Swiss Franc The Euro has risen by 0.14% to 1.0831 EUR/CHF and USD/CHF, February 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The bout of profit-taking in equities continued today, and most markets in Asia Pacific and Europe are lower. China’s markets re-opened but struggled to sustain early gains. However, the Shanghai Composite rose by about 0.5%, and a smaller increase was recorded in Taiwan and an even...

Read More »Switzerland tops global e-commerce index

There is a significant gap in the online trade between high and low-income countries that UNCTAD says urgently needs to be narrowed, if populations are to benefit from the digital economy. © Keystone / Christian Beutler Switzerland is the best equipped country for online shopping, according to a United Nations comparison of more than 150 states. Last year, 97% of the Swiss population used the Internet, the annual study by the Geneva-based UN Conference on Trade and...

Read More »The United Nations in Geneva – before and during the pandemic

The Conference on Afghanistan on November 28, 2018. With the exception of a few organisations and institutions that continue to operate in person, such as the UN Human Rights Council, which is currently conducting its Universal Periodic Review process, the Office of the UN High Commissioner for Human Rights, the WHO and some permanent missions to the United Nations, most day-to-day business and multilateral activities are conducted online. March 2020 marked a major...

Read More »If America Splits Up, What Happens to the Nukes?

Opposition to American secession movements often hinges on the idea that foreign policy concerns trump any notions that the United States ought to be broken up into smaller pieces. It almost goes without saying that those who subscribe to neoconservative ideology or other highly interventionist foreign policy views treat the idea of political division with alarm or contempt. Or both. They have a point. It’s likely that were the US to be broken up into smaller...

Read More »Money, Interest, and the Business Cycle

[This essay is a selection from lecture 7 in Marxism Unmasked: From Delusion to Destruction.] The banks very often expand credit for political reasons. There is an old saying that if prices are rising, if business is booming, the party in power has a better chance to succeed in an election campaign than it would otherwise. Thus the decision to expand credit is very often influenced by the government that wants to have “prosperity.” Therefore, governments all over...

Read More »Uncle Sam Was Back Having Consumers’ Backs

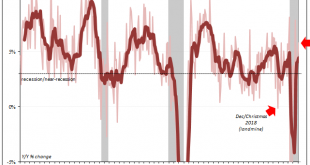

American consumers were back in action in January 2021. The “unemployment cliff” along with the slowdown and contraction in the labor market during the last quarter of 2020 had left retail sales falling backward with employment. Seasonally-adjusted, total retail spending had declined for three straight months to end last year. The latest updated estimates from the Census Bureau, released today, show that December’s drawback, in particular, was much larger than...

Read More »FX Daily, February 17: Follow-Through Dollar Buying after Yesterday’s Reversal Tests the Bears

Swiss Franc The Euro has risen by 0.03% to 1.0802 EUR/CHF and USD/CHF, February 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After reversing higher yesterday, the US dollar sees follow-through gains today, leaving the euro around a cent lower from yesterday’s highs. Sterling’s surge is also being tempered. Most emerging market currencies are lower as well. The jump in bond yields has stalled, but only...

Read More »Swiss competition watchdog to investigate Mastercard

The dispute centres around a Swiss attempt to uniformise functions across ATMs from different providers. © Keystone / Alexandra Wey The competition authority suspects the global credit card firm of using its position to prevent the rollout of a new, more uniform, ATM system across Switzerland. COMCO said on Tuesday it had launched an investigation on February 8 after a complaint by the Swiss financial infrastructure company SIX, which is responsible for developing...

Read More »“Self-control and self-respect have become undervalued”

Interview with Theodore Dalrymple After a year of lockdowns, social isolation, financial uncertainty and extreme political polarization, a lot of people are finding it very difficult to remain optimistic and to see a way back to some kind of normalcy. While the economic, social and political impact of the covid crisis can be easily identified and frequently discussed, the unseen, psychological pressures that millions of people are struggling with often go...

Read More »Down with the Presidency

The modern institution of the presidency is the primary political evil Americans face, and the cause of nearly all our woes. It squanders the national wealth and starts unjust wars against foreign peoples that have never done us any harm. It wrecks our families, tramples on our rights, invades our communities, and spies on our bank accounts. It skews the culture toward decadence and trash. It tells lie after lie. Teachers used to tell school kids that anyone can be...

Read More » SNB & CHF

SNB & CHF