Swiss Franc The Euro has risen by 0.05% to 1.0682 EUR/CHF and USD/CHF, November 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Initially, the markets built on Tuesday’s price action, but as soon as a few counties in Florida indicated that it was not going to be the “blue wave,” risk came off, and it was most evident in the bond and currency markets. Equities rallied in the Asia Pacific area, and all but Hong...

Read More »A New World Monetary Order Is Coming

Image from Zerohedge The global coronavirus pandemic has accelerated several troubling trends already in force. Among them are exponential debt growth, rising dependency on government, and scaled-up central bank interventions into markets and the economy. Central bankers now appear poised to embark on their biggest power play ever. Federal Reserve Chairman Jerome Powell, in coordination with the European Central Bank and International Monetary Fund (IMF), is...

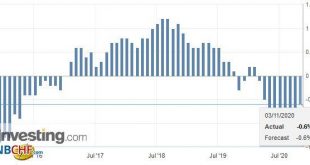

Read More »Swiss Consumer Price Index in October 2020: -0.6 percent YoY, 0.0 percent MoM

03.11.2020 – The consumer price index (CPI) remained stable in October 2020 compared with the previous month, remaining at 101.2 points (December 2015 = 100). Inflation was –0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The stability of the index compared with the previous month is the result of opposing trends that counterbalanced each other overall. Prices for clothing and footwear increased,...

Read More »Covid: Geneva goes into semi-lockdown

© Erik Lattwein | Dreamstime.com On Sunday 1 November 2020, Geneva’s government announced the canton would go into semi-lockdown. Bars, restaurants and non-essential businesses in Geneva are set to close at 7pm on Monday 2 November 2020. Schools will remain open. Faced with surge in cases and a steep rise in hospitalisations, the government of Geneva decided to introduce stricter measures to stem the spread of the virus. Between mid-October and 1 November 2020, the...

Read More »Our Imperial Presidency

Regardless of who holds the office, America’s Imperial Project and its Imperial Presidency are due for a grand reckoning. While elections and party politics generate the emotions and headlines, the truly consequential change in American governance has been the ascendancy of the Imperial Presidency over the past 75 years, since the end of World War II. As commander-in-chief of the armed forces, the Constitution grants the President extraordinary but temporary powers...

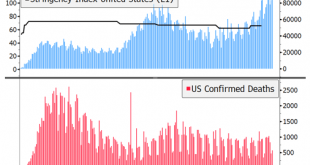

Read More »FOMC Preview: Coronavirus Daily Change

The two-day FOMC meeting starts tomorrow and wraps up Thursday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in Q4. While we are confident about our call for this meeting, the medium-term outlook will remain highly uncertain until we get a firm result from the US elections and a better grasp of how the pandemic will impact...

Read More »Socialists Have Never Shown How They Could Increase the Standard of Living

[A selection from Nation, State, and Economy. Editor’s note: When Mises refers to “liberals” or “liberalism” he means the ideology of laissez-faire, sometimes now called “classical liberalism.”] Marxism sees the coming of socialism as an inescapable necessity. Even if one were willing to grant the correctness of this opinion, one still would by no means be bound to embrace socialism. It may be that despite everything we cannot escape socialism, yet whoever considers...

Read More »Covid: 6,200 new cases as Swiss hospitals reach breaking point

© Stefan Amer | Dreamstime.com On 3 November 2020, Switzerland’s Federal Office of Public Health (FOPH) reported 6,216 new cases of SARS-CoV-2 infection over 24 hours, bringing the total to 182,303. The number of tests over the last 24 hours was lower than last week. On Friday 30 October 2020, 38,211 tests were conducted with a positivity rate of 24%. Over the last 24 hours, 22,177 tests were conducted with a positivity rate of 28%. Lower test numbers and higher...

Read More »Living with disability in Switzerland: sometimes tough, sometimes comic

Comedian Eddie, who has cerebral palsy, shows us around his city to get a glimpse of what everyday life with disability looks like in Switzerland. Access to jobs, education, or even a good night out can be difficult, but being in a wheelchair isn’t all bad, says the Zurich man, who was born with cerebral palsy. Because of how people jump apologetically out of his way, his friends now call him “Disco Moses”, parting the seas of dancers. This, and the strange condescendence...

Read More »FX Daily, November 3: Risk Appetites Return as the US Goes to the Polls

Swiss Franc The Euro has risen by 0.09% to 1.0706 EUR/CHF and USD/CHF, November 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: More than 95 mln Americans voted before today, and many observers warn of a cliffhanger that could be decided in the courts. The polls sand surveys show strong odds in favor of a Democratic sweep. Looking at the capital markets, nothing looks amiss. The biggest rally in the S&P...

Read More » SNB & CHF

SNB & CHF