Death tax, inheritance tax, estate tax—call it what you will, they all mean that some government entity wants to put its hand in your pocket or your heirs’ pockets, after your demise. On the federal level, the estate tax issue is not as big a deal as it was back in the day. Today individuals can pass on more than million and couples can pass on more than million before Washington comes after your money. 17 states, on the other hand, have not moderated their position on estate and inheritance taxes. According to the Tax Foundation, Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, Washington and the District of Columbia all charge an estate tax, which is levied on the value of the deceased’s assets

Topics:

Bob Williams considers the following as important: 5.) Alhambra Investments, Estate Planning, Featured, Financial Planning, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Death tax, inheritance tax, estate tax—call it what you will, they all mean that some government entity wants to put its hand in your pocket or your heirs’ pockets, after your demise.

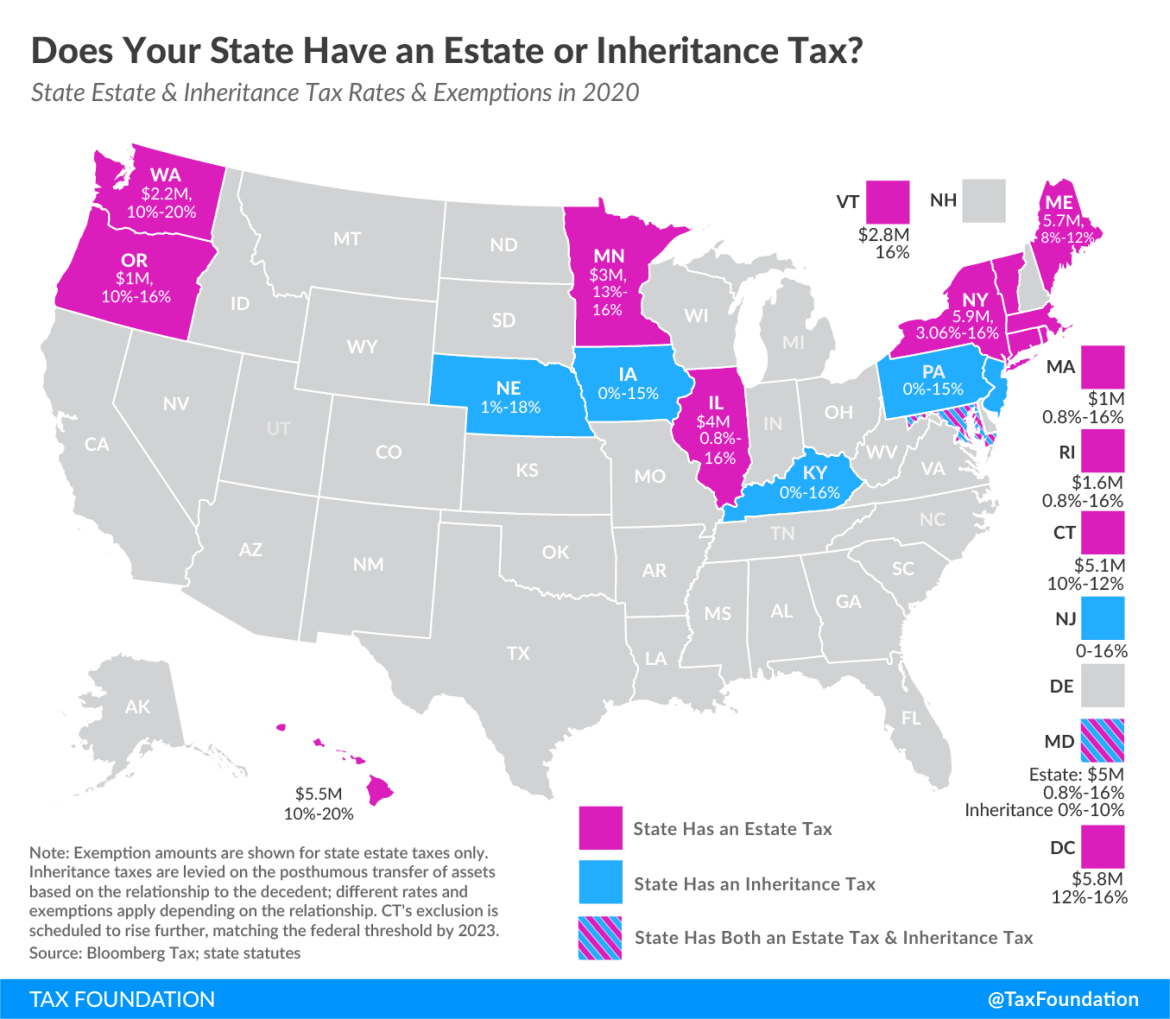

On the federal level, the estate tax issue is not as big a deal as it was back in the day. Today individuals can pass on more than $11 million and couples can pass on more than $23 million before Washington comes after your money. 17 states, on the other hand, have not moderated their position on estate and inheritance taxes. According to the Tax Foundation, Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, Washington and the District of Columbia all charge an estate tax, which is levied on the value of the deceased’s assets after debts have been paid. Maine, for example, levies no tax on the first $5.7 million of an estate, but taxes everything above that at a graduated rate from 8 percent to 12 percent. 6 states charge an inheritance tax, meaning the beneficiaries of an estate receive a tax bill. Those states are Iowa, Kentucky, Nebraska, New Jersey, Pennsylvania, and Rhode Island. Kentucky, for example, taxes inheritances at a rate of up to 16 percent. Spouses and certain other heirs generally receive inheritances without being taxed. And then, there’s Maryland, which has both an inheritance tax and an estate tax. |

State Estate & Inheritance Tax Rates & Exemptions in 2020 |

From the Tax Foundation, here’s the estate and inheritance taxes charged by state in 2020.

- Connecticut: Estate tax of 10%-12% above $5.1 million

- District of Columbia: Estate tax of 12%-16% on estates above $5.8 million

- Hawaii: Estate tax of 10%-20% on estates above $5.5 million

- Illinois: Estate tax of 0.8%-16% on estates above $4 million

- Iowa: Inheritance tax of up to 15%

- Kentucky: Inheritance tax of up to 16%

- Maine: Estate tax of 8%-12% on estates above $5.7 million

- Maryland: Estate tax of 0.8%-16% on estate above $5 million. Inheritance tax of up to 10%

- Massachusetts: 0.8%-16% on estates above $1 million

- Minnesota: 13%-16% on estates above $3 million

- Nebraska: Inheritance tax of up to 18%

- New Jersey: Inheritance tax of up to 16%

- New York: Estate tax of 3.06%-16% for estates above $5.9 million

- Oregon: Estate tax of 10%-16% on estates above $1 million

- Pennsylvania: Inheritance tax of up to 15%

- Rhode Island: Estate tax of 0.8%-16% on estates above $1.6 million

- Vermont: Estate tax of 16% on estates above $2.8 million

- Washington: Estate tax of 10%-20% on estates above $2.2 million

Today, we have wetlands. When I was a kid, it was a swamp. Whatever name you attach to it, it’s still a soggy place in the ground. So it is with estate and inheritance taxes. A tax, by any other name, still means somebody is going to pay in 17 of the United States.

Tags: Estate Planning,Featured,Financial Planning,newsletter