Viel wurde diskutiert als China das Bitcoin Mining aus dem eigenen Land verbannte. Doch es hat nur wenige Monate gedauert und die Mining Community hat sich von diesem Bann erholt. Daten zeigen, dass nur noch 16 Prozent zum Allzeithoch fehlen. Bitcoin News: Bitcoin Mining Hashrate hat sich fast vollständig erholt China kontrollierte mehr als die Hälfte des weltweiten Mining Marktes – bevor es zu einem landesweiten Verbot für Crypto Mining kam. Es wurde befürchtet,...

Read More »Geldcast Update: Monetary policy and the climate crisis

Fabio Canetg completed his doctorate in monetary policy at the University of Bern and the Toulouse School of Economics. Today he is a lecturer at the University of Bern and hosts the monetary policy podcast “Geldcast”. swissinfo.ch For years, central banks have been called upon to do more to combat climate change. Now a new monetary policy instrument is being discussed as a way forward. The climate strike is back: Last week, thousands of people demonstrated in Bern...

Read More »Thanks to Central Banks, the Old Investment Rules Don’t Apply Anymore

Thanks to central banks’ easy money policies, historically low interest rates and a desperate search for yield have created new danger zones for investors trying to stay out of trouble. Original Article: “Thanks to Central Banks, the Old Investment Rules Don’t Apply Anymore” Sixty percent equities, 40 percent bonds. What has been considered the golden rule of portfolio theory for decades is of less and less value to investors today. Because central banks have...

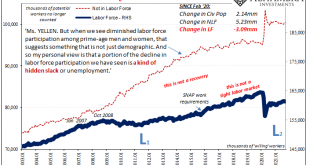

Read More »What Does Taper Look Like From The Inside? Not At All What You’d Think

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace. This is a messy and dynamic environment, in which the economy operates out of seeming randomness at times. Yet, here we have something that is “quantitatively” determined...

Read More »Reading Jeff Snider: Nobody’s Looking, Economic Activity Revised Down [Ep. 147, Macropiece Theater]

The September 2021 reading for America's new orders of durable goods shows stagnation / stalling. It is likely much worse but we won't know it for several years, not until the benchmark revisions are performed. We've seen this before, in 2018. And 2014. And 2012. Don't be surprised this time. A reading, by Emil Kalinowski. ----------WHO---------- Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Alegro" by TAGE at Epidemic Sound....

Read More »Credit Suisse to shrink investment bank

Keystone / Urs Flueeler The Credit Suisse Group says it will shrink its investment bank and shift more resources to the wealth management unit. It is part of a restructuring plan intended to draw a line under a tumultuous year in which it was rocked by the Archegos Capital Management and Greensill scandals. The Zurich-based bank is exiting most of its prime services business after the implosion of Archegos and shifting about $3 billion of capital from the investment...

Read More »What “Inflation” Really Means

Most commentators label increases in the prices of goods and services over a period of time as inflation. Ludwig von Mises however, held that the popular definition of inflation is erroneous. He wrote in Economic Freedom and Interventionism (p. 99), Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today...

Read More »Revenge of the Real World

The status quo response would be amusing if the consequences weren’t so dire. Rather than stare at empty shelves, you have two options for distraction: you can don a virtual-reality headset and cavort with dolphins in the metaverse, or you can trade various forms of phantom wealth that always go up (happy happy!) because the Fed. Neither distraction actually solves any real-world problems, a reality we can call the Revenge of the Real World We’ve entered a peculiar...

Read More »Gold is Boring – That’s Why You Should Own It!

Gold and silver price actions have been the opposite of dramatic for months now, they have been boring. In the last 100 days, gold has moved sideways in the US$100 range between $1725 and $1825. Silver had a similar experience moving in a US$5 range between $21.50 and $26.50. These ranges are quite small when compared to exciting moves in Tesla shares and cryptocurrencies such as Shiba! Some people think that being boring this year means we should not own the...

Read More »Gold 1, Bitcoin 0

In this article CEO Keith Weiner explains how gold is beating bitcoin. Case in point, bitcoin is not suitable for borrowing. He also debunks the idea that bitcoin is "digital" gold or better than the real thing. To read the full article click here: https://monetary-metals.com/gold-1-bitcoin-0/ Earn Interest on Your Gold and Silver with Monetary Metals ? Gold Financing, Simplified™ https://buff.ly/3wLaI2F ? The New Way to Hold Gold https://buff.ly/3xoCgNm ? The Case for...

Read More » SNB & CHF

SNB & CHF