The United States' third quarter is in the books - how did the economy do? A reading, by Emil Kalinowski. ----------WHO---------- Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Alegro" by TAGE at Epidemic Sound. ----------WHAT---------- GDP Red Flag: https://bit.ly/2ZIBbBD ----------WHERE---------- Jeff's Alhambra Blog: https://bit.ly/2VIC2wW Jeff's RealClearMarkets Essays: https://bit.ly/38tL5a7 Jeff's Twitter:...

Read More »Why a Yield on Gold Matters

Picture, if you can, a world in which gold circulates as the medium of exchange. People pay for everything, from groceries to rent, in gold. Employers pay wages in gold. Productive enterprises borrow gold to finance everything from food production to constructing apartment buildings. In other words, picture a world where there’s abundant opportunities to earn a yield on gold and finance productive businesses in gold. What Happened to Gold After the Gold Standard? It...

Read More »Corruption of the currency and decivilization – Part II

Lessons from the Fall of the Roman Empire – Part II of II Gold-backed civilization vs. the Welfare State Many rational economists and students of history have written countless analyses on the gold standard and the terrible impact that its end has had on the world economy. However, as the Fall of Rome clearly demonstrates, the implications of the introduction of the fiat money system and of the limitless manipulation of the currency by the State reach much further....

Read More »The Great Reset, Part VI: Plans of a Technocratic Elite

In previous installments, I introduced the Great Reset idea1 and treated it in terms of its economic2 and ideological3 components. In this, the sixth installment, I will discuss what the Great Reset entails in terms of governance and the Fourth Industrial Revolution (4-IR), closing with remarks about the overall Great Reset project and its implications. According to Klaus Schwab, the founder and executive chair of the World Economic Forum (WEF), the 4-IR follows the...

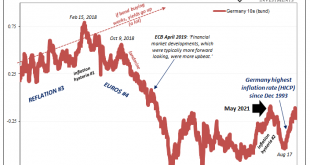

Read More »The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup? You can’t blame COVID at the tail end for a woeful string which actually dates back farther than the last pandemic (H1N1). Emil Kalinowski has it absolutely right; what happened in 2013 in the Treasury...

Read More »Zermatt restaurant operators in prison after defying Covid rules

Source: Twitter Over the weekend the owners of a family-run restaurant were taken into police custody for defiantly operating their restaurant in contravention of Switzerland’s Covid rules, reported 20 Minutes. On Saturday 30 October 2021, the police arrested the operators of the Walliserkanne restaurant in Zermatt. Three family members, a mother, father and son were arrested on Saturday morning and taken into custody. The restaurant operators had refused to check...

Read More »Reading Jeff Snider: Bond Markets Betting on Dis- & De- not In-flation [Ep. 145, Macropiece Theater]

How can anyone say there’s a dollar shortage and dramatically rising deflationary potential right now? Easy, actually. A reading, by Emil Kalinowski. ----------WHO---------- Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Alegro" by TAGE at Epidemic Sound. ----------WHAT---------- Short Run TIPS, LT Flat, Basically Awful Real(ity): https://bit.ly/3bu4Y38 ----------WHERE---------- Jeff's Alhambra Blog:...

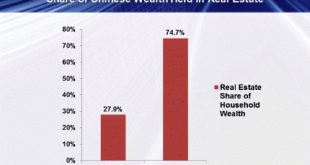

Read More »Will China Pop the Global Everything Bubble? Yes

The line of dominoes that is already toppling extends around the entire global economy and financial system. Plan accordingly. That China faces structural problems is well-recognized. The list of articles in the August issue of Foreign Affairs dedicated to China reflects this: Xi’s Gamble: the Race to Consolidate Power and Stave Off Disaster China’s Economic Reckoning: The Price of Failed Reforms The Robber Barons of Beijing: Can China Survive its Gilded Age? Life...

Read More »Weekly Market Pulse (VIDEO)

Alhambra CEO talks about last week’s reversal in bonds yields, if there’s a growth scare, what the yield curve is saying, plus reports on wages & salaries, core capital goods, and jobless claims. [embedded content] [embedded content] You Might Also Like Weekly Market Pulse: Inflation Scare! 2021-10-25 The S&P 500 and Dow Jones Industrial stock averages made new all time highs...

Read More »Weekly View – Central Bank Halloween

Last week, the US GDP growth figure for Q3 came in lower than expected, while prices moved higher than anticipated and the US Employment Cost Index update rose at its fastest pace in 31 years. The headline increase was driven by the biggest surge in wages since 1982, up 1.5% in the third quarter. Substantial productivity gains would be required now to offset this rise in wages. Without gains in productivity and/or a fall in labour costs, there could be a risk to...

Read More » SNB & CHF

SNB & CHF