In view of the sustained improvements in U.S. dollar funding conditions and low demand at recent U.S. dollar liquidity-providing operations, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, in consultation with the Federal Reserve, have jointly decided to discontinue offering dollar liquidity at the 84-day maturity. This operational change will be effective as of 1 July 2021. The auction schedule until 30 June 2021, as...

Read More »A Dozen Dangerous Presumptions of Crisis Policymaking

Congress and the president have adopted many critically important policies in great haste during brief periods of perceived national emergency. During the first “hundred days” of the Franklin D. Roosevelt administration in the spring of 1933, for example, the government abandoned the gold standard, enacted a system of wide-ranging controls, taxes, and subsidies in agriculture, and set in motion a plan to cartelize the nation’s manufacturing industries. In 2001, the...

Read More »Making Sense Eurodollar University Episode 66

In 2014 the St. Louis Federal Reserve noted that despite a MASSIVE increase in money the expected 4 to 6% inflation did not materialize. The researchers suggest it was a "liquidity trap". Yes, and no. But mostly no. Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski. Topics & Time Codes 00:05 In the pre-2007 period an increase in money supply lead to an increase inflation but... 02:59 ...the post-2007 period displayed a break in the...

Read More »The Biggest Threat to US Hegemony: China, Russia, or Debt?

China and Russia are trying to build a Eurasion bloc that can break free of any American spheres of influence. The American regime obviously opposes this, but money printing and debt limits the American options. Original Article: “The Biggest Threat to US Hegemony: China, Russia, or Debt?” Now that the Biden administration has settled in, it is time to reassess American policy towards Russia, China and the wider Asian scene. Is it going to be a continuation of...

Read More »FX Daily, April 23: Greenback Slips into the Weekend

Swiss Franc The Euro has risen by 0.28% to 1.1044 EUR/CHF and USD/CHF, April 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Many narratives link the prospect of higher capital gains tax on about a third of 1% of Americans as the catalyst for losses in US equities yesterday (and Bitcoin) and weakness in some global shares today. Of the large markets in the Asia Pacific region, only Japan, which is reimposing...

Read More »Ohio House Votes to Fix Blunder, Remove Sales Tax on Sound Money

The Ohio House of Representatives just approved a bill which helps Buckeye State citizens protect themselves from the loss of monetary purchasing power caused by federal money printing. Introduced by Representative Oeslager, House Bill 110 includes a provision to eliminate the sales and use tax on purchases of gold, silver, platinum, and palladium coins and bullion in Ohio. Ohio recently repealed a longstanding sales tax exemption on the sale of precious metals....

Read More »Covid: 80 percent of nation must be immunised to stop spread, says Swiss health minister

© Filmfoto | Dreamstime.com This week, Alain Berset, Switzerland’s health minister said that 80% of the population must be immunised for the virus to stop spreading, according to RTS. Vaccination against the SARS-CoV-2 virus is voluntary in Switzerland. Currently, estimates suggest only 60% of Switzerland’s population is prepared to be vaccinated, according to Berset, a figure below the level required to get rid of the virus. If 60% had immunity the virus would still...

Read More »The Only Way to Get Ahead Now Is Crazy-Risky Speculation

It’s all so pathetic, isn’t it? The only way left to get ahead in America is to leverage up the riskiest gambles. It’s painfully obvious that the only way left to get ahead in America is crazy-risky speculation, but nobody seems to even notice this stark and stunning reality. Why are people piling into crazy-risky bets on speculative vehicles like Gamestop and Dogecoin? The obvious answer is because others have reaped a decade or two of wages in a few weeks, and...

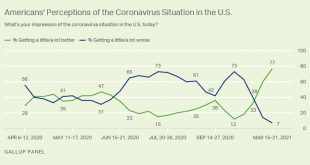

Read More »Not Even Gretchen Whitmer Wants More of the CDC’s Lockdowns

The US state with the fastest growing covid-19 caseload is a state that has experienced some of the harshest and longest lockdowns and covid restrictions: Michigan. As of April 20, the seven-day moving average for new covid cases in Michigan was 790 per million. This is higher than any other US state, and it is several times higher than the case rate for Michigan a year ago. It is comparable to what it was at the beginning of cold and flu seasons last fall, when...

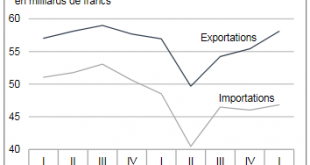

Read More »Swiss Trade Balance Q1 2021: exports go back above their pre-Covid-19 level

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More » SNB & CHF

SNB & CHF