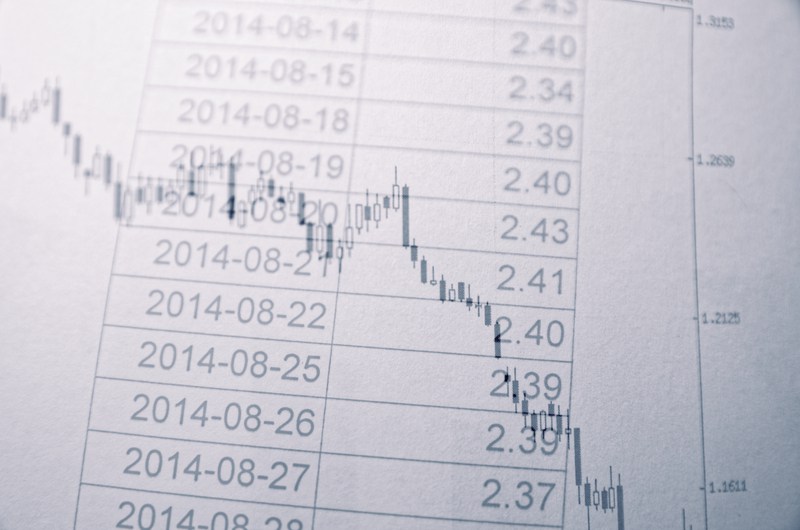

Swiss equities are expected to finish lower this week, underperforming global stocks after the Federal Reserve and the bank of Japan held off on policy changes, mirroring last weeks “wait and see” stance of the European Central Bank.

© G0d4ather | Dreamstime.com

U.S. central bankers skipped an interest-rate hike on Wednesday for the third straight meeting since kicking off its tightening cycle last year. According to the Banks statement, the Fed remains positive about U.S. growth prospects and a little less worried about global economic weakness but is still in no rush to up rates for a second time. Economic data released on Thursday failed however to support the Fed’s optimistic view. US Gross Domestic Product (GDP) rose just 0.5% in the first quarter of 2016, reflecting a continued deceleration in the pace of economic growth according to analysts.

Following the Fed’s inaction, the Bank of Japan disappointed investors on Thursday by dashing hopes for more monetary easing to revive the flagging economy. Governor Haruhiko Kuroda and his colleagues opted to take more time to assess the impact of negative interest rates before taking any further measures to boost growth and inflation. Focus now turns to Prime Minister Shinzo Abe’s administration’s plans for potential fiscal stimulus. The earthquakes earlier this month in Kumamoto, which killed 49 people, led Abe last weekend to say he’ll create an extra budget for relief to the region and support for the local economy.

Closer to home, UBS released its Consumption Indicator this week. The measure, which tracks retail sales, credit card transactions and employment figures to gage purchasing activity, rose slightly in March indicating an increase in consumer sentiment. It was however a bad week for foreign consumption indicators after a report showed that Swiss watch exports saw their biggest quarterly drop since 2009 in March. The Federation of the Swiss Watch Industry said exports declined 16 percent in March to 1.5 billion francs ($1.5 billion), the lowest level for that month in five years.

In other company related news, Apple’s stock dropped more than 8% this week after reporting its first fall in revenue drop for 13 years. Shares in the tech giant came under further pressure on Friday after Billionaire activist investor Carl Icahn dumped his entire stake in the company, citing the risk of China’s influence on the stock.