[caption id="attachment_590936" align="alignleft" width="400"] © 8213profoto | Dreamstime.com[/caption] On 2 November 2020, Switzerland’s Federal Office of Public Health (FOPH) reported 21,926 new cases of SARS-CoV-2 infection over 72 hours, bringing the total to 176,177. This weekend’s reported Covid-19 case figure in Switzerland was 26% higher than the weekend before. In addition to a rise in the number of reported...

Read More »Dollar Firm at Start of Very Eventful Week

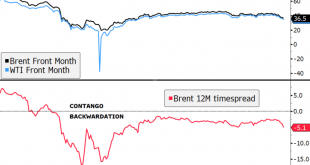

Oil prices continue their rapid decline due to both supply and demand concerns; the dollar is trading at the top end of recent trading ranges This is one of the most eventful weeks for the markets in recent memory; one day ahead of the elections, the implied odds remain roughly at the same levels as they have been for the last few weeks; October ISM manufacturing PMI will start the ball rolling for a key US data week The outlook for the virus in Europe continues to...

Read More »Jeff Deist on Hoppe’s Democracy: The God That Failed

Why don’t elections bring harmony and closure rather than ever greater political friction? Hans-Hermann Hoppe explained all of the fundamental problems with mass democracy more than 20 years ago in Democracy: The God That Failed. Jeff Deist finishes his series on this devastating classic with a look at Hoppe’s final chapters, critiquing conservatism, liberalism, and constitutionalism. Why do both conservatism and liberalism fail? (hint: democratic mechanisms)....

Read More »Recovery: GDP vs MPoD, 2 November

On Wednesday last week, the price of silver dropped from over $24.25 to just a bit over $23 before bouncing back to around $23.50. The next day, the price dropped again, briefly to around $22.60 before mostly recovering (but a dime to a quarter down). Let’s look at the graph of the price and basis (i.e. abundance) action for 28 and 29 October. At the end of the day (second day), the price is about a buck lower. And the basis (i.e. abundance) is about 50bps lower....

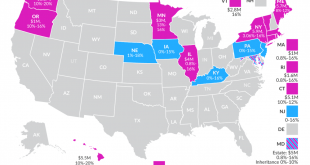

Read More »17 States that Charge Estate or Inheritance Taxes

Death tax, inheritance tax, estate tax—call it what you will, they all mean that some government entity wants to put its hand in your pocket or your heirs’ pockets, after your demise. On the federal level, the estate tax issue is not as big a deal as it was back in the day. Today individuals can pass on more than $11 million and couples can pass on more than $23 million before Washington comes after your money. 17 states, on the other hand, have not moderated their...

Read More »Romeo Lacher and Christoph Mäder nominated for election to the SNB Bank Council

Romeo Lacher ist Verwaltungsratspräsident von Julius Bär. Bild: ZVG At its meeting today, the Bank Council of the Swiss National Bank decided to propose to the General Meeting of Shareholders of 30 April 2021 that Romeo Lacher and Christoph Mäder be elected to the SNB Bank Council for the remainder of the 2020–2024 term of office. Romeo Lacher is Chairman of the Board of Directors of Julius Baer Group Ltd. and Bank Julius Baer & Co. Ltd. Christoph Mäder is...

Read More »Covid: Swiss government announces new measures

On 28 October 2020, after a record number of 8,616 daily new cases of infection were reported, Switzerland’s federal government announced new measures to fight against the spread of Covid-19. These rules come into effect from Thursday 29 October 2020.Nightclubs to close Discos and nightclubs will be closed. New rules for restaurants and bars No more than four people will be allowed to sit at a table in restaurants and bars, with the exception of families with...

Read More »Coronavirus: a record 9,386 new daily cases in Switzerland

© Niccolo Pontigia | Dreamstime.com On 29 October 2020, Switzerland’s Federal Office of Public Health (FOPH) reported 9,386 new cases of SARS-CoV-2 infection over 24 hours, bringing the total to 145,044. New daily cases continue to rise in Switzerland. The number of reported laboratory-confirmed cases today was 9% higher than yesterday. Over the last 14 days, Switzerland has recorded 837 new cases per 100,000, with nearly half of Switzerland’s laboratory-confirmed...

Read More »Understanding the Proper Meaning of “Equality”

[A Selection from Liberalism: In the Classical Tradition.] Equality Nowhere is the difference between the reasoning of the older liberalism and that of neoliberalism clearer and easier to demonstrate than in their treatment of the problem of equality. The liberals of the eighteenth century, guided by the ideas of natural law and of the Enlightenment, demanded for everyone equality of political and civil rights because they assumed that all men are equal. God created...

Read More »Populism Worked for the Pro-Freedom Party in the Past. Can It Work Again?

Although he was a scholar with degrees in mathematics and economics, Murray Rothbard was very much a fan of the American layman. Indeed, he was a populist both in temperament and in his political views. In a 1992 column outlining his populist strategy, Rothbard noted the importance of reaching out to the general public and especially to those groups that were most negatively impacted by state power: This two-pronged strategy is (a) to build up a cadre of our own...

Read More » SNB & CHF

SNB & CHF